(ATF) Chinese corporate and municipal bonds edged higher Friday only slightly paring a fourth weekly loss in five as coupon payments and concern over local government indebtedness weighed on sentiment.

The week ended on a cautiously upbeat note after the top government body said it would continue a loans waiver programme begun for small businesses at the height of the coronavirus pandemic last year. However, gains may be limited next week as more issuers make coupon payments on their bonds.

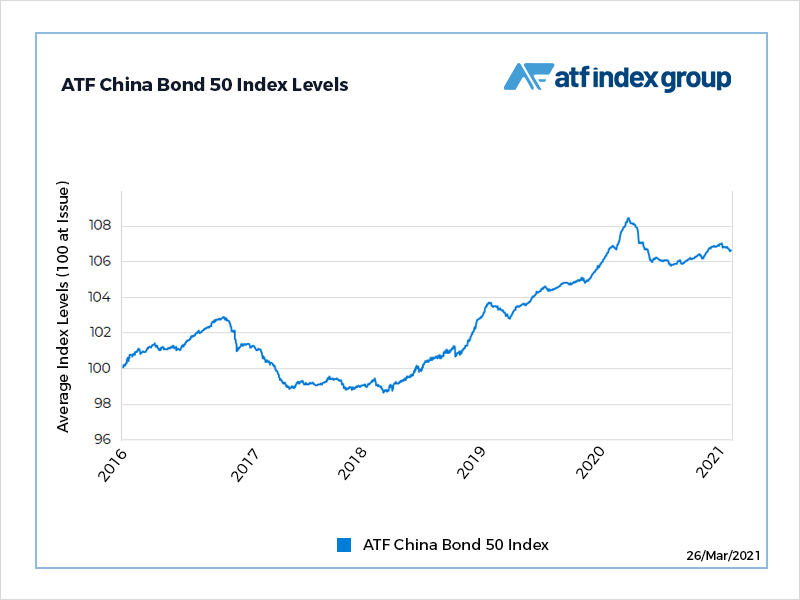

The returns-focused benchmark ATF China Bond 50 Index of AAA rated credits eked out a 0.02% advance to 106.65 on Friday.

Read more: China puts its total foreign debt at $2.4 trillion

The gauge fell 0.04% last week as coupons payments by issuers including Wuhan Metro Group, China National Petroleum Corporation and Export-Import Bank of China weighed on investors.

Prices tend to fall when coupon payments are made because they reduce the pool of interest payments during the rest of the bond’s lifetime.

Investors were cheered by the State Council’s announcement that it would extend a loan concession scheme for small and micro-businesses.

OVER-LEVERAGED

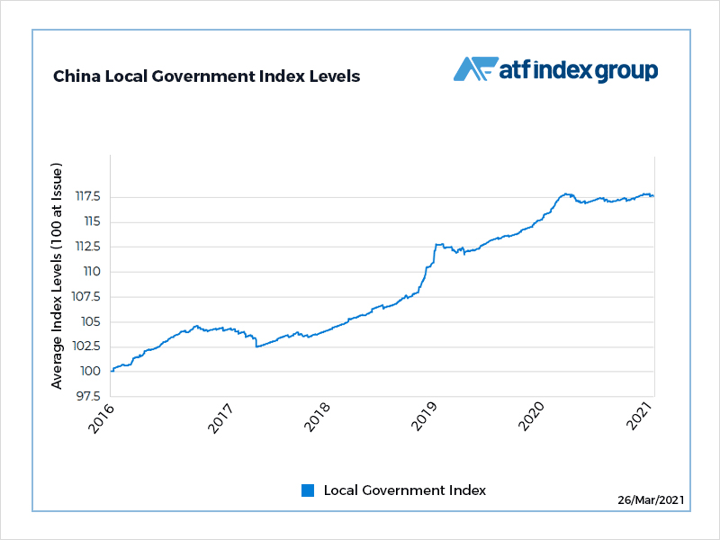

It lifted the tone slightly in a week when the central bank reiterated concerns that private companies and local governments were over leveraged and urged regional authorities to pull back on their bond sales to avoid creating financial risks.

That pulled the Local Government sub-index 0.10% lower on Thursday and 0.03% down for the week. Local Government debt has been the best performer of the five ATF bond indexes, largely on the strength of record issuance last year to help cities and counties counter the pandemic downturn by initiating infrastructure projects.

The State Council also urged Chinese regulators to provide policy support to boost lending for green projects before the end of June. With more coupon payments due next week, that could give enough optimism to lift credits.

Also on ATF: