(ATF) The MSCI Emerging Market index has experienced substantial changes to country, sector and stock composition over the last 20 years. These reflect the impact of economic cycles, socio-political events, government reform policies, sector trends, as well as technical factors specific to the asset management business. These include index constituent rules, the rise of thematic investing and the popularity of Exchange Traded Funds (ETFs).

More recently, there has been an increasing focus on ESG – Environmental, Social and Governance – investing in parallel with greater societal attention on issues like gender equality, carbon footprint and good corporate citizenship.

As many sources of change overlap or run in parallel, this article will only focus on some of the larger country and sector developments over the last 20 years.

Continual change

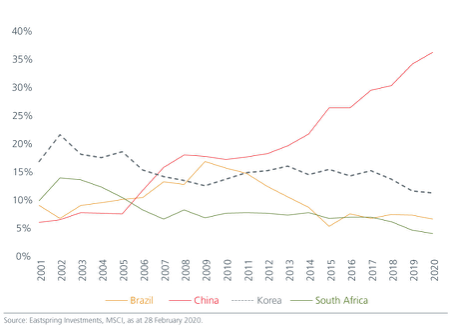

At a country level (see graph-1 below), while we have seen many countries join and leave (and occasionally re-join) the MSCI EM Index over the years, a few seismic changes stand out. For one, China represented just 5% of the MSCI EM Index 20 years ago. It now exceeds 35% of the index on the back of its phenomenal economic growth and the gradual opening of its financial markets to foreign investors. China’s rising share of the index has come at the expense of some major markets. South Korea, for example, was the largest emerging market in 2002, briefly accounting for 20% of the index. Today, its share is nearer to just 10%. Likewise, South Africa almost reached 15% of the index in 2002 but today accounts for less than 5%.

However, not all the changes were one-directional. Brazil is a good example of a country whose index weight (and economy) has been somewhat of a rollercoaster ride. On the back of the commodity super cycle, Brazil’s index weight rose from less than 10% in 2000 to 17% in 2009, briefly becoming the second largest country constituent then. Its rise stopped precipitously with the Global Financial Crisis from 2007 and today, Brazil comprises for just 5% of the MSCI EM Index.

Graph 1: Selected country weights in the MSCI EM Index (%) – 2001 to 2020

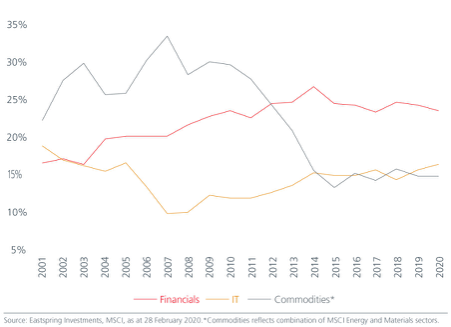

The path for other sectors, however, has been bumpier. Today, much of the discussion around the technology sector seems to suggest that its importance within markets (emerging and developed) can only increase. Such comments clearly forget that Information Technology (IT) was the largest sector in 2000 with a 19% index weight before crashing to just 10% of the index with the bursting of the tech bubble.

That said, the IT sector has since recovered to become the second largest sector today accounting for around 16% of the index. Admittedly, even that recovery may understate the true size of “tech” today as changes in the definitions of index constituents have moved several well-known “tech” giants to other sectors.

Alibaba’s transition, for example, from the IT sector to the Consumer Discretionary sector has boosted the latter’s weight to almost 15% of the index. Yet the principle remains that the weights of some sectors or countries are driven by many factors including their relative popularity at the time, which may not always reflect their true underlying value.

Perhaps the best counter-example to the IT sector story can be found in the commodity sectors within the MSCI EM Index. Rising from a combined weight of 22% at the start of the 21st century, the Materials and Energy sectors rode the commodity super cycle to peak at over 30% of the index in 2007. They have since collapsed and together account for just over 10% of the index today. As in many previous cycles, the bottom of the commodity cycle is replete with fears of a glut in supply and limited visibility on future demand; investors monitoring the current oil price should be very familiar with these arguments.

Graph-2: Selected sector weights in the MSCI EM Index (%) – 2001 to 2020.

In no way should the preceding paragraphs be read as a forecast for commodity prices to rise or that the technology sector is suddenly going to reverse course. We are not making any such forecasts but simply observing the changes that have taken place in emerging markets.

Some things don’t change

While emerging markets will continue to see changes in the future, investor bias is likely to remain constant. Human emotions and investor behavioural biases will continue to create equity mispricing opportunities which disciplined value investors can take advantage of.

The most primal of human behavioural bias – fight or flight – is forever present in equity markets. We often see investors herd into popular and defensive quality stocks during periods of heightened risk aversion. During these periods, investors, influenced by their emotions, tend to overpay for the perceived comfort of stability and security while turning away from cyclical stocks almost without regard for their valuations. This typically creates a strong case for outperformance by those unloved stocks when the cycle turns.

Short-termism or recency bias is another often observed bias. Investors tend to look at a company’s recent outperformance and extrapolate that trend into the long-term or even into perpetuity – and pay the associated high price. Yet, history constantly reminds us that very, very few companies grow above average for extended periods even if the exact causes of the growth slowdown are not always obvious upfront. The market, on the other hand, is frequently quick to punish companies which have disappointed.

Discipline required

We believe that investors need a disciplined investment philosophy and approach to navigate the constant changes in the Emerging Markets in order to exploit the behavioural biases in the market and capture structural alpha opportunities.

This includes focusing research on stocks that display attractive valuation signals on absolute and relative valuation measures – price-to-earnings (PE), price-to-book (PB) and dividend yield (DY).

Evaluating these measures in the context of price performance can help investors identify stocks that were highly rated in the past but have become significantly cheaper due to a price event. This discipline can also help investors avoid the temptation of overly focusing on much loved but very expensive stocks that are currently the hottest “new thing”.

We acknowledge that there is no single approach to research a stock as each may require some unique perspectives. Yet having standard valuation models that rely on multiple methodologies can help guard against subconscious efforts to achieve a desired valuation target. Multiple methodologies that use discounted cash flow (DCF), residual income analysis (RI), dividend discount models (DDM) as well as multiples-based valuations that were mentioned earlier can also mitigate the potential biases inherent in certain methodologies which may favour certain stocks at times.

Although models and methodologies can offer investors a guide to valuations, it is equally important to understand the potential risks that companies face in terms of cash flow, gearing and ESG risks, etc. In these instances, we find that there is no substitute for experience or a hands-on approach which involves consulting with experts and talking to management.

Most importantly of all, we believe that investors should focus on a company’s sustainable earnings instead of guesstimating its short-term earnings. Companies often become cheap due to the market’s excessive attention on recent earnings. By looking through the immediate fear and panic, however, investors are likely to enjoy potential upside when earnings normalise.

Stand the test of time

Emerging markets are no stranger to change. In a post-Covid world, supply chain disruptions, commodity price dynamics and the recent easing measures by emerging market policymakers will bring about long-term consequences and further change. At the same time, these dislocations would present opportunities for long-term investors. When the outlook is uncertain, it makes even greater sense to focus on what is enduring.

As investor biases do not change, a disciplined investment process and philosophy which seeks to exploit hard-wired biases will serve investors well. Over the years, we have had an unwavering focus on valuations and companies’ sustainable earnings trend. We believe that this approach, together with the team’s varied and in-depth experience, will help us navigate the upcoming changes and stand the test of time.

# Steven Gray, CFA, is Portfolio Manager of Global Emerging Market Equities at Eastspring Investments;

# Samuel Bentley is Client Portfolio Manager at Eastspring Investments.