Both houses of the Indian parliament in New Delhi were suspended on Monday amid uproar by opposition lawmakers demanding the government discuss bribery charges imposed by US prosecutors on the Adani Group.

Prices for Adani dollar bonds plunged, meanwhile, to almost one-year lows as investors and lenders weighed impacts from the case.

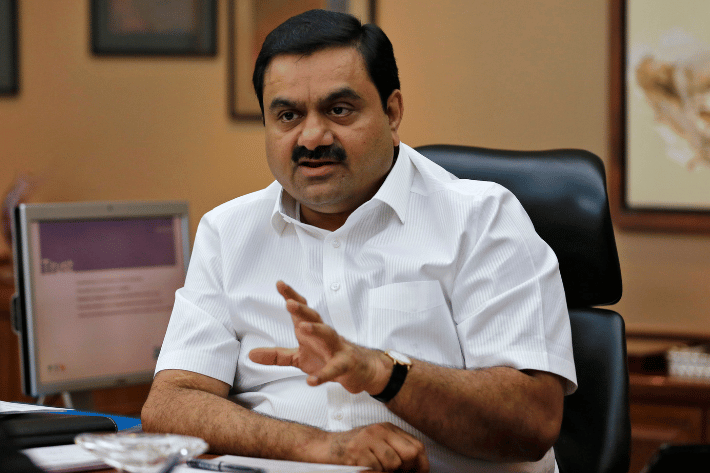

The Indian conglomerate’s billionaire chairman, Gautam Adani, and seven other people were last week charged by US authorities with agreeing to pay around $265 million in bribes to Indian government officials.

ALSO SEE: Bangladesh Wants Legal Help For Probe Into Adani, Power Deals

The charges related to alleged payments to obtain contracts that could yield $2 billion of profit over 20 years, as well as to develop India’s largest solar power project.

The alleged bribes caught the attention of US authorities when Adani’s companies were raising funds from US-based investors in transactions starting in 2021.

They include making misleading statements to the public despite being made aware of the US investigation in 2023.

The Adani Group has said the accusations, plus those levelled by the US Securities and Exchange Commission in a parallel civil case, are baseless and that it will seek “all possible legal recourse”.

But opposition parties in India, who have consistently targeted Adani for what they say are his ‘close ties’ to Prime Minister Narendra Modi, had said last week they would raise the issue in parliament when it meets on Monday.

“As the parliament session begins, the first step the government should take is to have a detailed discussion on the Adani saga which has the potential of tarnishing India’s image at the global stage,” Mallikarjun Kharge, president of the main opposition Congress party, posted on X just as proceedings began in the upper house of parliament.

That was the demand of the opposition alliance Congress leads, because “hard-earned investments” of tens of millions of retail investors are at stake, Kharge said.

Jagdeep Dhankhar, the vice president of India and chair of the upper house, said he had received 13 notices from lawmakers demanding a discussion on the Adani issue but he could not allow them as they did not conform to rules.

Dhankhar asked Kharge to speak but was interrupted by lawmakers pressing their demand for a discussion, causing him to suspend the chambers briefly and later for the rest of the day.

Modi ‘protecting and favoring Adani’

Similar scenes played out in the lower house a little later, forcing the speaker to suspend business for the day there as well.

Indian opposition parties have in the past accused Modi’s government of protecting and favouring Adani and his businesses, charges both deny.

Modi’s opponents say he has longstanding ties with Adani, going back nearly two decades to when Modi was chief minister of the western state of Gujarat, to which Adani also belongs.

They accuse the government of favouring the group in business deals, charges the government has rejected as “wild allegations”.

The government has not commented on the indictment but Modi’s Bharatiya Janata Party (BJP) has said that it is for the Adani Group to deal with and defend itself and that the law will take its course.

BJP ‘used brute force to win state polls’

Meanwhile, the New York Times on Saturday published a damning expose of the BJP’s “use of brute force to take over Indian state governments” through a tactic known as “resort politics,” which allegedly involves kidnapping, intimidating and drugging rival politicians, then holding them in luxury hotels for long periods until their party leaders collapse or agree to form a coalition.

It cited the case of several opposition lawmakers from Maharashtra, including Nitin Deshmukh, who alleged he was taken across state lines and “held in a hotel behind locked gates and later restrained and drugged after trying to flee” in June 2022.

“The hidden hand behind the maneuvering, according to several lawmakers with knowledge of the events, was the party of Prime Minister Narendra Modi. In a series of closely contested states, his Bharatiya Janata Party, after failing to win power through elections, has gained effective control through similar episodes in which lawmakers were sent to resort hotels until their government fell.

“In Maharashtra, several lawmakers said, some of the defectors had been paid to switch loyalties. Other lawmakers who sided with the BJP had publicly spoken beforehand of coming under withering pressure from investigating agencies controlled by Mr Modi’s party.”

Adani bonds sink

The disruption of parliament in New Delhi on Monday came as Adani dollar bond prices fell as investors cut their exposure to the conglomerate and some bankers considered pausing fresh lending in the wake of the indictment.

Banks and regulators have been reviewing exposure to the ports-to-power conglomerate in the wake of the charges.

The Singapore banking sector’s overall exposure to the Adani Group, is small, the Monetary Authority of Singapore said on Monday.

“Banks have in place measures to review and manage their exposures to borrowers and counterparties,” an MAS spokesperson said in a statement.

DBS Group, Singapore’s biggest bank by assets, had said in early 2023 that its exposure to the Adani Group was S$1.3 billion ($967 million). DBS declined comment in response to request from Reuters.

Some global banks are considering temporarily halting fresh credit to the company after the US indictment but maintaining existing loans, according to several bankers spoken to by Reuters, raising questions about its access to future funding.

“In the near-term, the US indictment is likely to constrain the group’s access to financing, particularly in the offshore market,” a Lucror Analytics note published on Smartkarma said.

Cash balances of Adani portfolio companies stood at $6.33 billion as of first half of the current fiscal year ending March 2025, the company said.

The cash balances exceed long-term-debt repayments for the next 28 months, Adani said in a presentation on the credit and financial performance of its group companies, which it regularly shares after its quarterly results.

The crisis is the second in two years to hit the Adani group, which was last year accused by short seller Hindenburg Research of improperly using offshore tax havens. The company denied those claims.

Bond values sinking

In Asian trade on Monday, some of the most liquid debts, issued by Adani Ports and Special Economic Zone fell between 1 cent and 2 cents, with similar selling in Adani Transmission debt.

Ports bonds maturing in 2027 were down 1.6 cents to 88.98 cents on the dollar, having lost nearly 7 cents in face value since US prosecutors issued the charges last week.

Longer-dated Ports bonds were down on Monday and have lost between 8 cents and 10 cents in face value on the news.

Adani Transmission debt maturing in May 2036 fell 1.8 cents on Monday for a loss of more than 7 cents since Wednesday.

Adani group’s 10 listed stocks led by Adani Enterprises lost $27.9 billion in market value over two sessions last week after the US charges.

On Monday, most Adani-backed stocks pared gains from early trade, with Adani Energy Solutions reversing course to trade down about 2%. Eight of 10 Adani stocks were trading in the green at 0643 GMT.

What’s next?

US prosecutors have charged Adani with foreign bribery, securities fraud, securities fraud conspiracy and wire fraud conspiracy.

The billionaire has not been arrested and his whereabouts are unknown, though he is believed to be in India. A trial could still be a long way off, even if he was extradited or surrendered in the US.

If convicted, he could face decades in prison as well as monetary penalties, but given his wealth and influence in India there is uncertainty over such prospects.

For now, a US court has directed that Adani must answer the US SEC’s allegations within 21 days.

- Reuters with additional editing and input (on NYT report) by Jim Pollard

NOTE: Further text & a photo were added to this report on November 25, 2024.

ALSO SEE:

Adani Scandal Ups Risk to Global Banks, India’s Renewables Push

Adani Stocks Plunge After US Charges For Bribery, Fraud

New Hindenburg Report Wipes up to $13 Billion Off Adani Firms

India Regulator Puts Seven Adani Firms on Notice For Violations

Indian Regulator Seen Probing Adani’s Ties With Gulf Asia Fund

Adani Family Partners ‘Used Opaque Funds to Buy Stocks’

India Regulator Warns Against Hasty End to Adani Group Probe

Indian Protesters Say Modi Favoured Adani as Losses Top $110bn

All Eyes on India Market Regulator Amid Adani Share Sale Probe

Probe Into Some Adani Offshore Deals for Disclosure Violations

Indian Market Regulator Seen Seeking Details on Foreign Investors