(ATF) Chinese companies accounted for the top five venture capital (VC) mega-deals globally in the fourth quarter. Sectors with high demand amid the pandemic such as logistics, ed-tech and healthcare attracted interest across Asia, according to an analysis by KPMG.

“After a lacklustre first half of the year, VC investment in Asia continued to rebound, particularly in China,” KPMG said in a report released last week.

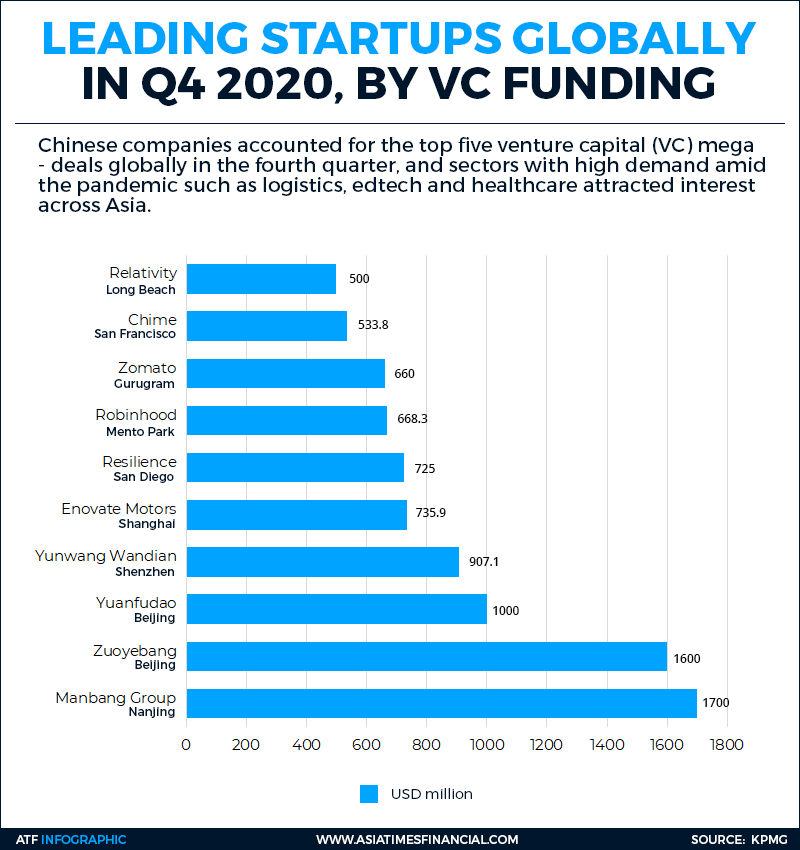

The world’s 10 largest startups by VC funding raised just over $9 billion during the fourth quarter, which China dominated and accounted for the top five positions, according to KPMG.

Manbang Group, which offers freight services to help connect truck drivers with shippers through mobile applications, raised the highest amount at $1.7 billion.

Next after that were ed-tech providers Zuoyebang and Yuanfudao, which raised $1.6 billion and $1 billion, respectively.

Ranking the fourth and fifth were a $907-million fundraising effort by e-commerce company Yunwang Wandian, and a $736-million fundraising by electric vehicle maker Enovate motors.

Meanwhile, the US took four positions in the world’s top 10 venture capital deals in Q4. Investment was focused on fintech, health and biotech, plus the transportation sectors.

The quarter’s largest funding rounds by American startups were a $725-million fundraising by biotech company Resilience, a $668-million fundraising by fintech Robinhood, a $533-million fundraising by fintech Chime, and a $500-million raise by aerospace company Relativity.

India’s food delivery company Zomato ranked the eighth with a $660-million raise

VC market resilient despite Covid-19

“The VC market globally showed incredible resilience in 2020, defying early expectation of a potential dip due to Covid-19,” KPMG said.

As it was first hit, the Asia-Pacific VC market saw the impact of the pandemic ahead of the rest of the world in Q1 and Q2. But funding recovered in Q3 and Q4 with several companies raising significant amounts.

It’s worth mentioning that VC investors focused primarily on late-stage deals and on supporting companies with their existing portfolios, due mainly to uncertainties in the markets.

Domestic focus spurred VC market in China

While VC investment around the world continued to focus on sectors that help people navigate the pandemic, such as logistics, healthcare, and edtech, investors in China focused heavily on domestic opportunities.

The ongoing US-China trade tensions have heightened concerns about supply chain availability, and led to an increase in support technologies such as chipsets and chipset architecture, KPMG said.

IPO activity was very strong in Hong Kong and Shanghai during Q4, despite the sudden cancellation of Ant Group’s IPO.

Healthcare and biotech were big winners in the IPO market in Asia during Q4 with China-based biotech firm RemeGen raising $515 million in October and JD Health raising $3.5 billion in December.

Amid mounting tension between the world’s largest two economies and concerns about the delisting of Chinese companies in the US, many VC investors looking to exit are considering Asian exchanges.

Global VC investors optimistic in Q1

KPMG expects global VC investment to remain high in Q1 with the low interest rate environment in many regions and the vast amount of liquid assets in the market. IPO activity is also expected to remain strong.

Given the increasing focus on domestic investment and growth, the outlook for VC investment in China is also optimistic, they said.

“Hot sectors (in China) will likely continue to be things like transportation and logistics, automotive, edtech, and health and biotech. We may also start to see increasing investments in different green technologies – not only in China, but across Asia,” said Egidio Zarrella, Partner of Clients and Innovation at KPMG China.