China Evergrande’s financial crisis is shining a light on the frailty of China’s gigantic property sector as concern grows that a disorderly unravelling of the world’s most indebted developer risks triggering a domino effect of industry defaults.

Large private real estate companies including Sinic Holdings are facing similar liquidity crises that make them vulnerable if Evergrande’s failure leads to a loss of investor confidence. With almost a quarter of the country’s GDP tied up in the property market, such an event could prompt a sudden selloff, sending shockwaves through the entire economy. That would inflict potentially huge losses on investors and put millions of citizens’ homes in peril.

The likelihood of that happening increased when Evergrande, saddled with $305 billion of liabilities including $70bn of offshore bonds, recently missed a second bond repayment in a week. That led to the suspension of trading in its shares.

If the regulatory environment does not improve and property sales continue to slide, 60% of China’s privately owned developers will go bankrupt by June of next year, said Pan Jun, chairman and chief executive of Fantasia Group, at a forum last month.

Investor worries over the fate of the nation’s largest developer have been deepened by the refusal of China’s government to offer a bailout.

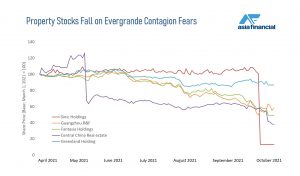

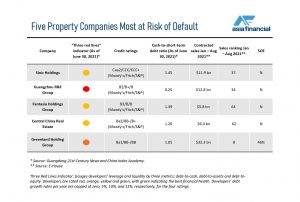

An AF survey of the sector has identified five companies whose billions of dollars of debt, junk rating downgrades and precarious financial positions make them prime candidates for default if Evergrande’s collapse sparks a selloff. As well as Sinic, Central China Real Estate (CCRE), Guangzhou R&F Group, Fantasia Holdings and Greenland Holding have all either missed recent bond coupon payments, or sold assets and sought emergency funding to ease liquidity shortages.

All have seen their market capitalisations decline since Evergrande’s troubles became apparent in the spring.

Sinic Declines

Jiangxi-based Sinic’s stock has suffered most, plummeting 87% in Hong Kong on September 20, leading to their suspension on the Hong Kong stock exchange, amid media reports that it had informed employees of an across-the-board salary cut of as much as 70%. In late September the company missed a 100-million-yuan ($15.5m) loan payment and doubt now hangs over its ability to meet a $246m repayment on October 18. Its rating had been downgraded by S&P, Moody’s and most recently Fitch.

“The downgrade reflects the diminishing likelihood of Sinic refinancing its immediate maturity,” Edwin Fan, an analyst from Fitch, said.

The company’s refinancing plans are becoming less transparent and its access to offshore capital markets has significantly weakened after the sharp price drops in its bonds and shares, Fan added.

State-run China Business News reported on Monday that Zhang Yuanlin, Sinic’s chairman, was in talks with Jinke Service over a potential sale of its property management arm for as much as 1.8 billion yuan, citing sources with knowledge of the matter. The potential buyer – Jinke Property Group’s property service arm – has declined to comment.

R&F Funding

R&F said on September 20 it had secured $1 billion in short-term financing from top executives, giving it room to meet near-term obligations. On the same day, Country Garden Services Holdings said it would buy an R&F property management subsidiary for 10 billion yuan, a price some analysts said represents a 10% discount.

R&F has a junk rating, and was downgraded earlier in the month by Moody’s and put on a negative credit outlook by Fitch. It has about 12 billion yuan in bonds due by October 2022, most trading at distressed levels.

Shares of R&F have fallen 47% in Hong Kong this year.

Fantasia Crunch

Shenzhen-based Fantasia missed a $206m coupon payment early this week, which halved the value of the bond.

Trading of Fantasia’s shares had already been suspended in late September after Country Garden said it would acquire a property service subsidiary for not more than 3.3bn yuan.

That came after S&P, Fitch and Moody’s cut the Shenzhen-based firm’s outlook to negative.

Moody’s downgrade reflects Fantasia’s “increased refinancing risks because of its weakened funding access and sizeable amount of maturing debt,” Moody’s Senior Analyst Celine Yang said on Monday.

Fantasia, founded by former vice-president Zeng Qinghong’s niece in 1996, has $762m of offshore bonds maturing this year and another $1.15bn due in 2022. It also has 1.7bn yuan of onshore bonds maturing this year, but had only 10bn yuan of cash as of June, according to S&P.

Fantasia’s shares have declined 65% in Hong Kong this year.

CCRE Risks

Both Moody’s and S&P Global lowered their outlooks for CCRE to negative this month, while affirming their ratings.

The Zhengzhou, Henan-based group was established in 1992 and is the largest developer in the province, according to S&P Global Ratings.

Kaven Tsang, a Moody’s senior vice president, said the agency expects CCRE’s sales and financial metrics would weaken because of “regional economic and regulatory risks”, as well as its “weakened access to offshore funding”.

A report circulated online earlier this month showed that CCRE requested government assistance after it incurred a more-than 5bn yuan loss from Covid-19 and deadly floods in its home province of Henan.

The firm later told investors it has set aside sufficient cash to repay a bond due in November, while the company has been buying back other issuance.

Its shares have declined 21% in Hong Kong this year. And on Thursday its August 2024 maturing bond dropped 6 cents to leave it at half its face value.

Greenland Chill

Last week, Moody’s affirmed Greenland Holding’s rating of Ba1 but revised its outlooks to negative from stable.

Moody’s expects a weakening in Greenland’s credit quality and ability to raise new debt, both onshore and offshore, Tsang said. However, he believes Greenland would have sufficient liquidity in the next 12-18 months.

With more than 1.2 trillion yuan of liabilities, Greenland has been scrambling to sell assets to improve its liquidity. It sold a hotel in Shanghai for 860m yuan in June and a property service firm for 1bn yuan in July.

Expansion into the construction business has put new pressure on Greenland’s cash flow and profit margin. The firm took over a controlling stake in Guangxi Construction Group last August for 3.6bn yuan.

Shares of Greenland have decreased 14% in Shanghai this year. And on Thursday a July 2024 bond issued by the company, which has permission to build what could be Europe’s tallest residential tower – in London, also fell below 50 cents in the dollar.

Deleveraging Policy

By no means all Chinese developers are in trouble. China Sunac Holdings, the fourth largest developer, has seen wild swings in its share price on suggestions its finances are unhealthy. A letter from one of its local offices seeking government help to ease a funding crunch raised a red flag but the company soothed investor concerns when it said sales had grown 35% year-on-year.

While Sunac’s shares recovered some lost ground, the episode illustrates how sensitive China’s markets have become to the fate of its property developers amid the Evergrande crisis.

Property developers’ difficulties stem partly from their aggressive expansion through leverage, but also from China’s measures to tamp down risks in its economy.

Wild speculation in real estate had sent property values soaring, spurring a building spree. An estimated 91 million new homes – enough to house all of Germany – still stand empty. In an attempt to slowly deflate such bubbles, authorities imposed new deleveraging rules and borrowing limits on companies. It established the so-called “three red lines” system in August 2020, which ranked companies according to three levels of indebtedness and liquidity.

Authorities’ actions have also been driven by a policy of diverting investment that has been fuelling these bubbles into supporting the ruling Communist Party’s strategic aim of making the country self-sufficient in key industries such as chipmaking.

Adding to property market pressures, officials limited the amount of land released for development and imposed mortgage quotas on banks. Together these measures led developers to sell off property quickly and at huge discounts to maintain liquidity, eating into their margins. They also sent prices falling; data from the National Statistics Bureau show that homes sales slid in August, with a 19% decrease over a year earlier and a 7% month-on-month decrease.

SOE Bias

Structural problems with China’s economy are also at play. State-owned enterprises (SOEs) enjoy benefits that aren’t available to private firms, creating a clear divergence of performance, according to Natixis Asia Research. Only 18% of private firms can meet all requirements of Beijing’s “three red lines,” compared with 26% of locally run SOEs and 46% of centrally controlled SOEs, the research firm said.

• By Iris Hong and Mark McCord

This report was updated on October 7.