(ATF) The bonds of Chinese financial companies declined for a third day this week on Thursday, driven down by a coupon payment and after officials criticised the actions of an online lender.

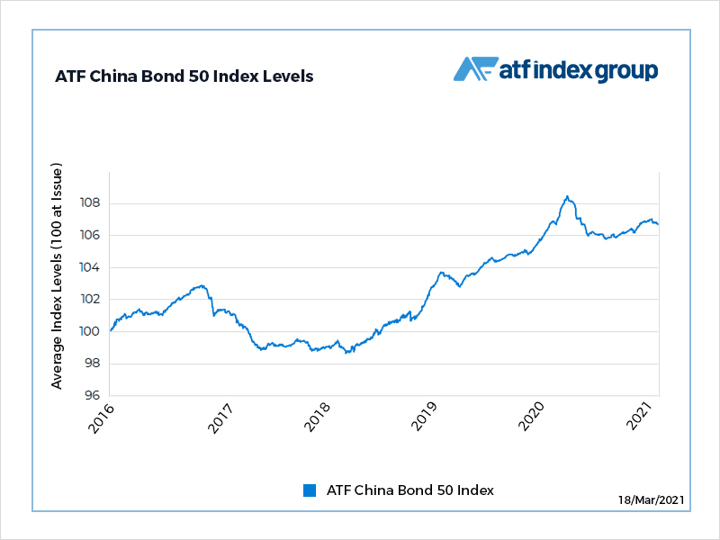

The losses weighed on the ATF China Bond 50 Index of AAA rated credits, dragging the benchmark down for the third time this week.

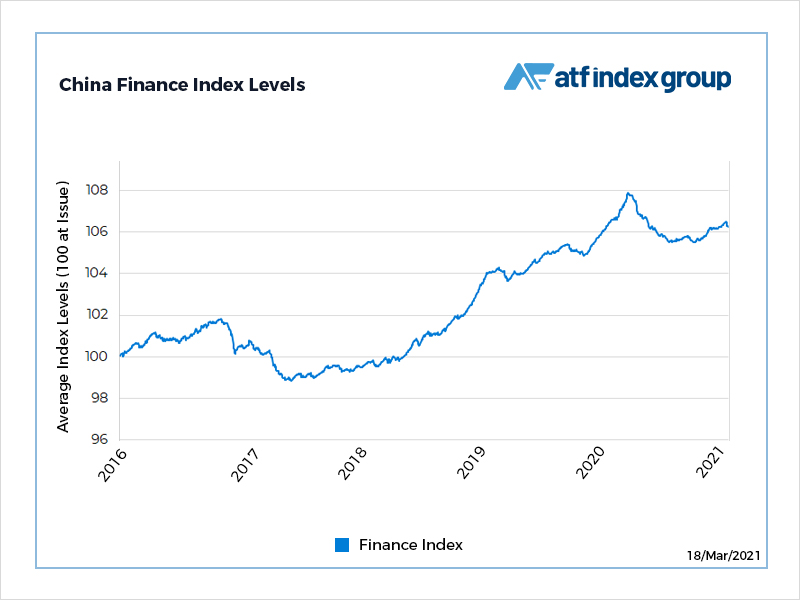

An ATF measure of financial bonds fell 0.06%, extending losses since the weekend to 0.23%. The ATF CB50 fell 0.05% to 106.67. It’s declined 0.15% this week.

Also on ATF

- China adds record wind power capacity before subsidies end

- Canadian firm to build China’s largest solar battery

- Video site Bilibili gets the nod for a listing in Hong Kong

China CITIC Bank made a coupon payment on its 2.75% bond due March 2023. Bonds tend to decline after coupon obligations are met because that reduces the pool of interest the debt will pay out before maturity.

Sentiment was also dented after the China Banking and Insurance Regulatory Commission said Sichuan XW Bank, was found to have charged interest rates of up to 30% on consumer loans with an auto financing platform.

The lender, one of three internet-based banks, also failed to follow risk assessment and debt collection regulations.

Chinese bonds also sold off as US Treasury yields climbed to an 18-month high on concern the improving global economic outlook will prompt central banks to withdraw stimulus measures that have kept borrowing costs at ultra-low levels over the past year.