The essay below was published June 8 by the American Compass foundation, as the introduction to a set of policy recommendations for restoring America’s manufacturing industry. A bipartisan consensus is emerging around the need to restore America’s technological edge and industrial base. Donald Trump won the presidency in 2016 by promising to make America great again and restore lost manufacturing jobs. His Democratic Joe Biden announced July 9 a six-point plan to support manufacturing and research.

Biden’s outline mentions a $400 billion “buy American” program focusing on “clean energy and infrastructure: “unspecified incentives for American manufacturers; a $300 billion investment program for R&D including electric vehicles, 5G broadband and Artificial Intelligence; a “tax and trade” policy to help American manufacturers compete against foreign competition; and unnamed measures to “bring back critical supply chains to America so we aren’t dependent on China or any other country for the production of critical goods in a crisis.”

This is a welcome addition to the national debate. The risk in any industrial policy is that resources will be squandered on handouts to favored constituencies, subsidies to inefficient industries, dubious projects of political cronies, and so forth. Nonetheless, as I argue in the American Compass essay, America already has an industrial policy, albeit one that has been set by Asian economies. Asia subsidies capital-intensive investment the way that America subsidizes sports stadiums, so capital-intensive industry and high-tech manufacturing, in particular, has migrated to Asia away from the United States. It is encouraging that the issue has moved to the center of the presidential campaign, and it is to be hoped that the Republicans will offer a more detailed program for American industry and technology.

The devil is in the details. I encourage interested readers to review the whole American Compass symposium.

Until quite recently, the issue of supply chains has been absent from America’s policy agenda. Our supply chains have been guided nonetheless by government action for the past 20 years – not ours, but Asia’s and especially China’s. America has an industrial policy, namely off-shoring. State support for capital-intensive manufacturing, the hallmark of the Asian model since Japan’s 1868 Meiji Restoration, shifted industrial output from the United States to Asia. Together with this shift, American manufacturing employment fell to about 11.4 million from almost 20 million in 1980.

We also have a chronic trade deficit in manufactured goods, an accumulating foreign debt, a chronically low savings rate, an excessively consumption-based economy, and stagnant labor productivity. To paraphrase Leon Trotsky, you may not be interested in supply chains, but supply chains are interested in you.

The so-called neoliberal consensus in the economics profession rationalized the hollowing-out of America’s industrial base. A liberal economist believes in free trade; a neoliberal talks about free trade while seeking rents from subsidies provided by foreign governments.

For several reasons, America must reshore key industries. These include:

- National Security. The Covid-19 epidemic showed America’s dependence on imports of protective gear, medicine, and equipment, as well as the prospective development of vaccines.

- American “Soft Power.” For example, America’s lack of manufacturing capacity for 5G telecommunications equipment leaves us open to significant loss of influence to the benefit of China. The same problem will occur in other key industries without corrective action.

- Productivity. Loss of high-tech manufacturing capability has a direct negative impact on productivity and important indirect effects, such as the loss of skills in support sectors.

- Innovation. America’s tradition of innovation from Thomas Edison through Bell Labs came from the cooperation of scientists, engineers, and production workers, rather than academic research in isolation.

- Resilience. The off-shoring of American industry skews the American economy towards household consumption (70% of GDP vs. an OECD average of 60%), at the expense of investment.

This leaves the United States more vulnerable to shocks to consumer confidence, as in 2008-2009 and during the Covid-19 pandemic. Economic resilience requires a stronger investment component in economic growth.

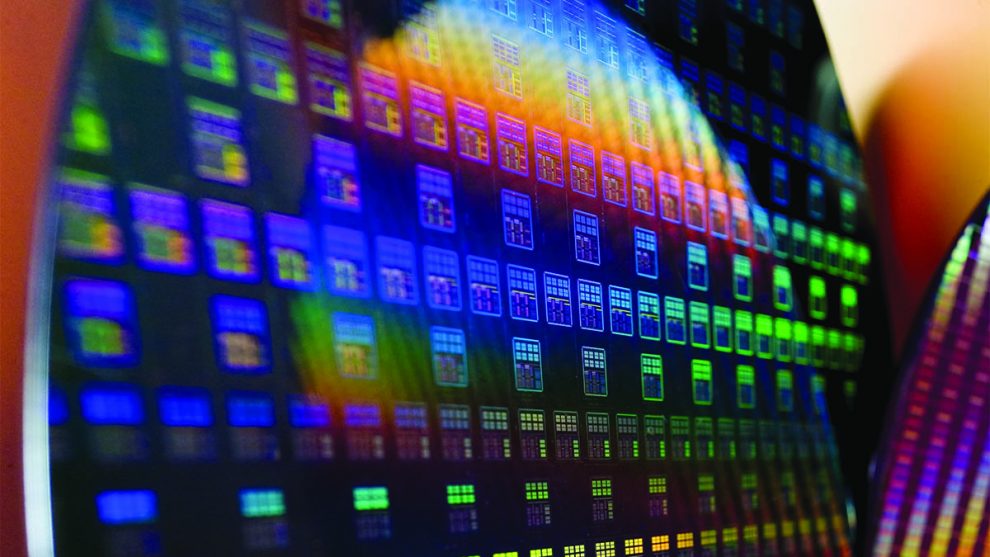

America planted the seeds of the digital revolution but failed to harvest the fruits. We invented the semiconductor, but today we produce only 10% of the world’s computer chips, down from 25% in 2015.

We invented all of the core digital technologies: flash memory, liquid crystal displays (LCDs), light-emitting diodes (LEDs), plasma displays, semiconductor lasers, and the solid-state sensors that power smartphone cameras. Virtually all of these products are now produced in Asia. The LCD market is divided among South Korea, Taiwan and China; LEDs are produced by China and Taiwan; Taiwan and Japan produce most sensors; and the US share of flash memory production is down to 10%.

American firms still lead the world in chip-making equipment, but about 90% of equipment sales are to foreign chip fabricators.

In 1999, the American share of global high-technology exports was nearly 20%, and China’s share was less than 5%.

By 2015 our share had fallen to 7% while China’s rose to 26%, according to the World Bank.

As a share of US exports, high-technology goods, including electronics and pharmaceuticals, fell to 19% in 2018 – from 31% in 2007.

For several reasons, this symbiotic model – what Niall Ferguson dubbed ‘Chimerica’ – is no longer tenable.

Asia’s ascent in manufacturing produced some benefits for the United States, or at least benefits for some Americans: American companies exited from hardware businesses and focused on “capital-light” software businesses, which are infinitely scalable and benefit from inexpensive Asian hardware imports. This produced enormous growth in the stock-market capitalization of a handful of software companies that captured network effects (e.g., Microsoft, Amazon, Google, Facebook). American consumers benefited from cheap products that would cost considerably more to make at home, although that is something of a devil’s bargain; with declining manufacturing investment and employment we also had stagnant productivity growth and almost no growth in real household income. Real median household income declined from 1999 to 2012 and didn’t regain its 1999 level until 2016.

The disruption of economic and community life in former manufacturing hubs due to this shift helped to elect Donald Trump on a program of restoring American industrial employment. The Covid-19 pandemic revealed American dependence on China and other Asian countries for urgently required protective gear as well as basic pharmaceuticals. America’s effort to suppress Chinese dominance in the next generation of mobile broadband revealed the lack of American hardware manufacturing – or even design – as a strategic weakness.

For strategic reasons, long-term structural reasons, and short-term economic reasons, the issue of supply chains has forced its way to the top of the policy agenda, where it will remain for a long time to come. President Trump recently asked during a press conference why the United States should have global supply chains, rather than make everything at home. But decoupling on a large scale is impossible in the foreseeable future, for a simple reason: America’s imports from China in 2018 were equal to a quarter of our $2 trillion GDP in manufacturing, too large a portion to replace in the near future. The largest category of imports, about $70 billion of smartphones, cannot easily be relocated to the United States, as Apple CEO Tim Cook argues, because specialized engineering skills now abundant in China are scarce in the United States.

More broadly, genuine autarky is surely unnecessary and unwise. But targeted decoupling of strategically critical industries is long overdue.

We have the opportunity to reshore key industries with a quantum leap in productivity driven by information technology. If we fail to grasp the opportunity, however, we confront the risk that our strategic rivals will increase their lead in advanced manufacturing techniques. China has committed vast sums to 5G broadband, artificial intelligence (AI), and STEM education with the goal of becoming the world’s dominant power in high technology. America’s competitive position in the world, long-term growth prospects, and national security all depend on maintaining our superior capacity for innovation.

Restoring American industry through innovation will require a visionary portfolio of policy initiatives, including tax incentives for R&D, direct subsidies for target projects, revisions to international trade policy, regulatory reform, and domestic content rules, among other measures. In this symposium, a distinguished group of policy experts offers a range of recommendations to bring about the rapid reshoring of manufacturing.

When America led the world

During the 1970s and 1980s, federal spending on basic research and development reached 1.4% of GDP, or the equivalent of $300 billion in current dollars.

Most of this was channeled through NASA or the Defense Advanced Research Projects Agency (DARPA). This sustained effort won the Cold War and created the digital age.

Among all postwar presidents, Ronald Reagan had the strongest commitment to free markets. But as his Treasury Secretary James Baker III noted, Reagan “granted more import relief to US industry than any of his predecessors in more than half a century.”

This included restraints on Japanese auto exports to the United States, “voluntary” restraints on 18 countries’ steel exports to the United States, anti-dumping tariffs on Japanese computer chips, and numerous other measures.

Major corporations that maintained large-scale labs, including the Bell System, General Electric, RCA, IBM, and DuPont, absorbed most of DARPA’s grants. Scientists and engineers worked with production personnel to determine the practicality of innovations. Although “Big Science” dominated the grants, the venues gave rise to an unprecedented wave of entrepreneurship, as entrepreneurs formed new firms to commercialize the discoveries. Employment growth during the 1980s was among the highest of the postwar decades, with employment at new companies more than offsetting declining employment at large companies.

A clear division of labor separated government subsidies for basic research from private risk-taking in commercialization.

Two facts about this great surge in innovation are noteworthy. The first is that, without exception, every important technology of the digital age began with a DARPA or NASA subsidy: the semiconductor, CMOS manufacturing of semiconductors, the graphical user interface, semiconductor lasers, optical networks, LED and plasma displays, and the Internet itself. The second fact is, that without exception, the original grants in every case did not envision the enormous commercial potential of these technologies. The discoveries were the “accidental” result of basic research with a different initial goal. For example, DARPA funded a study of night-time battlefield illumination and got the semiconductor laser and, with it, optical networks and the cable television industry.

These two observations illustrate the inadequacy of classical free-market theory. Entrepreneurs will risk the unknown, but they will not risk money for unknown unknowns – possible discoveries whose commercial application cannot be imagined because the underlying science has not yet been discovered. Indeed, by definition, the outcome of basic innovation cannot be predicted in advance.

Thus, basic R&D requires state support. Before the “accidental” invention of the semiconductor laser, it was impossible to imagine a commercially viable optical network; no one could – let alone would – invest to develop and build one. As a practical matter, national security has been the driver of basic R&D for two reasons: First, because taxpayers are willing to accept expenditures with no specific benefit as a matter of national defense, and second, because the constant drive for progress in weapons systems and cryptography provides a concrete target for innovation that pushes at the frontier of science.

For the pipeline from basic R&D through commercialization to flow, policymakers must also ensure the private sector stands ready and able to participate. Efforts to protect established industries do not directly produce innovation, of course. But it is critical to note that the main venue for innovation at the dawn of the digital age was the corporate laboratory. Research isolated from production facilities – at universities, for example – is not as effective. The interaction of scientists with production engineers and skilled workers is an indispensable part of innovation. Scientists generate countless promising ideas every day; it takes experienced engineers and skilled personnel to sift out the few practical innovations from those of mere academic interest. If the United States loses the most advanced production capabilities and disperses its skilled workforce, our ability to innovate will be crippled.

Regaining the lead

It is important to be clear about the different goals that bear on the onshoring of supply chains and to devise policies that address these objectives in the most direct way. Where the rationale is national security, onshore production may be considerably more costly than imports, but worth paying for strategic reasons. Where the rationale is economic, greater precision about both goal and mechanism is necessary. Protection of existing industrial jobs or subsidies for new jobs may be desirable in some contexts, but we should be aware that we simply may transfer income from one group of Americans (consumers who pay higher prices for the same goods and taxpayers who pay the subsidy) to another (investors and workers in protected industries).

A separate and often better economic rationale is that, as we have seen, a strong and diverse industrial base is a precondition for innovation and growth in labor productivity and incomes. Innovation does not occur in a vacuum. The collaboration of scientists, engineers and production workers is required to identify innovations that have commercial value. High-tech manufacturing depends on a complex set of supply chains, and industrial innovations require a critical mass of domestic inputs.

For instance, at the urging of the Trump Administration, Taiwan Semiconductor Manufacturing Corporation agreed in May 2020 to build a chip fabrication plant in Arizona at a cost of $12 billion.

Although the plant’s expected output will be small compared to total American demand, it will help to secure a supply of computer chips for American military applications, an important precaution because undetectable backdoors can be secretly inserted into complex chips at the production level. Intel plans to build an onshore chip foundry in Oregon.

A similar rationale could support is onshore production of medical equipment and medicines even at substantial cost.

“Jobs,” while frequently cited as a motivation for industrial policy, play little direct role in a case like Taiwan Semiconductor’s new plant. It will employ 1,600 workers, with combined annual pay of less than 1% of the total investment.

In general, innovation in manufacturing does not support employment growth. Indeed, while the United States could subsidize manufacturing employment, for example, through a tax credit for new jobs or direct subsidies or subsidies for specific industries, that might reduce rather than accelerate productivity growth, and conflict with the strategic goal of increasing America’s competitiveness against an aggressive and potentially hostile Asian challenger.

Welfare policy

But a reshoring policy that keeps key industries in business in the face of heavily subsidized foreign competition is more than an overpriced welfare policy for industrial workers. It is a necessary condition for future innovation. The indirect impact of new technologies on employment is likely to be far greater than the direct impact. The production of 5G devices and their embedded semiconductors is highly automated, but the installation of millions of ground stations will require enormous amounts of labor, including a good deal of skilled labor, just as the buildout of fiber optic networks for cable television created hundreds of thousands of jobs in the past.

The good news is that a revolution is underway in manufacturing that will change the economics of off-shoring. The migration of manufacturing jobs from the United States to China and other countries is often explained as the result of relative labor costs. That surely was the case for some industries, but labor costs cannot explain the shift in capital-intensive industries, and key manufacturing processes are only becoming more capital-intensive with time. The application of AI to robotics sharply reduces the importance of relative labor costs. Dr. Henry Kressel, the former director of RCA Labs, explains, “this change makes manufacturing closer to home practical for some industries and creates a competitive advantage by allowing a much more nimble business compared with relying on offshore production.” Changes in tooling can be programmed quickly and cheaply, reducing dependence on offshore production lines and traditional labor skills.

The bad news is that America has failed to prepare for capital-intensive competition. Our competitors subsidize capital-intensive industry. We subsidize sports stadiums. Correspondingly, the United States invests a far lower portion of its GDP than China or South Korea.

The capital intensity (the ratio of total assets to earnings before interest and taxes) of the components of the S&P 500 Index has fluctuated around the same level during the past 20 years, while the capital intensity of the components of China’s Shanghai Composite Index has nearly tripled during the same time period.

Corporate accounting for assets, to be sure, is unreliable, but the trend nonetheless is striking. Financing for large Chinese companies comes mainly from state-owned banks at fixed interest rates – that is, through an industrial policy. This is not a Chinese, but rather an Asian phenomenon; South Korea subsidizes capital-intensive industries, and the capital intensity of its KOSPI Index is close to that of China.

The place to begin is at the source of the problem, namely the tilted playing field. No American company can compete with a Huawei or Samsung in hardware because the Chinese and Korean governments provide a capital subsidy. The industrial policies that cause the least distortion of the economic as well as the political process tilt the playing field in favor of capital-intensive industry by lowering the cost of capital, and support innovation by subsidizing basic R&D. The most effective government intervention into industry has fostered transformative innovations through public-private collaboration in basic research.

Several remedies are available. The simplest is to reduce taxes on capital income. The most important form of subsidy that the federal government can offer, though, is generous support for basic R&D. Industries that receive such subsidies are a self-selecting group of prospective innovators. As in the past, the Department of Defense remains the most effective agency for the distribution of such subsidies. By its nature, warfare pushes the boundaries of science in the development of new weapons systems. Military objectives such as laser defenses for American ships, anti-missile systems able to stop hypervelocity missiles, drone swarms guided by AI, submarine detection, cryptography and so forth pose scientific challenges and are likely to elicit fundamental breakthroughs.

An important indirect subsidy to high-tech industry is education and worker training. With shrinking capital commitment to manufacturing, colleges do not attract the brightest American students to engineering. America’s technology industry is increasingly dependent on foreign workers. Only 5% of American college students major in engineering, compared with 33% in China; as of 2016, China graduated 4.7 million STEM students versus 568,000 in the United States as well as six times as many students with engineering and computer science bachelor’s degrees.

Educational reform

Meanwhile, foreign students earned 73% of the doctorates in electrical engineering at American universities in 2017.

Essential to any program of industrial recovery is an educational reform comparable to our 1957 National Defense Education Act as well as increased technical training for computationally intensive, skilled industrial jobs.

Then there are cases in which direct subsidies to specific industries – “picking the winners” – are required for national security or other reasons. Direct subsidies are a problematic policy tool. They inevitably invite rent-seeking behavior by corporations, subsidies to particular groups of workers, and a politicized division of spoils. There are some forms of employment that are senseless to subsidize. Robotics will replace the dirty, dangerous business of sending men into coal mines before long as white-coated technicians with virtual reality visors manipulate underground machines. Dependence on Canada and Mexico for steel is not a major national security concern. On the other hand, dependence on China or even South Korea for semiconductors is. Despite these concerns, direct subsidies are sometimes required to prevent the loss of key industries and the dispersion of skilled labor.

Alongside these targeted efforts at lowering capital costs, accelerating R&D, improving skills, and boosting targeted industries, policymakers can also take action to alter the environment in which investment decisions occur in order to make the building of industrial capacity a more attractive bet. And they can reform the institutions within which they act to improve their own coordination, their international negotiation, and their efforts at regulation.

The essays offered in this symposium cover a broad range of topics, including pre-competitive R&D as a driver of long-term productivity gains (Willy Shih), tax incentives for private-sector investment (Rob Atkinson), local content requirements (Michael Lind), active labor market policy (Samuel Hammond), regulatory reform (Oren Cass), administrative structures to coordinate policy planning (Ganesh Sitaraman), international trade reforms (Thomas Duesterberg), infrastructure financing (Terrence Keeley), and antitrust enforcement (Matt Stoller). Hopefully, these papers will provide a resource for policymakers now grappling with the decisive economic issue of our time.