(ATF) The ATF index gauges ended the week on a losing note, with the ATF China Bond 50 retreating 0.17% on Friday, and the ATF ALLINDEX Enterprise and Financial falling 0.13%. Meanwhile, the ATF ALLINDEX Corporates and Local Governments dropped 0.11% and 0.16%, respectively.

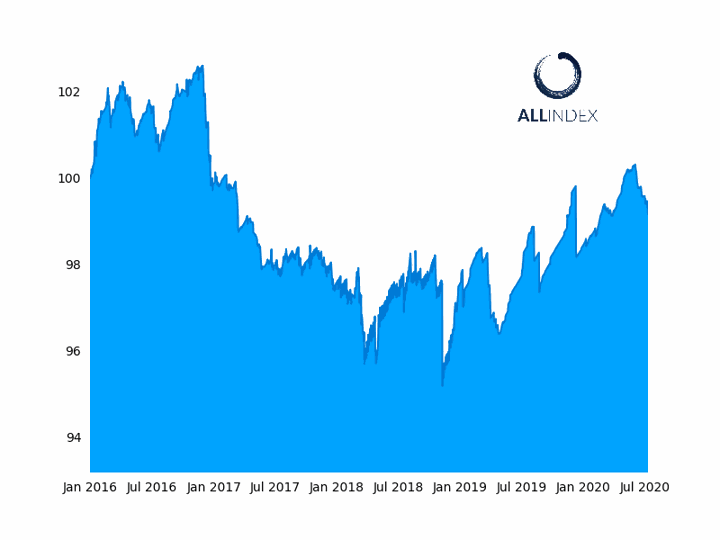

The ALLINDEX Local Government Bonds Index fell 0.16%

The figures come ahead of a slew of economic data due next week, particularly the release of China’s year-on-year GDP print for Q2 on July 19. It will give some indication of the country’s likely policy direction. The world’s second-largest economy enters its third quarter with strong signals of a continued recovery, as data released on Friday by the People’s Bank of China (PBoC) indicates an acceleration in credit growth to help offset the economic impact of the coronavirus pandemic.

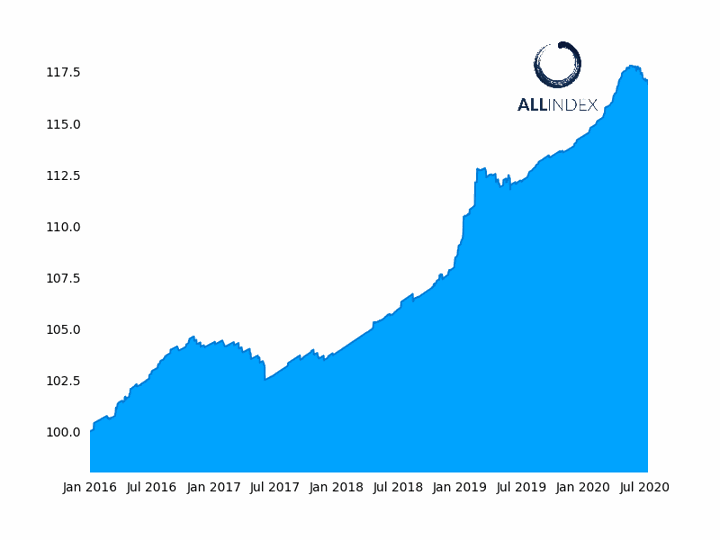

The ATF China Bonds 50 Index fell 0.17%

Yuan-denominated loans rose by 1.81 trillion yuan ($260bn) in June, which was 147.7bn yuan more than growth in the same period last year, according to a PBoC announcement. This amounts to the most in the last three months and beat market forecasts of 1.8tn yuan, according to Trading Economics. Meanwhile, loans expanded by 12.1tn yuan in the first half, or 2.24tn yuan more than in the same period last year.

“It’s very clear that credit expansion has replaced the monetary easing stance that many expected at this point in time,” said Jinny Yan, Chief China Economist at ICBC Standard Bank. “If the data next week shows that economic recovery is even more significant than expected, this will give the PBoC a reason to continue its wait-and-see approach to monetary policy stimulus.”

Slower easing

The PBoC has slowed its pace of broad-based easing since May amid signs of economic recovery, frustrating many bond investors who hoped for more decisive easing action.

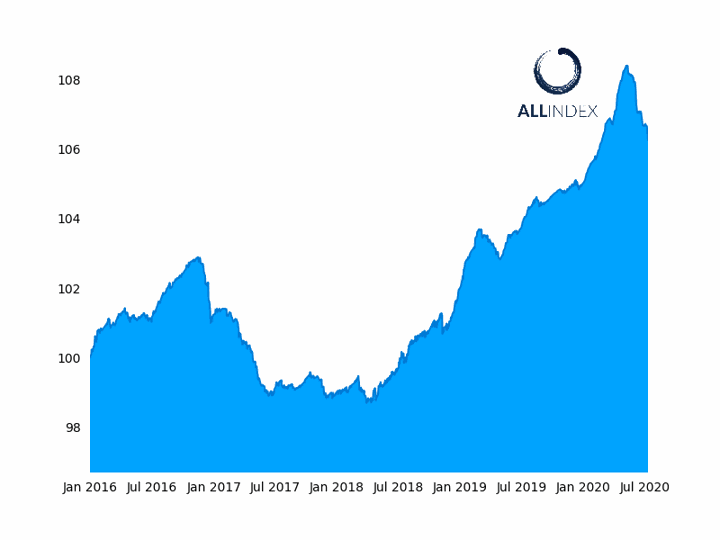

The ALLINDEX Corporate Bonds Index fell 0.11%

But Beijing is under pressure to boost growth without fuelling asset markets. Earlier this week it triggered a surge in stock prices by encouraging investors to purchase shares through a state-owned media organisation. This led the CSI 300 Index to jump nearly 7% to a five-year high, and revived unauthorised margin lending activities blamed for the 2015 stock-market crash.

“There is a need for the PBoC to tread very carefully in order to avoid asset bubbles, particularly in the equity and housing market,” said Yan.

Unlike in 2015, the China Securities and Regulatory Commission this time was quick to take action and exposed 258 funding platforms that illegally lend money to investors for buying stocks, according to a Caixing report on July 9.

“Going forward, we will likely see a differentiated approach: while monetary policy support will continue for specific sectors such as the most vulnerable SMEs, there will be decisive measures to make sure that asset bubbles don’t reflate. That’s clear from the recent policy stance.”

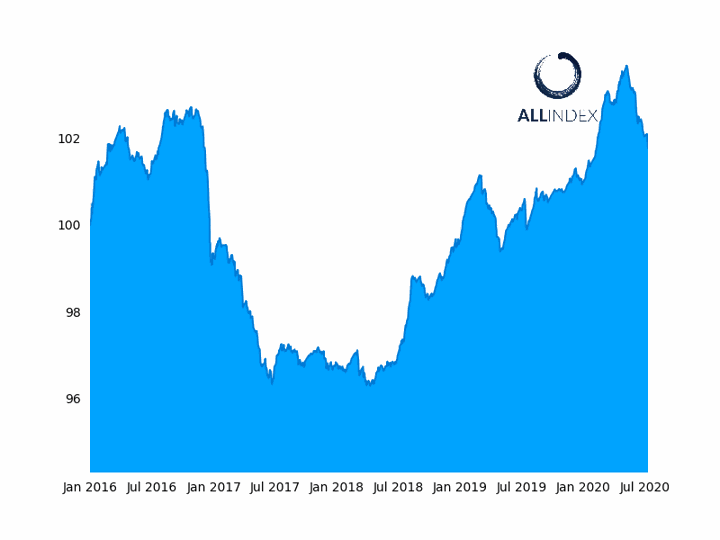

The ALLINDEX Enterprise Bonds Index fell 0.13%

In line with the government’s objective to support the real economy rather than letting liquidity run into sectors that are already seeing a low cost of funding, measures such as a targeted reserve ratio requirement cut could be on the cards, said Yan.

“This would mean that only the smaller banks would benefit from a RRR cut, channelling liquidity to the real economy from financial institutions that tend to lend more to SMEs than the bigger banks”.

Representing the lion’s share of GDP and employment, SMEs are crucial for China’s stability. The sector has taken a big hit from the lock-downs as a result of the pandemic.

The ALLINDEX Financial Bonds Index fell 0.13%