Shares of Japanese carmaker Nissan surged nearly 24% on Wednesday following reports that it was in talks about a possible merger with larger rival Honda.

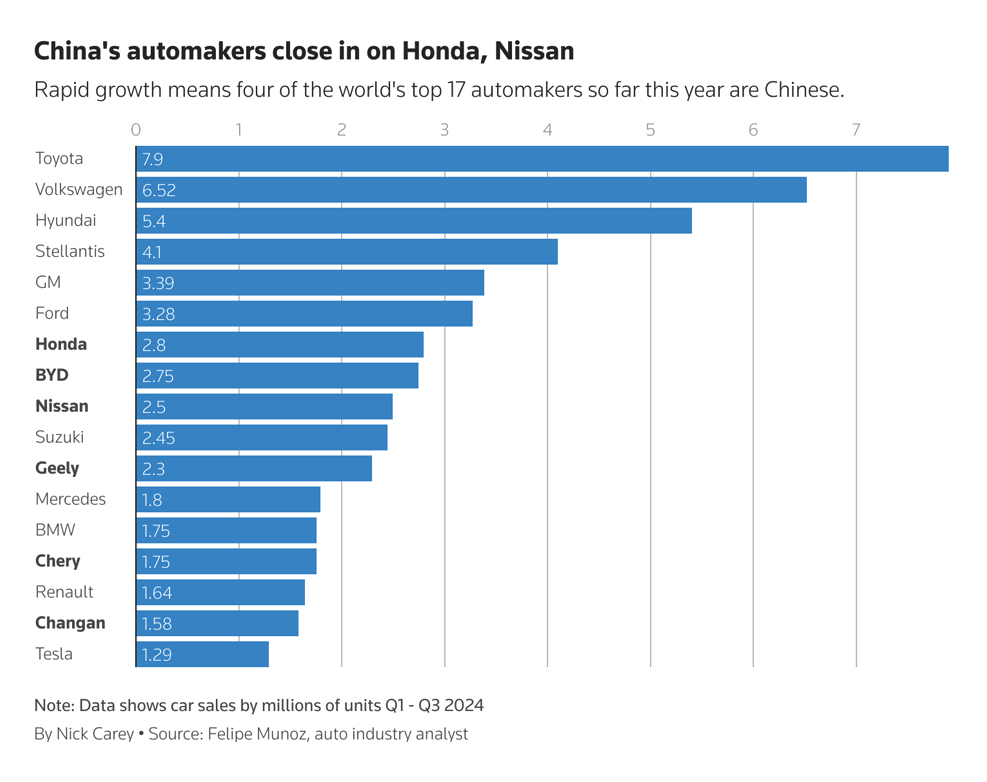

A combined Honda and Nissan would create a $54 billion company with an annual output of 7.4 million vehicles, making it the world’s third-largest auto group by vehicle sales after Toyota and Volkswagen.

The carmakers’ discussion on a merger is the clearest sign yet of how Japan’s once seemingly unbeatable auto industry is being reshaped by challenges from Tesla and Chinese rivals.

Also on AF: Trump Planning to Clamp Down on Chinese EV Supply Chains

Sources told Reuters that the two companies were looking to deepen ties and find ways to bolster collaboration, including by possibly setting up a holding company.

The companies are also discussing the possibility of a full merger, according to one of the people, as well as looking at ways to cooperate with Mitsubishi Motors, in which Nissan is the top shareholder.

Japanese newspaper Nikkei was the first to report of a potential merger.

Honda, Nissan and Mitsubishi said no deal had been announced by any of the companies. But Nissan and Mitsubishi noted the three automakers had previously said that they were considering opportunities for future collaboration.

Meanwhile, French automaker Renault — Nissan’s largest shareholder — is open, in principle, to a deal and would examine all the implications of a tie-up, two people familiar with the matter said.

‘Bailing out Nissan’

Legacy carmaker Nissan has particularly struggled to shore up sales, with a slump in China and the United States leading to an 85% plunge in its profit in the second-quarter.

Last month, the carmaker announced a $2.6 billion cost savings plan that included cutting 9,000 jobs and 20% of its global production capacity.

“This deal appears to be more about bailing out Nissan,” said Sanshiro Fukao, executive fellow at Itochu Research Institute.

That sentiment was also visible in Japan’s markets where, while Nissan ended the day with gains of 23.70%, Honda Motor saw losses of 3.04%.

Investors were Hawkish on Honda despite a broad-based rally in auto shares in Japan. Mitsubishi Motors jumped 19.65%, while Mazda Motor closed with gains of 5.54%.

Meanwhile, Renault was the stand-out performer in European markets, rising 6%.

The EV challenge

Honda and Nissan already forged a strategic partnership in March to cooperate in electric vehicle development — an area where Japan’s legacy carmakers have continued to struggle.

Itochu Institute’s Fukao noted that the potential merger would benefit Honda as well, considering the company’s “cash flow is set to deteriorate next year and its EVs haven’t been going so well.”

Japanese carmakers are particularly struggling in China — once their largest export market — where competitors like BYD have surged ahead with cheap-yet-high-quality electric vehicles.

Furthermore, an EV price war launched by Tesla and BYD has intensified pressure on any automakers losing money on the next-generation vehicles.

At such a time, a merger could allow Honda and Nissan to cut costs, speed-up vehicle development, cooperate more on technology and create a more formidable domestic rival to Toyota.

“In the mid- to long-term, this is good for the Japanese car industry as it creates a second axis against Toyota,” said Seiji Sugiura, a senior analyst at Tokai Tokyo Intelligence Laboratory.

“Constructive rivalry with Toyota is a positive for the rather stagnating Japanese car industry when it must compete with Chinese automakers, Tesla and others.”

Corporate culture concern

But Honda and Nissan would have to work out how to integrate their different corporate cultures if they proceed with a merger, analysts said.

“Honda has a unique, technology-centric culture with strengths in powertrains, so there should be some internal resistance to the merger with Nissan, a competitor with a different culture that is now faltering,” said Tang Jin, a senior researcher at Mizuho Bank.

S&P Global Ratings also cautioned it would take time for the synergies from a potential merger to boost the firms’ creditworthiness.

Differences in corporate culture and strategies may mean a merger that does not give one side control is unlikely to have meaningful results.

“In our view, there have been few instances where mergers and alliances between major automakers have led to significant benefits,” it said in a note.

Any merger would also face significant scrutiny in the US, where president-elect Donald Trump has vowed to take a hard line on imported vehicles.

Trump could seek concessions from Honda and Nissan to approve any deal, auto industry officials said. Honda and Nissan both produce cars in Mexico for export to the US.

- Reuters, with additional editing and inputs from Vishakha Saxena

Also read:

China EV-Makers Eat Into Japan, Korea’s Markets in SE Asia

China’s Rapid Shift to EVs Hurting Japanese Carmakers

Nissan, Honda Agree Tech Team-Up Deal in EV Catch-Up Bid

Nissan, Honda Seen Slashing China Production By Up To 30%

Nissan Eyes Solid-State EV Battery Breakthrough by 2029 – AP

Toyota, Honda in the Net as Japan Safety Test Scandal Worsens

China’s EV Stars Leaving Global Auto Rivals in Their Wake

China Car Exports Hit Record High in April