Economic events

While the US-China confrontation will remain front and centre of investor focus, the week ahead will also shine a light on the extent of the economic collapse due to the coronavirus pandemic as GDP data is unveiled for the second quarter. The extent of the recovery will be echoed in the retail sales and industrial production data due to be released in the week.

“After news of the US economy contracting at a record 32.9% annual rate in the second quarter, eyes turn to industrial production and retail sales updates for July to gauge the recovery path heading into the third quarter,” Chris Williamson, chief business economist at IHS Markit, said.

Williamson said the end of the second quarter had seen a recovery in sales and production, but doubts as to the durability of these rebounds have been raised amid redoubled efforts to stem increased Covid-19 infection rates. Thus July PMIs showed demand faltering as lockdown measures were reimposed.

In Asia, China will hog the limelight as it releases a slew of data, but investors will also monitor GDP updates from Japan, Malaysia, Singapore, Hong Kong SAR and Taiwan.

The weakness of the dollar is also turning investment strategies on their heads as it brings to the fore the EM and old economy investment theses.

“A sustained decline in the dollar which oils the wheels of world trade is set to be a major boost to EM equities and fixed income – the July decline in the greenback has largely been against G10 majors,” Oxford Economics strategists said in a note.

“Capex on structures has historically been associated with a weaker dollar, as it boosts industrial commodities and therefore the terms of trade of non-US markets which have a heavier concentration in and dependence on old economy cyclical sectors. US capex on structures has been weak since 2011-12. A major infrastructure spending plan will likely lead to a change of direction in a boost to non-US markets.”

And as the US sends a senior government official on a visit to Taiwan in a veiled message, hostilities between the two sides are set to rise. China has not announced any specific retaliation yet against the US decision to ban WeChat and TikTok. Its Foreign Ministry simply said the US will suffer consequences.

Beijing’s failure to meet its purchase commitments under the trade agreement is in focus after China’s trade surplus with the United States widened to $32.46 billion in July from $29.41 billion in June. This will certainly bring a lot of attention to a Sino-US video conference on August 15 about bilateral issues and the phase-1 trade deal signed in January.

Gold will remain in the spotlight amid expectations it is seen extending gains as stagnation looms, according to some experts. BofA Securities has projected a price of $3,000 per ounce. Others say that the weak demand and currency debasement at a time of surging gold prices, points to disinflation .

Fund flows

August began on a risk averse footing with equity and balanced funds seeing outflows and money flowing into bond and money market funds as scepticism about the durability of China’s economic recovery, surging coronavirus infections in many markets and volatile markets kept investors cautious, according to fund flows data provider EPFR.

US bond funds posted their 18th consecutive inflow, while flows to money market funds were positive for the fourth time in the past five weeks, but Emerging Markets equity funds posted their 24th outflow in the past 25 weeks and US equity funds their sixth in the past seven weeks.

Investors poured $17 billion into bond funds and $22.6 billion to money market funds but pulled a net $7.4 billion from all equity funds and another $728 million from ‘balanced funds’ during the week ending August 5, EPFR said.

“Amid risks of a second wave of Covid infections, investors have reduced risk in high-yield and equities last week,” BofA Securities analysts said in a note.” Investors have shifted their preference to longer-dated instruments over the past months amid rising funding risks.”

So, although US equity benchmarks struck record highs at the start of the month, investors have not bought into the rally in a big way as global equity funds witnessed $7.4 billion in redemptions.

“Markets have moved from despair to euphoria over one of the shortest periods in modern history. Indeed the ‘sigma’ moves in March broke many records but there has been an ‘equal reaction’ through 2Q and July,” Jefferies analysts said in a note.

“Seasonally, August is a notoriously difficult month,” they warned. “There is still a large amount of cash stuck in money market funds while institutional and retail cash holdings as a % of market cap according to the Fed is above average. Historically, August is not a great period of equity returns. We tactically turn even more cautious on MSCI All World.”

Economic data calendar

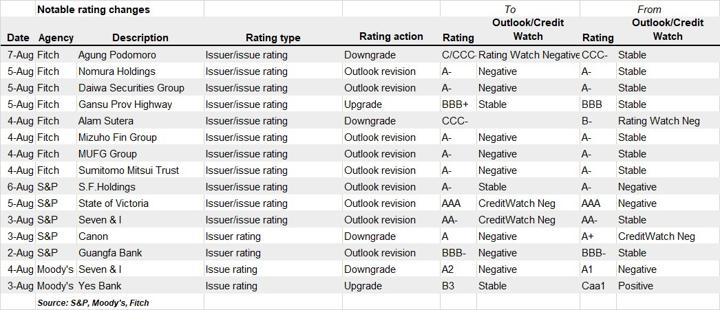

Last week’s rating changes