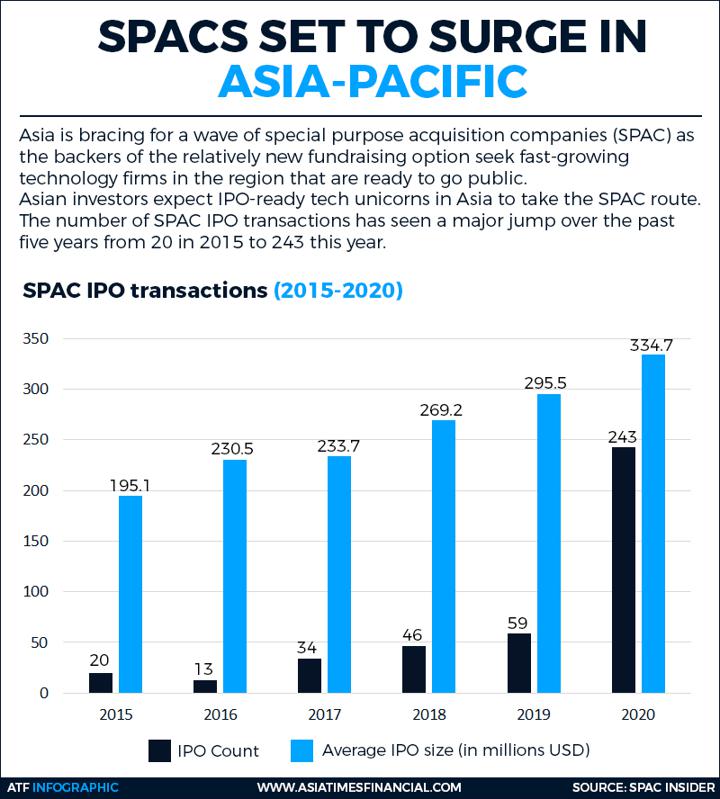

(ATF) Asia is bracing for a wave of special purpose acquisition companies as the backers of the relatively new fundraising option seek fast-growing technology firms in the region that are ready to go public.

SPACs are exchange-listed shell companies that raise money through initial public offerings (IPOs) and merge with firms by enticing them with shorter listing timelines. Such structures have raised a record total of more than $70 billion in the US this year, according to Credit Suisse data, up from just $13 billion in 2019.

Asian investors expect IPO-ready tech unicorns in Asia to take the SPAC route. Tokopedia, one of south-east Asia’s biggest start-ups, already plans to go public. The online shopping app Founder and chief executive William Tanuwijaya , which has raised money from Google and Singapore’s Temasek, has approached Citi and Morgan Stanley to begin work on a public listing.

Tokopedia was approached by Bridgetown Holdings, a SPAC backed by Hong Kong businessman Richard Li and Silicon Valley investor Peter Thiel, while Traveloka, which operates Southeast Asia’s largest online travel app, told Reuters it would go public soon and was evaluating a merger with a SPAC as an option.

“These days, not a single conversation goes by in Asia when SPACs are not discussed. Southeast Asia is a focus market given the number of high-growth tech-enabled companies,” Sarab Bhutani, head of Southeast Asia investment banking at Nomura, told Reuters.

SPACs, also known as blank-cheque companies, emerged in the 1980s, but “became associated with lack of regulatory oversight and, on occasion, even fraudulent activity.”, a recent Credit Suisse analysis noted. “The ensuing backlash from market participants led to reforms that transformed the product over the years.”

SPACs are not new to Asia, either. In 2014, Reach Energy made its market debut in Kuala Lumpur after completing a $229 million IPO, then the country’s largest SPAC-enabled listing. Niron Stabinsky, head of SPAC at Credit Suisse in New York, said investors these days can draw comfort from the “blue-chip” people and firms attached to such projects.

Asian tradition

The father of Asian SPAC investment is widely regarded to be Antony Leung, a former finance secretary of Hong Kong and an ex-Blackstone Asia executive. He raised $1.5 billion using a SPAC on the New York Stock Exchange, United Family Health, which he bought from private equity firm TPG and Fosun.

“While nobody has a crystal ball to predict what the future market holds, a closer look at volumes during 2020 can help serve as a guide for which way the SPAC market is headed in the near term. In the second half of 2020 alone – through October – there have been over 130 SPAC IPOs in the US,” Credit Suisse said in its report.

Known as high-risk, high-reward investments, SPACS attract investors who hope a team of experienced industry executives can translate seed money into profits down the road. Many SPACs are holding talks with Southeast Asia’s tech, healthcare and fintech start-ups, bankers and lawyers familiar with the matter told Reuters.

Ride-hailer Gojek, food delivery company Grab and e-commerce firm Bukalapak have all either been approached or are targets for SPACs, Reuters said, although the companies either declined comment or did not respond to queries.

Chinese buyout firm CITIC Capital, Singapore-based healthcare entrepreneur David Sin and former hedge fund manager George Raymond Zage are among a growing list of backers of SPACs. Last month, a SPAC led by Zage raised $276 million, while SoftBank Group’s Vision Fund is also seeking to raise $525 million through such a structure.

“Chinese companies tend to be more conservative about taking the SPAC route as they have a proven track record of raising money via an IPO,” Peter Kuo, partner of buyout firm Canyon Bridge, told Reuters. However, SoftBank, the owner of stakes in Didi Chuxing and Paytm, could boost further SPAC activity in Asia.