(ATF) China’s Wanda Group, the major shareholder in AMC Entertainment Holdings – a target of the recent retail frenzy by Reddit group WallStreetBets – said on February 8 it had conducted a share conversion to permit sales of its stock in the cinema operator.

A US Securities and Exchange Commission filing said a unit converted its Class B common stock in AMC to Class A shares on February 1, but did not give details on the amount of stock converted or whether Wanda had sold any shares in AMC.

AMC shares touched $17.25 on Feb. 1, almost quadrupling from a week earlier, as social media platforms fuelled frenetic retail buying into heavily-shorted stocks, including AMC and GameStop. AMC shares plunged 41% the next day and the stock is now down about 60% from its Feb. 1 peak. It closed at $6.18 on February 8, down 9.5% for the day

According to the SEC filing, a unit of the group, Wanda America Entertainment, had converted the shares “in order to permit sales of its common stock”.

Wanda bought a majority stake in AMC in 2012 for $2.6 billion, in what was then the largest overseas acquisition by a privately held Chinese company, to diversify from property into entertainment and other films.

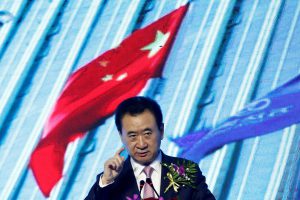

In 2015, Wang Jianlin, Wanda’s chairman, surpassed Alibaba founder Jack Ma and late Hong Kong tycoon Li Ka-shing to become the richest person in Asia. He also ranked among the top 10 wealthiest people in the world.

DIVESTING ASSETS

Wang has fallen in the rankings since, as Wanda’s acquisition spree did not prove successful and, like HNA Group, Anbang Insurance Group and Fosun International, the company has been seeking to divest assets and pay down mounting debts.

Last month, Wanda’s sports unit sold its Ironman triathlon business.

Wanda still owns a controlling stake in AMC, according to the group’s website. Wanda also owns Hollywood producer Legendary Entertainment and Australian cinema chain Hoyts Cinema.

AMC, the world’s largest cinema chain, has warned that without a run of major blockbusters and with some of its most profitable screens closed it could run out of cash.

The company said that it was exploring several avenues to raise cash including asset sales, additional debt or equity financing and joint ventures with current business partners.

With reporting by Reuters and Agence France-Presse