An increasing number of Chinese chip design firms are working with Malaysian companies to assemble part of their high-end chips.

Three industry sources say Chinese companies are asking Malaysian chip packaging firms to assemble a type of chip known as graphics processing units (GPUs).

They say the companies want to hedge risks in case Washington expands its sanctions on China’s chip industry.

The requests only encompass assembly – which does not contravene any US restrictions – and not fabrication of the chip wafers, the sources, who declined to be identified said. Some contracts have already been agreed, two of them said.

ALSO SEE: China Tightens Rules for Non-Bank Payment Firms Like Alipay

Concern that chiplet tech could be targeted next

The Biden administration has placed greater export restrictions on the sale of advanced chips, plus sophisticated chip-making equipment in a bid to limit China’s access to high-end GPUs that could fuel artificial intelligence breakthroughs or could power supercomputers and military applications.

As those sanctions bite and an AI boom fuels demand, smaller Chinese semiconductor design firms are struggling to secure sufficient advanced packaging services at home, analysts have said.

Some of the Chinese companies are interested in advanced chip packaging services, two people said.

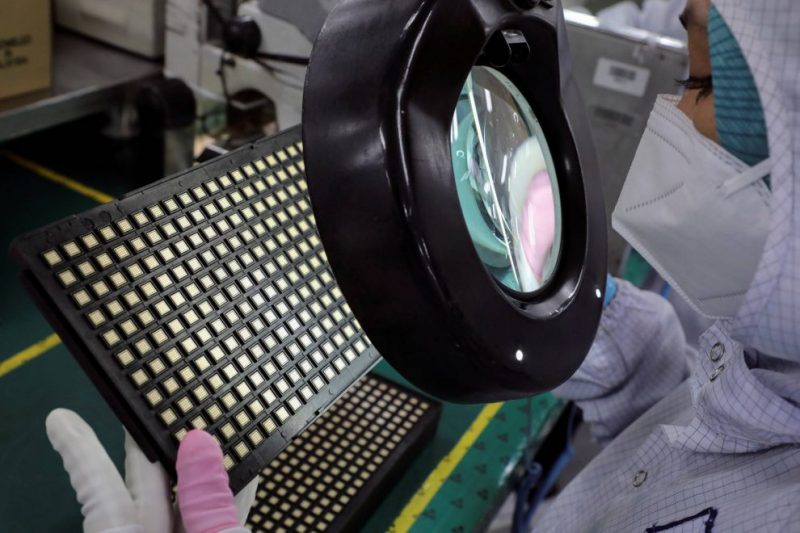

Advanced packaging of chips can significantly improve chip performance and is emerging as a critical technology in the semiconductor industry. This sometimes involves the construction of chiplets where chips are packaged tightly to work together as one powerful brain.

Although not subject to US export restrictions, it’s an area that can require sophisticated technology which the firms worry might one day be targeted for curbs on exports to China, the two people added.

Malaysia, a major hub in the semiconductor supply chain, is seen as well placed to grab further business as Chinese chip firms diversify outside of China for assembling needs.

Malaysia has experienced workers, affordable firms

Unisem, majority owned by China’s Huatian Technology, and other Malaysian chip packaging companies have seen increased business and inquiries from Chinese clients, one source who was briefed on the matter said.

Unisem chairman John Chia declined to comment on the company’s clients but said: “Due to trade sanctions and supply chain issues, many Chinese chip design houses have come to Malaysia to establish additional sources of supply outside of China to support their business in and out of China.”

Chinese chip design firms also see Malaysia as a good option because the country is perceived as being on good terms with China, is affordable, with an experienced workforce and sophisticated equipment, two of the sources said.

Asked whether accepting orders to assemble GPUs from Chinese firms could potentially provoke US ire, Chia said Unisem’s business dealings were “fully legitimate and compliant” and the company did not have the time to worry over “too many possibilities”.

He noted that most of Unisem’s customers in Malaysia were from the United States.

The US Department of Commerce did not respond to requests for comment.

Other big chip packaging firms in the country include Malaysian Pacific Industries and Inari Amertron. They did not respond to Reuters requests for comment.

Chinese companies are also interested in having their chips assembled outside China as that could also make it easier to sell their products in non-Chinese markets, said one source, an investor in two Chinese chip startups.

Country keen to be a chip hub

Malaysia currently accounts for 13% of the global market for semiconductor packaging, assembly, and testing and is aiming to boost that to 15% by 2030.

Chinese chip firms that have announced plans to expand in Malaysia include Xfusion, a former Huawei unit, which said in September it would partner with Malaysia’s NationGate to manufacture GPU servers – servers designed for data centres and which are used in AI and high-performance computing.

Shanghai-based StarFive is also building a design centre in Penang, and chip packaging and testing firm TongFu Microelectronics said last year it would expand its Malaysia facility – a venture with US chipmaker AMD.

Offering an array of incentives, Malaysia has attracted multi-billion dollar chip investments. Germany’s Infineon said in August it would invest 5 billion euros ($5.4 billion) to expand its power chip plant there.

US chipmaker Intel announced in 2021 that it would build a $7-billion advanced chip packaging plant in Malaysia.

Chinese companies are not just choosing Malaysia. In 2021, JCET Group, the world’s third-largest chip assembly and testing company, completed an acquisition of an advanced testing facility in Singapore.

Other countries such as Vietnam and India are also seeking to expand further into chip manufacturing services, hoping to lure clients keen to minimise US-Sino geopolitical risks.

- Reuters with additional editing by Jim Pollard

ALSO SEE:

Chinese Chip Firms Closed at a Record Rate in 2023 – TH

US Still Backing China Firm Providing Chips for Drones, PLA Units

New Huawei Laptop Fuels Talk of Sanctions-Beating 5nm Chip

Report Explains How China Got Round US’s Initial Chip Curbs

US Expands Ban on Top AI Chips, Curbs to Hit Many Countries

New Huawei Phone Spurs Fear China Got Around US Chip Curbs