China electric car maker Nio’s factory in Hefei has spent much of the past two weeks motionless and the reason is a Covid lockdown in Shanghai 186 miles to the east.

While Tesla, Volkswagen and General Motors restarted some production in Shanghai last week, other EV makers far from the city are still scrambling for supplies.

Hozon New Energy Vehicles, based about 62 miles southwest of Shanghai in Tongxiang, says it’s facing “strained supplies” and as far away as Chongqing, 895 miles west of Shanghai, Great Wall Motor halted production of some SUV models last week as supplies ran low.

“Shanghai is China’s largest auto city and when it shuts down all carmakers are jolted, no matter which far-flung places they are in,” said Tony Shen, a transport analyst with the Bank of Shanghai’s investment research team. “The city is slowly reopening a small number of factories but that won’t give any immediate relief to manufacturers starved of auto parts.”

Also on AF TV: Will Tesla’s Shanghai Plant Restart Last?

Largest Auto Cluster

The Shanghai area is home to the largest cluster of auto parts suppliers in the country. There are 17 publicly-listed auto parts companies and 20,000 suppliers in Shanghai and nearby Zhejiang and Jiangsu provinces, according to a report by consulting firm AskCI Research.

Leading global automotive parts suppliers including Bosch, Michelin, Continental, BorgWarner, BWI, Hyundai Mobis and Takata run their China operations from Shanghai and have at least 34 plants in or near the city, AskCI says.

Bosch’s factory in Suzhou, just west of Shanghai, remains largely shut, Shanghai-based China Business News reported this week.

EV makers Nio, Hozon and Guangzhou XPeng Automobile Technology are among companies most vulnerable to the lockdown because they operate a fast turnover, low inventory business model, says Wu Xiaobo, a business lecturer at Shanghai Jiao Tong University.

“It’s like being suddenly locked down at home with your fridge almost empty,” he said. “Chinese EV makers founded within the past 10 years are novices in supply risk management.”

Grinding to a Halt

Xpeng founder He Xiaopeng said last week that China’s auto production may grind to a halt in May if Shanghai factories aren’t up and running by the end of this month. Xpeng is based in the southern city of Guangzhou, 900 miles south of Shanghai.

Nio restarted small-scale production last week after Hefei’s government came to the rescue, helping it find some alternative suppliers in Anhui province, according to state media.

China says it’s doing all it can within the constraints of its zero-Covid policy to get things back up and running in Shanghai.

The Ministry of Industry and Information Technology dispatched a task force to Shanghai last week to work with local cadres on a list of more than 600 factories and businesses allowed to resume partial activities, the official Xinhua News Agency reported.

Key suppliers of Tesla and state-owned Shanghai Automobile Industry Corp (SAIC), which has joint ventures with Volkswagen and General Motors, are on the list.

Still, it’s unlikely that things will get back to normal quickly even after the lockdowns end, Wu said.

“Even when Shanghai loosens more restrictions, manufacturers in the city like Tesla and SAIC will be given priority,” he said. “Nio and the like may lose out to bigger conglomerates in the scramble for auto parts.”

- By Frank Chen

Read more:

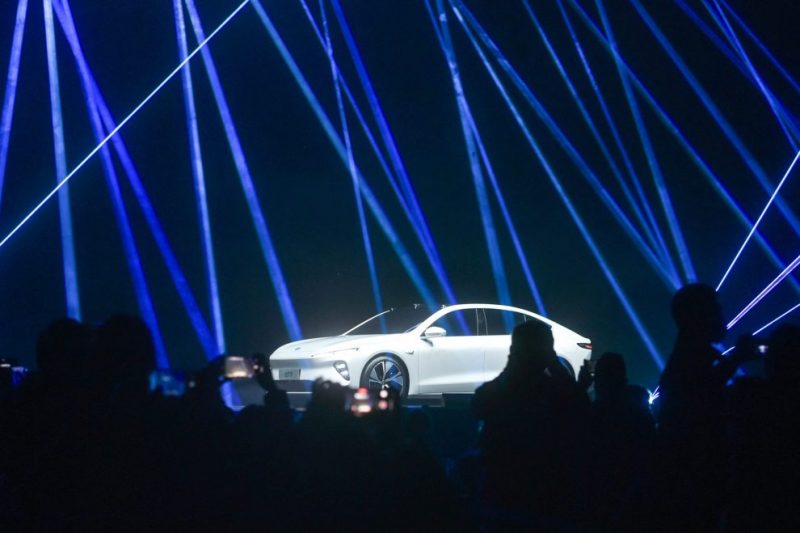

EV Maker Nio Suspends Production Over Covid-19 Curbs

China EV Upstart Hozon Stuns Rivals With Sales Surge

China’s Great Wall to Spend $1.8bn in Brazil EV Production Plan