Asian stocks saw a mixed day of trading on Wednesday with indexes heading in different directions as investors reacted to a strengthening yen, positive China data and the likelihood of another interest rate rise.

A crucial US inflation report due out later in the day will help gauge whether the Federal Reserve is at the end of its aggressive rate hiking policy with traders predicting another hike is on its way.

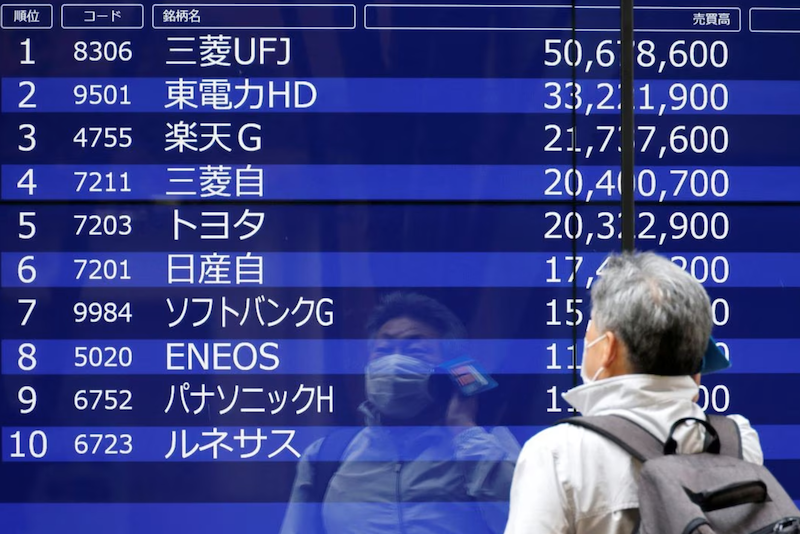

Japanese shares were the worst performers in Asia, with the Nikkei sliding to a one-month low as a firmer yen applied the brakes on a market rally, although the prospect of a potential SoftBank spinoff helped limit losses.

The Nikkei fell 1.3% to 31,791.71 in the morning, before recouping some losses to close 0.81% down at 31,943.93. The broader Topix fell 0.67% to 2,221.48.

Also on AF: Toyota Targets Hydrogen Trucks, Car Push in China, Europe

The yen and stocks typically move in opposite directions, since a stronger currency hurts exporters’ competitiveness and also makes stocks more expensive for foreigners.

The yen strengthened about 0.6% to 139.50 per dollar, and has gained nearly 4% in four trading days as a lot of short positions have been reversed. The Nikkei has lost more than 5% since hitting a three-decade high last week.

The Nikkei’s sharp rally this year – up 22% versus world stocks’ 13% jump – has also drawn in a lot of foreign investors, who might be holding back on adding to positions while the cost in dollar terms goes up.

Also it was reported that tech conglomerate SoftBank and its internet subsidiary Z Holdings are mulling a US listing for its payments business, lifting their shares and limiting the losses in the benchmark index. Shares of Z Holdings rose 5.6% and SoftBank gained 2.1%.

Hong Kong stocks rose as stronger-than-expected credit figures in June partially lifted sentiment, though mainland Chinese stocks edged down as impatient investors waited for bigger stimulus measures.

The Shanghai Composite Index dropped 0.78%, or 25.23 points, to 3,196.13, while the Shenzhen Composite Index on China’s second exchange retreated 1.08%, or 22.16 points, to 2,030.77.

China Bank Loans Boost

China’s new bank loans jumped more than expected in June from the previous month, helped by central bank efforts to support the economy as a post-pandemic recovery fades.

Meanwhile, the National Development and Reform Commission (NDRC), China’s top economic planner, said on its official WeChat account on Tuesday they have visited companies including Alibaba, Tencent and Meituan recently, and praised the leading role the companies are taking in innovations and high-quality development.

The tone of support for China’s big tech companies further boosted the performance of tech stocks and the Hang Seng Tech Index jumped 2.5% by midday, set for a three-day winning streak.

At the close, the main Hang Seng Index had gained 1.08%, or 201.12 points, to 18,860.95, and the Hang Seng China Enterprises Index was ahead 1.30%.

Elsewhere across the region, in earlier trade, Sydney, Singapore, Mumbai, Taipei, Manila and Jakarta were also up while Seoul and Wellington dipped.

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.77%, set for its third straight day of gains. The index is up 2% for the week and on course for its best weekly gain in a month.

Futures indicated that the risk-on rally was set to continue in Europe, with the Eurostoxx 50 futures up 0.44%, German DAX futures 0.36% higher and FTSE futures up 0.30%.

Wall Street Earnings Due

Investors will be zeroed in on the US inflation report later in the day, with economists polled by Reuters expecting the consumer price index to have risen by 3.1% in June, after May’s 4% increase.

The core rate is expected to have dropped for a third month to 5% from 5.3%, though that is more than double the Fed’s 2% target.

Markets are pricing in a 92% chance of a 25-basis-point Fed hike later this month, the CME FedWatch tool showed, but remain doubtful of further hikes after that.

Second-quarter earnings start this week, with results due from some of Wall Street’s biggest institutions including JPMorgan, Citigroup and Wells Fargo.

Wall Street banks are expected to report higher profits for the second quarter as rising interest payments offset a downturn in dealmaking.

In the currency market, the dollar index, which measures the US currency against six peers, fell 0.167% at 101.43, having slid as low as 101.34, its lowest in two months.

US crude rose 0.01% to $74.84 per barrel and Brent was at $79.40, flat on the day.

Key figures

Tokyo – Nikkei 225 < DOWN 0.81% at 31,943.93 (close)

Hong Kong – Hang Seng Index > UP 1.08% at 18,860.95 (close)

Shanghai – Composite < DOWN 0.78% at 3,196.13 (close)

London – FTSE 100 > UP 0.80% at 7,341.07 (0934 GMT)

New York – Dow > UP 0.93% at 34,261.42 (Tuesday close)

- Reuters with additional editing by Sean O’Meara

Read more:

Central Banks Want Digital Currencies, Not Private Tokens: BIS

China Property Stocks Rally on Rescue Package Extension

Alibaba, Tencent Shares Rise as China Tech Crackdown Nears End