Waning woes over SOEs help gauge climb but restructuring among two bellwethers could dim sentiment

(AF) Chinese corporate bonds are on a winning streak that’s put them within a whisker of a year’s high as investors shrug off recent debt default concern centred on state-owned enterprises (SOEs).

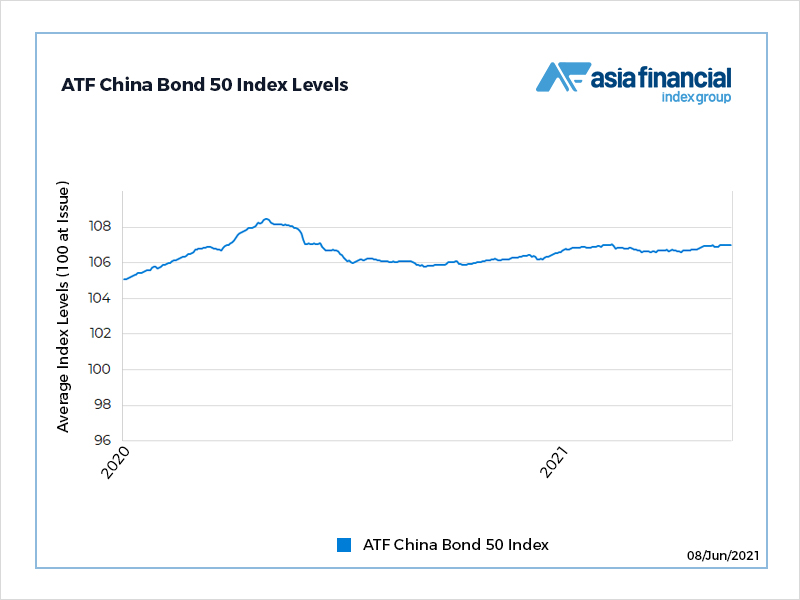

The returns-focused benchmark AF China Bond 50 Index of AAA rated Chinese corporate and local government bonds has risen 0.12% in the past eight days to 107.02. That’s just half a basis point from its 2021 high.

The last time it was that high was June 2020 when China’s corporate bonds market was booming amid record issuance and as the domestic economy recovered from the pandemic as the rest of the world faltered.

The threshold may yet take time to breach, however, as investors fret over a capital restructuring at China Huarong and Peking University Founders, two bellwether issuers. Their recent financial troubles stoked fears they would default on bond repayments. With no sign of government support for the two SOEs, markets remain on guard for more defaults, which could drag the index lower.