(ATF) The ATF indices were little change on Thursday as China’s State Council requested, in a briefing note, that banks lower their lending costs. It also pledged to cut reserve requirement ratios (RRRs) and ensure ample liquidity through the People’s Bank of China (PBoC) re-lending operations.

The statement suggests that market concern about tight liquidity and increased funding costs – which would hurt the economic recovery – were overdone, and that China will take the necessary steps to accommodate its bond-issuance programme.

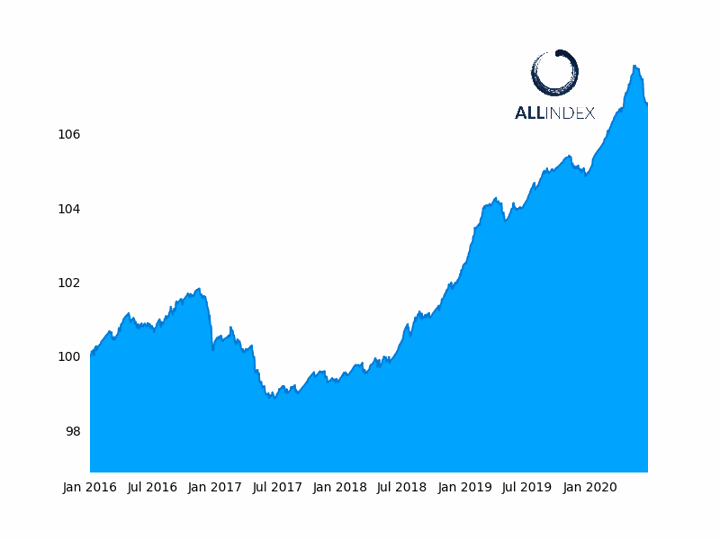

The Corporates Index lost 0.01%

The China Bond 50, the flagship index, and the ATF ALLINDEX Enterprise closed 0.02%, 0.03% higher while the ATF Financial gauge was flat. The ATF ALLINDEX Corporates index retreated slightly, losing 0.01%, while the ATF ALLINDEX Local Governments measure dropped 0.22% on the back of losses on the bonds of the People’s Government of Gansu (-1.73%) and the People’s Government of Anhui (-2.31%).

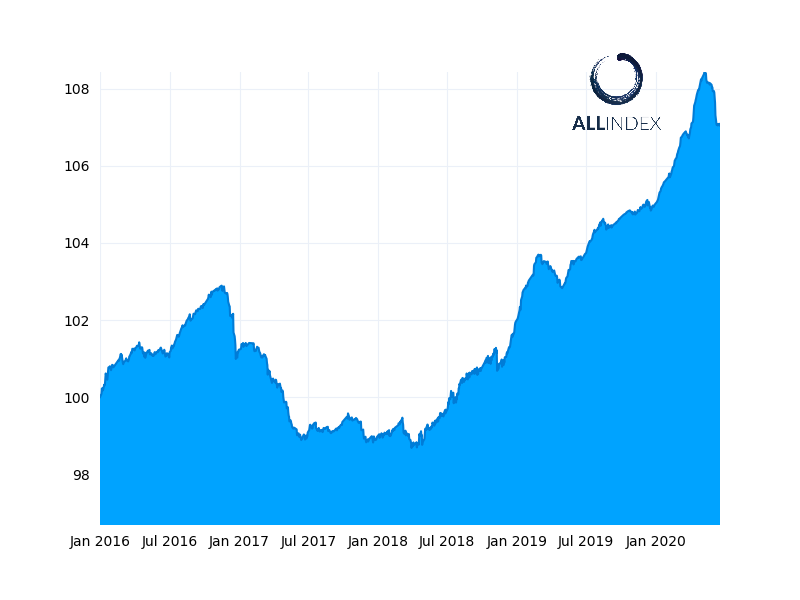

The Enterprise Index added 0.02%.

Investor worries about dwindling liquidity come on the back of Beijing’s announcement to issue 1 trillion yuan ($141 billion) of bonds to finance the economic recovery, with 100bn yuan of special treasury bonds to be auctioned on Thursday. China’s 10-year government bond yield rose to a high of 2.9%, while the yield on China’s one-year sovereign paper also spiked, to 2.15% on Thursday.

It is likely that government bond yields and the interbank interest rate have now peaked and a drop in the coming weeks is likely, Ting Lu, Chief China Economist at Nomura, stated in a note. Meanwhile, a cut in the reserve requirement ratio could come as early as this weekend, he said.

In the briefing note, the State Council vowed to help small- and medium-sized banks add equity capital, guide down lending rates, bond yields and financing costs, according to Nomura’s research note.

The Japanese bank anticipates that the PBoC could cut the medium-term lending facility rate by 10 basis points or more in order to guide down the loan prime rate.

On Thursday, the PBoC injected 120bn yuan into the financial system through reverse repos, at a rate of 2.20% on securities maturing in seven days, and 2.35% for 14-day debt.

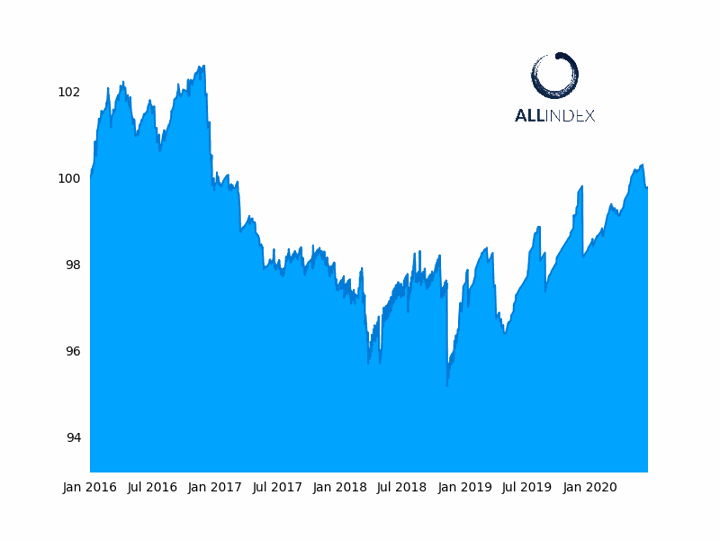

The Financial Index was unchanged.

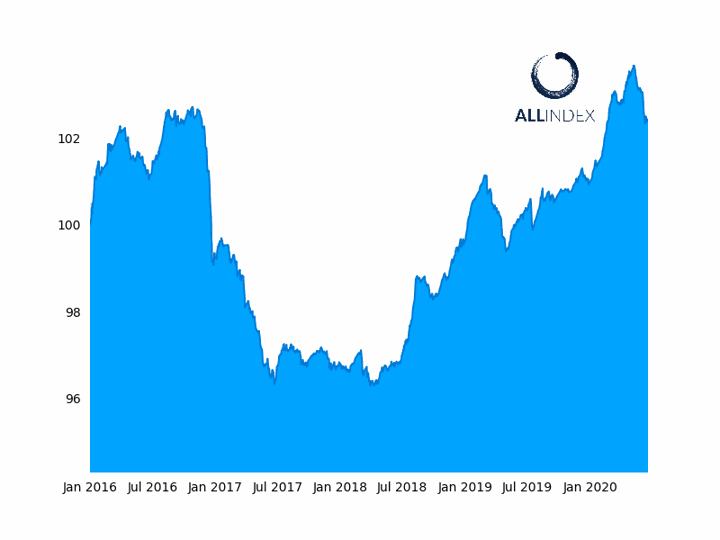

The Local Governments Index fell 0.22%