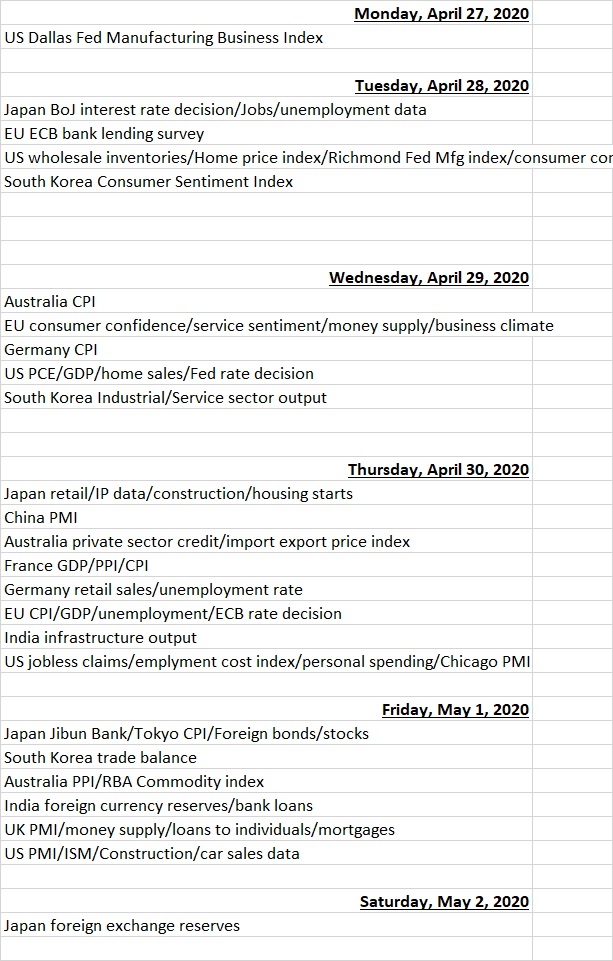

Economic events

Financial markets will be guided by earnings, central bank meetings and purchase manager index surveys from major economies.

“Policy meetings at the Bank of Japan, the Federal Reserve and the European Central Bank (ECB) will be scrutinised for their views on the global economy and guidance on potential changes to the policy stance after key indicators showed alarming declines,” said Chris Williamson, Chief Business Economist, IHS Markit.

The central bank of the world’s third biggest economy will meet on Monday and the key question is if it will step up its stimulus efforts, amid a media report the Bank of Japan will discuss shifting to unlimited purchases of Japanese government bonds.

“We are sceptical. This is a central bank that has been practising unorthodox monetary easing since 2001 and is unlikely to discover untapped sources of stimulus now,” ING Bank analysts said in a note.

Flash PMIs in April have already under whelmed and analysts expect Q2 to produce a worse outcome than Q1.

“The continued deterioration in activity between March and April confirms the intuition that Q2 2020 will likely represent the lowest point for global growth in multiple generations,” said BCA Research analysts in a note while adding that this weakness continued to support bond prices and the dollar.

The macro research firm said that while China spent much of April trying to recover, capacity utilization has not improved much since late March. A disappointing PMI print would likely roil assets linked to global growth and buoy the dollar. China reports its official PMI for April on Thursday.

But IHS’s Williamson said hopes are pinned on better news after initial signs of the sector stabilising in March.

The week also sees earnings updates from corporations like Alphabet, Microsoft, Apple, Amazon, Facebook, Spotify, Tesla, Mastercard, Visa, Merck, Pfizer, Pepsi, Starbucks, Mcdonald’s, UPS, AMD, Caterpillar, Shell, Exxon Mobil and Chevron.

Analysts expect earnings for S&P 500 companies to drop 17.9% in 2020 from the previous year, the IBES data shows. That is much steeper than the 3.5% decline estimated at the start of the month.

Fund flow

Equity funds saw outflows in the week to April 22, reversing a three-week inflow streak with investors seeking the relative safety of bond funds and money market funds, fund flow data provider EPFR said.

But emerging market debt funds saw outflows and BofA Securities analysts said in a note that amid rising uncertainty on the growth outlook across the globe, investors feel less comfortable buying “growth” proxies.

“ECB’s and Fed’s credit QE programs, have taken the pressure away from IG and HY euro and dollar funds,” .

Emerging Markets Equity Funds posted their 10th consecutive week of outflow as a steep plunge in oil prices hit investor sentiment towards this asset class, it said.

“Low oil prices cut both ways for emerging markets, biting into the revenues of major producers such as Russia, Saudi Arabia, Nigeria and Mexico but lowering the import bills of countries that buy rather than produce the bulk of the oil they use,” it said.

Barclays analysts said, the recent underperformance of emerging market credit versus developed market credit may persist if oil prices continue trading at very low levels.

“Only gradual easing of lockdown restrictions dampens hopes of a V-shaped economic recovery, while some EM currencies appear to have been overly resilient to the recent moves in commodities. We believe these risks likely need to ease before inflows may resume,” they said.

Bond Funds posted their second straight week of inflows after world’s major central banks announced supportive rate cuts and bond buying decisions. “US, Europe and Global Bond Funds all took in solid amounts of fresh money while, at the asset class level, Municipal, High Yield, Total Return and Inflation Protected Bond Funds all recorded inflows,” EPFR said.

Companies in focus

Xiaomi Corporation published its annual report for 2019 which showed a surge in its operating cash flow. In the year to December 2019, it posted an operating cash flow of 23.8 billion yuan versus an outflow in 2018. The company also reported a 100 basis point increase in gross profit margin to 7.2% and a decline in borrowings even though net profit fell due to absence of extraordinary income.

China Southern Airlines Company received the approval of China Securities Regulatory Commission for making a non public offering of A-shares of the company.

Yuzhou Properties unveiled its annual accounts for 2019 which revealed operating cash flow had turned negative despite a surge in net profit. This was driven by a surge in payables and accruals. The gearing ratio also rose to 70.2% from 67% as debt jumped by almost 50%.

ZTE Corporation declared its first quarter earnings in which it reported operating cash flow fell by 70% and its borrowings surged.

Coming Events

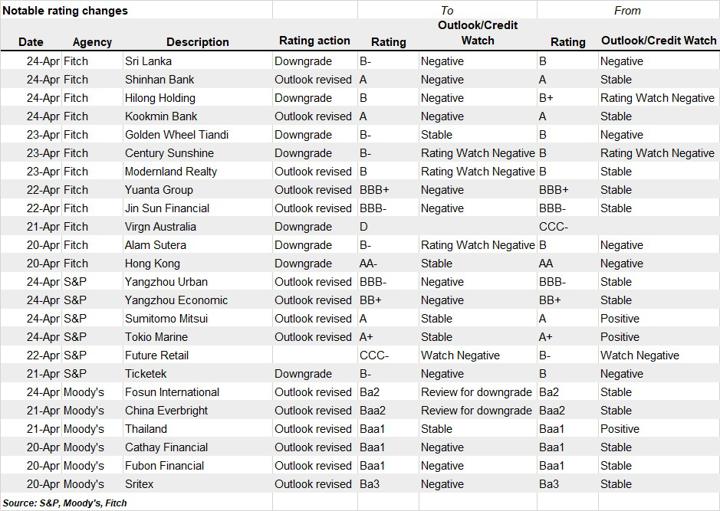

Ratings Changes