(ATF) Chinese financial bonds slid Wednesday, led be declines by Bank of Communications after a proposed security sale was rated junk by Moody’s.

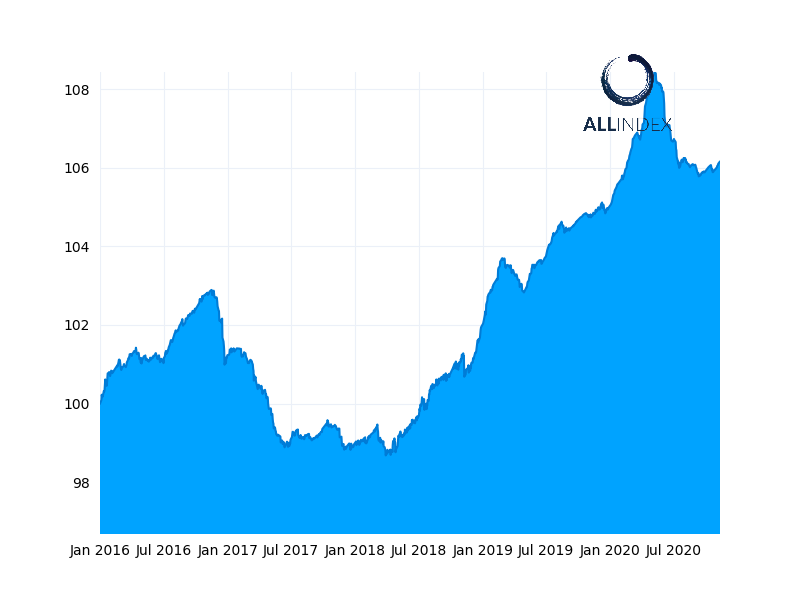

The retreat pared gains on the benchmark China Bond 50 Index, which eked out a 15th day of gains, just one day off equalling its longest-ever winning streak. The gauge climbed 0.01%. Among the Allindex sub-gauges, Financials slid 0.01%, Corporates climbed 0.02% and Corporates and Enterprises both advanced 0.01%.

China’s corporates bonds have climbed for 15 consecutive days as appetite for higher-yielding assets has been boosted by a variety of economic and geopolitical factors.Among them, the victory of Democratic challenger Joe Biden in the US election, hopes for an effective coronavirus vaccine within weeks and China’s indication it will add stimulus to the economy.

The Asia Eight: Daily must-reads from world’s most dynamic region

Bank of Communications’ 3.18% bond fell 0.02% after its yield climbed 0.28%.

Moody’s assigned the lender’s proposed Additional Tier 1 bond a BB+ rating, one step below investment grade.

“The proposed bonds have lower recovery expectations than for higher-ranking securities, due to their subordination status and write-off features,” the rating company wrote. “The proposed bonds will be irrevocably written-off, in whole or in part, upon the occurrence of a non-viability trigger event.”

Other movers included China Merchants Bank’s 3.45% bonds, which climbed 0.09% on a yield drop of 1.2%. Agricultural Development Bank of China’s 4.39% security rose 0.12% as its yield slid 0.52%.