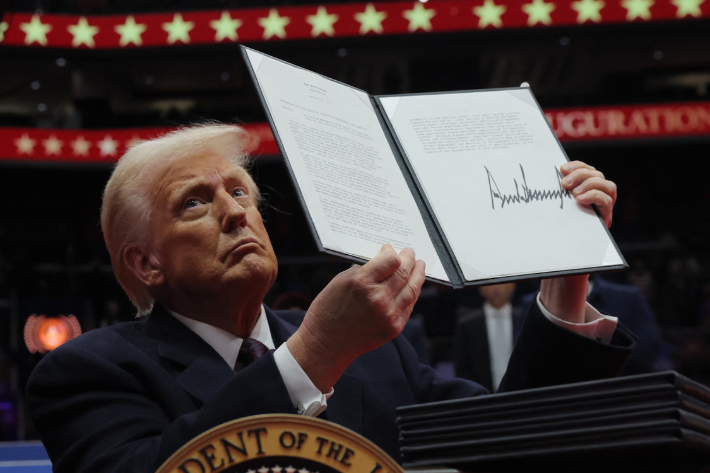

US President Donald Trump was fast at work on Monday, in the hours after his inauguration, signing a series of executive orders that will shake up American policies on technology, climate, health, and immigration.

After taking the oath of office, Trump began signing executive orders at an indoor rally and continued to sign more at the White House, including steps to reverse 78 orders enacted by former President Joe Biden.

These were Trump’s first steps in realising a far-reaching agenda that touched on everything from postponing a potential shutdown of TikTok to reevaluating foreign aid and upholding the use of the death penalty.

Also on AF: Xi Jinping Seen Luring Trump Into a New US-China Trade Deal

Among some of Trump’s most notable — but widely expected — moves were decisions to withdraw the United States from the World Health Organisation and the Paris climate agreement.

He also declared a national energy emergency, asserting that the capacity of the world’s biggest economy to develop, refine, and generate energy and critical minerals was “far too inadequate” to meet its needs.

Trump’s actions spurred small rallies in stocks of oil and technology firms, but a lack of announcements on tariffs led the dollar to stumble from near two-year highs.

The greenback staged a partial rebound on Tuesday, however, after Trump suggested the US could impose tariffs of around 25% on Canada and Mexico by February 1.

China’s currency yuan, meanwhile, was relieved as Beijing avoided the dramatic blizzard of executive orders. Markets across Asia remained flat, however, as investors waited to see what more Trump 2.0 had in store.

“The first few hours of Trump administration has underscored that policy environment will be dynamic once again and markets should brace for volatility. Clearly, the markets celebrated too soon with tariff threats missing at the outset in Trump’s inaugural speech,” Charu Chanana, chief investment strategist at Saxo, Singapore told Reuters.

So, before we head into Trump’s first full day in office on Tuesday, here’s a look at what his first day back as president meant for technology, climate, and markets.

No more guardrails for AI

Among the slew of executive orders Trump signed was one revoking a 2023 executive order signed by Joe Biden that sought to reduce the risks that artificial intelligence poses to consumers, workers, and national security.

Biden’s order required developers of AI systems that pose risks to US national security, the economy, public health, or safety to share the results of safety tests with the US government, in line with the Defense Production Act, before they were released to the public.

The order also directed agencies to set standards for that testing and address related chemical, biological, radiological, nuclear, and cybersecurity risks. Biden’s order came as US lawmakers have failed to pass legislation setting guardrails for AI development.

Trump has, however, claimed that Biden’s order hinders AI innovation. The 2024 Republican Party platform supports “AI development rooted in free speech and human flourishing.”

The US president’s decision to revoke the 2023 order comes at a time when a boom in AI has spurred furious innovation in tech ranging from generative AI to deepfakes. Critics of unchecked AI development warn that it could pose an “extinction-level threat to humanity”.

Despite those concerns, tech leaders such as Trump aide Elon Musk and OpenAI chief Sam Altman have been racing to accelerate the technology’s growth.

Concerns that they may be allowed to grow unchecked under Trump, have been furthered by tech chiefs laying out millions of dollars for Trump’s inauguration.

Tough market for EVs

On his first day, Trump also targeted electric vehicles, revoking a 2021 executive order signed by Biden that sought to ensure half of all new cars sold in the United States by 2030 were electric.

Biden’s 50% target, which was not legally binding, had won the support of US and foreign automakers.

However, Trump announced in an executive order that he was halting the distribution of unspent government funds for vehicle charging stations from a $5 billion fund.

He also called for ending the waiver requiring states to adopt zero-emission vehicle rules by 2035 and said his administration would consider ending EV tax credits.

His order said Trump’s administration should consider “the elimination of unfair subsidies and other ill-conceived government-imposed market distortions that favour EVs over other technologies and effectively mandate their purchase.”

Trump’s order comes at a time when the US is already a global laggard in the adoption of EVs, even as sales of electric cars have been surging worldwide.

China, meanwhile, has soared to fill the gap left by the US, with the country’s top carmaker, BYD, displacing Elon Musk-led Tesla as the world’s largest EV-maker.

Rough days for energy transition, renewables

Some of the most significant impacts of Trump’s policies will be felt on America’s energy transition, with the president’s repeated denial of climate change and moves to boost oil and gas expansion.

In keeping with his call to “drill, baby drill”, Trump signed an executive order repealing Biden’s efforts to block oil drilling in the Arctic and along large areas off the US coasts.

That call was also central to his energy emergency declaration, which aims to undo what the order called “harmful and shortsighted” energy policies that have pushed up energy prices for Americans.

Trump also issued an order for the US to resume processing export permit applications from new liquefied natural gas (LNG) projects supplying Asia and Europe, effectively reversing a pause Biden put in place in early 2024.

The reversal of US policies on oil and gas is unlikely to bode well for the development of the renewables sector, which can often require costlier infrastructure and larger investments.

Among the first hit renewables industry was wind energy, with Trump suspended new federal offshore wind leasing pending an environmental and economic review

Trump said windmills are ugly, expensive, and harm wildlife, adding, “we’re not going to do the wind thing.”

Breather for TikTok

The president also delayed a ban on the China-owned video app, TikTok, which was due to shut down in the US on Sunday due to national security concerns.

Trump said the executive order gives him the right to sell or close TikTok. He ordered the attorney general not to take action in the case for 75 days.

“If I do the deal, it’s worth maybe $1 trillion. A trillion. So if I do the deal, I’m talking about doing it for the United States,” Trump told reporters in an impromptu Q&A.

Heartbreak for crypto

Interestingly, while orders Trump signed signalled upheaval, his lack of action on one sector — crypto — did not go down very well either.

Bitcoin, other cryptocurrencies, and even the newly minted token bearing the US president’s name — $Trump — cooled on Tuesday, after the first set of policies following his inauguration did not refer to the asset class.

Trump promised on the campaign trail to be a “crypto president”.

Bitcoin hit a record high of $109,071 on Monday when Trump was sworn in but later started falling. By 1001 GMT on Tuesday, it was trading at $102,546.13 – still up around 9.5% so far this month.

Trump’s own cryptocurrency, launched on Friday night, was trading at $37.98, according to cryptocurrency price tracker CoinMarketCap.

It roughly halved from its peak of around $75 on Monday, when its market value exceeded $14 billion. At its launch, the coin was priced around $6.50.

- Reuters, with additional editing and inputs from Vishakha Saxena

Also read:

Stock and Currency Investors Jolted by Trump’s Chaotic Approach

Bankers up All Night to Assess Impacts From Trump Trade Moves

Trump’s Cabinet And Top Advisers Offer Mixed Insights on China

Ethics Experts Staggered by Trumps’ Launch of Crypto Coins

Trump Inauguration: Cautious China Wants ‘A New Start’ With US

Trump Planning to Clamp Down on Chinese EV Supply Chains

Chinese Media to Trump: ‘There Are No Winners in Tariff Wars’

Economists Say Trump Won’t Hit China With 60% Tariffs Early On

What Will Donald Trump Mean For Global Carbon Markets?