A group of niche Chinese gas firms is set to make waves in the global market with plans to invest tens of billions of dollars and double imports in the next decade as Beijing opens up its vast energy pipeline network to more competition.

The companies, mostly city gas distributors backed by local authorities, are ramping up purchases of liquefied natural gas (LNG) as newly formed national pipeline operator PipeChina begins leasing third parties access to its distribution lines, terminals and storage facilities from this month.

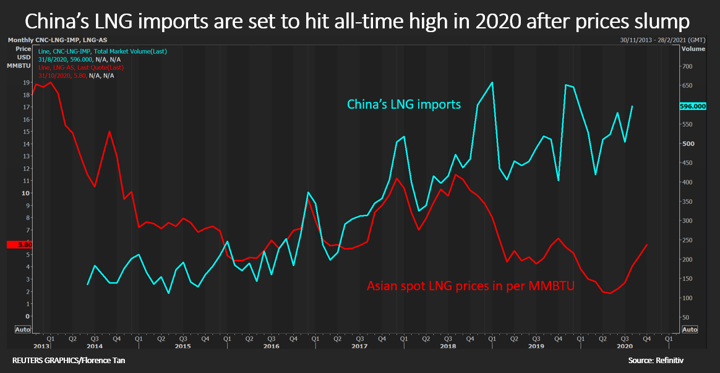

The acceleration in demand in what is already the world’s fastest-growing market for the super-chilled fuel is a boon for producers such Royal Dutch Shell, Total and traders like Glencore faced with oversupply and depressed prices.

Just last month, UK’s Centrica signed a 15-year binding deal to supply Shanghai city gas firm Shenergy Group 0.5 million tonnes per year of LNG starting in 2024.

“They’re very, very interested in imports…we’re talking to a lot of them already,” said Kristine Leo, China country manager for Australia’s Woodside Energy which signed a preliminary supply deal with private gas distributor ENN Group last year.

China could buy a record 65-67 million tonnes of LNG this year and is expected to leapfrog Japan to become the world’s top buyer in 2022. Imports could surge 80% from 2019 to 2030, according to Lu Xiao, senior analyst at consultancy IHS Markit.

State-owned Guangdong Energy Group, Zhejiang Energy Group, Zhenhua Oil and private firms like ENN were quick to take advantage of the market reforms and low spot prices for LNG, said Chen Zhu, managing director of Beijing-based consultancy SIA Energy.

Their imports will reach some 11 million tonnes this year, up 40% versus 2019, more than 17% of China’s total purchases, said Chen.

For years such companies have worked to expand a domestic consumer base among so-called “last mile” gas users like tens of millions of households, shopping malls and factories such as ceramic makers, but they had to rely on state majors for supplies.

With greater access to distribution networks, they are now incentivized to build their own import terminals that could account for 40% of the country’s LNG receiving capacity by 2030, versus 15% now, Chen said.

Frank Li, assistant to president of China Gas Holdings, a private piped gas distributor, said his company has been in talks with PipeChina for infrastructure access as it prepares to import LNG next year.

GUANGDONG BUYERS

In Southern China’s industrial hub Guangdong, companies like Guangzhou Gas, Shenzhen Gas and Guangdong Energy hold small stakes in LNG facilities operated by China National Offshore Oil Company. They imported their first cargoes from these terminals last year.

Guangzhou Gas is set to import 13 LNG shipments this year, up from five last year, after “tough negotiations” with CNOOC won it access to terminals, said Vice President Liu Jingbo.

“The reform is bringing us diversified supplies, helping us cut cost,” Liu told Reuters.

Some companies also plan to beef up trading expertise by opening offices overseas, such as in Singapore, executives said.

“Naturally, companies will be thinking of growing into a meaningful player globally,” said a trading executive with Guangdong Energy, adding that his firm looks to Tokyo Gas, Japan’s top gas distributor and trader, as a model.

The rise of niche players will erode some market share held by state giants CNOOC, PetroChina and Sinopec, prompting them to scale back gas infrastructure investment and focus on global trading, while extending into retail gas distribution at home, officials said.

“National majors’ investment in terminals and pipelines were previously self-driven for integration. Now that these assets have been spun off, the drive to build new facilities will subside,” said a PetroChina official.

(Reporting by Chen Aizhu; Additional reporting by Jessica Jaganathan in SIngapore and Emily Chow in Shanghai; Editing by Florence Tan and Kim Coghill)