(ATF) Corporate bonds climbed Wednesday after news that Beijing was considering raising the limit on overseas investments boosted hopes that more money would flood into offshore Chinese credits.

Gains among the debt of private businesses were not enough to lift the broader non-sovereign bonds market from a Lunar New Year slump. The world’s second-biggest debt market has seen recent tepid investor sentiment amid growing concern that inflationary signals in the global economy would work against fixed-income assets.

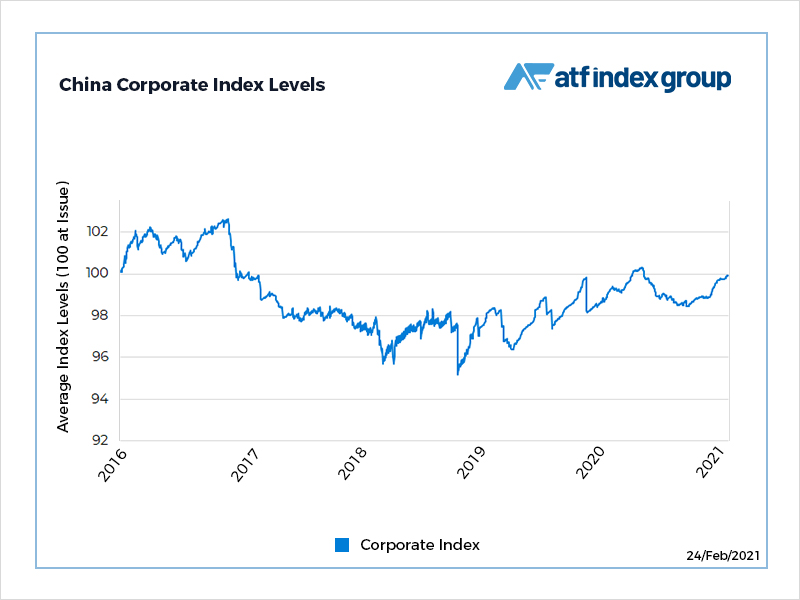

The Corporate sub-gauge of the ATF bond indexes rose 0.02%, rebounding from a 0.01% decline on Tuesday. The measure has risen 0.15% since market reopened after the long Lunar New Year Break on February 18. Even so, it is still trading at a notional loss since dipping below the par-value 100 mark in June.

Also on ATF

- China mulls allowing citizens to invest in overseas stocks

- Allowing foreign exchange purchases ‘may not affect yuan rate much’

- Another billion-tonne oil and gas discovery in Bohai oilfield

The benchmark ATF China Bond 50 Index was unchanged at 107.00. The Enterprise, Financial and Local Government sub-indexes were all little changed.

China is studying the feasibility of allowing citizens to invest in overseas securities and insurance policies with an annual individual limit of $50,000.

The comment from the foreign exchange authority prompted analyst speculation that the move had been designed to help rein in the nation’s currency, which has been appreciating against the dollar at the fastest rate in a decade. Some speculated that money could find its way into China’s offshore corporate bonds market, which is already a favourite destination of domestic capital.

The benchmark ATF CB50 has been rising since the autumn on a string of economic data releases that have pointed to China’s continued strong recovery from the pandemic downturn at the start of last year. The reluctance of the People’s Bank of China to increase fiscal stimulus has also benefited the $15 trillion market.

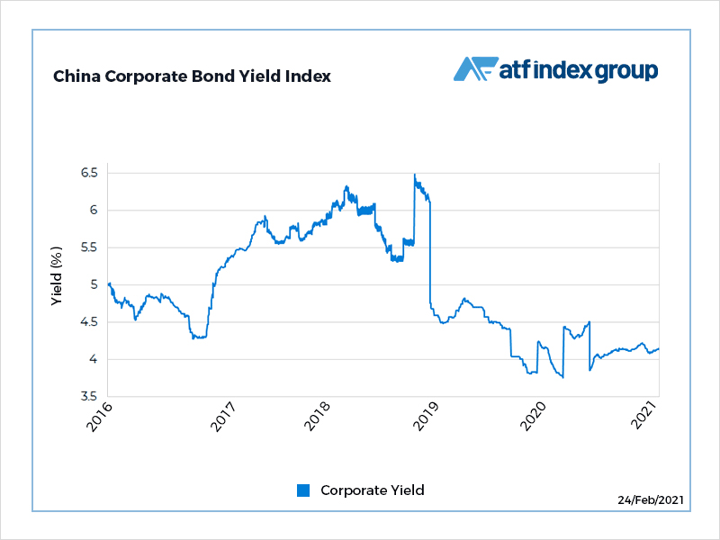

However, recent declines in US Treasuries – the international safe haven asset – has narrowed the yield premium that Chinese bonds enjoy over their American counterparts. That’s reduced their appeal to investors who have been flooding into China’s capital markets as low interest rates in the rest of the world reduces the potential earnings from other assets.

Their appeal has all been diminished by rising expectations of a global recovery as vaccination programmes around the world show signs of muting the coronavirus pandemic. That’s given investors the confidence to shift capital into riskier asset such as stocks and out of the relative safety of bonds.