(ATF) The struggle to free a stricken mega-ship that has been blocking the Suez Canal for the best part of a week continued even after engineers said they’d partly refloated the giant container carrier.

The major waterway was reportedly reopened Monday when the Ever Given was partially released from the canal’s banks after having been blown off course last week and wedged across the of the major waterway.

The enormous container ship has been turned 80% in the right direction, officials said Monday. The Japanese owners of the Panama-flagged vessel said that while it “has turned”, it was still not yet fully unwedged.

Also on ATF

- Many H&M stores close in China, as govt tells firms ‘avoid politics’

- Australia boosts iron ore exports as trade shrugs off China bans

- Crunch week looms for US-listed shares of Baidu and Tencent Music

While later reports suggested a witness had seen the ship blown back across the channel, officials were confident a jam of more than 400 ships at either end in the Mediterranean and Red Seas would be cleared in days.

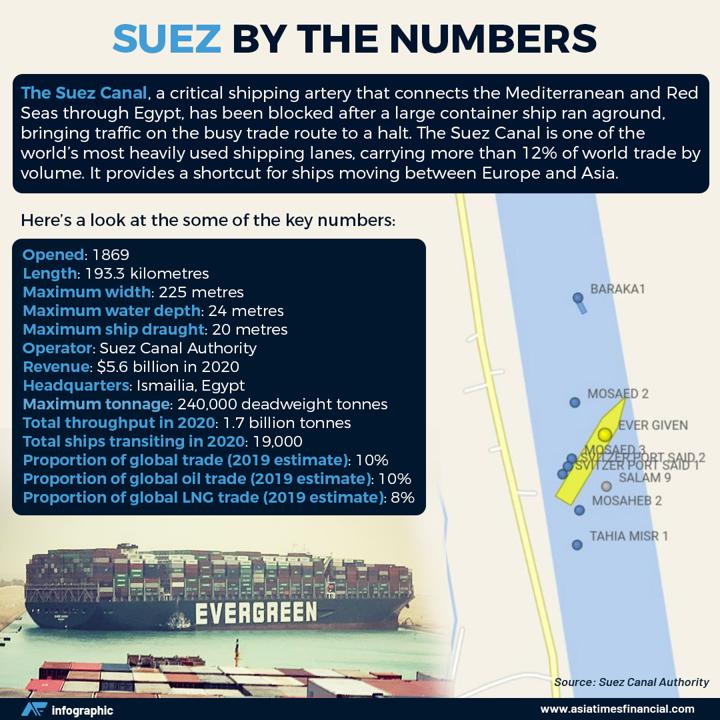

The ship, longer than the Empire State Building is high, became wedged diagonally across the canal during a sandstorm last Tuesday, strangling a waterway through which passes about 12% of the world’s trade by volume, including 10% of all oil. A surge in crude prices that followed the blockage last week partly unwound Monday on news that the canal would be working again.

Shipping data company Lloyd’s List said that the tailback of ships had reached 425 at the two ends of the canal, in the Mediterranean and Red Seas.

Once the ship is fully afloat, it will take around three and a half days to clear the traffic jam of ships, Suez Canal Authority (SCA) chief Osama Rabie told Egyptian TV.

Rabie said earlier Monday that rescue efforts with tugs had succeeded in shifting the stern of the ship.

“A total of 11 tug boats have been pulling Ever Given since this morning,” an official said, adding that while there was damage sustained by the ship on its bow when it got stuck, “no new damage has been reported”.

The crisis has forced companies to choose between waiting or rerouting vessels around Africa, which adds a huge fuel bill, 9,000km and more than a week of travel to the trip between Asia and Europe.

Each day of the blockade could be costing global trade some $6-10 billion, according to a study published Friday by German insurer Allianz. That translates to some 0.2 to 0.4 percentage points of annual trade each week.

The problem has brought to light a number of seismic changes happening in global trade.

Supply chains had been shortening as geopolitical tensions and the coronavirus pandemic prompted many manufacturers to bring production closer to home, away from politically sensitive regions, such as China.

Also, a migration of manufacturing capacity to other parts of the world means shippers no longer need as much long-distance sea capacity, a trend that has helped push up freight rates.

Worn down

At the same time, the pandemic has put pressure on shipping companies to carry more goods for online retailers.

“Many container shipping lines worn down by years of boom or bust are making hay while the sun shines. Many argue that higher freight rates may be the only way to sustain such a vital part of world trade,” said Russell Green, of RTG Communications, a Hong Kong-based media communications agency for shipping, logistics and energy sectors.

“There has been a sharp increase in freight rates as carriers have pared back capacity during the crisis and demand has soared as on-line shoppers have triggered a tsunami of orders of products from brands with factories in China.”

Other analysts have said that more ship smay avoid the Suez Canal in future. While sailing around Africa will add time and costs to shipping journeys, lower fuel costs and the rising fees charged to use the canal – upwards of $700,000 per ship – means the added expense may be worth bearing to avoid another potential logjam.

“For certain products and strategically important equipment, there will be an opportunity for near shoring to develop as countries look to mitigate the risks in sourcing and shipping from countries the other side of the planet,” said Green.

For the main, China specifically and Asia more generally will continue to dominate manufacturing and exports to the EU and the US. The migration of industry to South East Asia, specifically Vietnam and the gradual rise of manufacturing in India, will provide an alternative source for production.”

- Additional reporting by AFP