Profit growth at China’s industrial firms accelerated in January-February in line with other signs of momentum in the economy, although the outlook is clouded by Covid-19 outbreaks and the war in Ukraine stoking calls for supportive measures.

Profits rose 5.0% from a year earlier, up from a 4.2% gain in December, the National Bureau of Statistics (NBS) said on Sunday.

The growth in January-February was driven by surging profits in the energy and raw materials sectors, thanks to higher prices of commodities such as crude oil and coal. January and February data are typically combined to smooth out distortions from the Lunar New Year holiday, which can fall in either month.

Downstream, monthly profit growth among other industrial firms has been weighed down by high raw material costs, languishing in the single-digits since November.

The slightly faster industrial profit growth was in step with improvement in NBS data on industrial output, retail sales and fixed-asset investment in January-February, suggesting the impact of recent policy measures were starting to be felt.

Still, challenges have emerged this year including China’s most serious Covid outbreak since early in the pandemic in 2020, driven by the Omicron variant, threatening to disrupt local economies and further chill consumer spending.

“The gap between upstream and downstream profit margins widened as downstream profit margins fell further,” Goldman Sachs analysts wrote in a note.

“We expect the Covid outbreak in multiple provinces to weigh on industrial profits in the near-term.”

Given the coronavirus flare-ups, policies to further ease monetary and fiscal measures can be expected, they said.

The financial hub of Shanghai has been battling with its worst Covid spell in the past month since the initial outbreak in China two years ago.

War ‘Could Have Huge Impact’

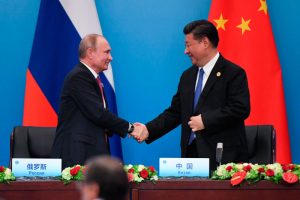

Global upheavals such as Russia’s attack on Ukraine have also created uncertainty over international supply chains and the potential for even higher commodity and energy prices, ultimately weighing on the bottom line of Chinese firms.

“The countries in conflict are important exporters of energy and agricultural products, and comprehensive sanctions on Russia may have a huge negative impact on global supply chains,” an opinion piece in the state-controlled China Daily warned on Monday.

“As the current positive manner of economic performance is hard-won and potential risks still exist, China should launch expansionary policies as soon as possible to protect incipient recovery.”

Vice Premier Liu He said recently that Beijing will take measures to boost the economy in the first quarter and that monetary policy would be set to support growth.

To ease financial burdens for smaller firms, China has pledged around 1.5 trillion yuan ($240 billion) in value-added tax (VAT) rebates.

The finance ministry said last Thursday that China would exempt some small firms from the 3% VAT levy, as they are the country’s main source of jobs.

The statistics bureau’s industrial profits data cover large firms with annual revenues above 20 million yuan from their main operations.

- Reuters with additional editing by Sean OMeara

ALSO READ:

China Industrial Profits Dip Amid Weak Demand, Property Crisis

China Industrial Profits Accelerate in September

China’s December Industrial Profits Show Growth at Slower Pace