(ATF) Economic events

Financial markets will begin trade on a soft note this week after central banks in the world’s two biggest economies sent hawkish messages.

After the Federal Reserve’s decision denied an extension to a temporary capital buffer to banks, with their temporary supplementary leverage ratio changes expiring at the end of this month, the People’s Bank of China (PBOC) Governor Yi Gang said in a speech on Saturday that “monetary policy needs to balance between supporting economic growth and preventing risks”. His remarks reiterated the need to prevent financial risks and cooling credit growth while stabilising leverage.

“The risk of policy over-tightening is nontrivial and could threaten the cyclical outlook on China’s economy and corporate profits,” BCA Research economists said in a note.

“The recent price correction in Chinese stocks has not yet run its course. Moreover, equity prices in both onshore and offshore markets are breaching their technical resistance,” they said while downgrading tactical (0 to 3 months) and cyclical (6 to 12 months) positions on Chinese stocks to underweight relative to global benchmarks.

PBOC is expected to keep China’s LPR unchanged on Monday, given the steady MLF rate and later in the year, there are growing chances of monetary policy adjustment as the country’s jobless rate breached policymakers’ tolerance limit of 5.5% in February.

Economic data releases will also drive sentiment as the calendar remains busy with flash PMI data for the Eurozone, UK and US, Japan and Australia, all of which will give indications of Q1 recovery.

“The IHS Markit APAC Manufacturing PMI for January and February 2021 shows that regional manufacturing production has strengthened in recent months, with the data signaling further positive expansion in manufacturing output in coming months,” Asia Pacific Chief Economist at IHS Markit Rajiv Biswas said. “With rapid world growth forecast for 2021, the APAC manufacturing sector is expected to show strong expansion this year.”

Industrial production and inflation data from around Asia will also be monitored closely.

“The economic risks around the world may be slowly shifting from growth to inflation, though we are yet to see such a shift in Asia as the pandemic continues to hit some economies after better than expected PMI data,” Prakash Sakpal, ING’s Senior Economist for Asia, said.

Fund flows

The combination of monetary and fiscal stimulus in the US and vaccine rollouts gathering speed, saw flows continue into riskier asset groups in the week to March 17. US Equity Funds posted a new inflow record, while almost all major Developed Markets Equity Fund groups attracted fresh money, according to funds data provider EPFR.

This involved equity fund inflows of $68 billion, surging to a record high for the fourth time in four months led by US equities (+US$57 billion), IT (+US $18 billion), FIN, Consumer Discretionary, Value (+US$9 billion) and Dividend funds, according to Jefferies.

But China saw outflows, only its second in 11 weeks, slowing Emerging Markets Equity Funds flows to the lowest inflow in 2021 although it recorded the 23rd straight week of inflow since the beginning of 4Q20.

“Investors hit the pause button during a week when the annual National People’s Congress wrapped up with several signals that regulators will be paying more attention to asset bubbles and the misallocation of capital in the coming year,” Cameron Brandt, EPFR’s Director of Research, said.

“That involves withdrawing the stimulus measures implemented to minimize the impact of the Covid-19 pandemic.”

Bond fund inflows were subdued as investors remained concerned about inflation, with US 10-year yields soaring to 15-month highs, despite Fed’s assertion that it will not raise rates until the US economy is generating both consistent inflation and full employment.

As a result, inflation protected bond funds recorded their 17th consecutive inflow while bank loan funds extended their longest inflow streak since 3Q18.

Interestingly of the flows to all emerging market bond funds year-to-date, over two-thirds of the $14 billion committed so far has gone to just two markets, China and India, with another 20% going to Brazil, Indonesia and Mexico.

Economic data calendar

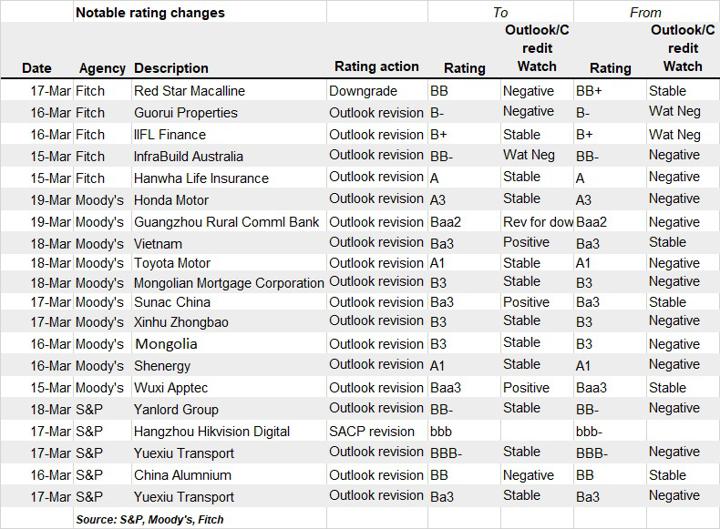

Last week’s rating changes