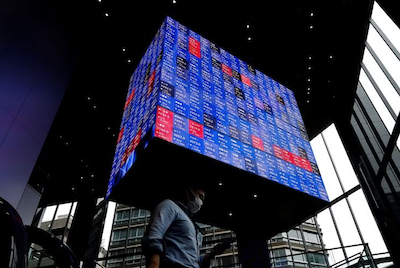

Asia’s major stock indexes slipped back on Friday after Fed officials dashed hopes of a turnaround soon in US interest rates.

Data on Wednesday showed cooling US consumer price inflation, prompting markets to swiftly price in at least two rate cuts this year, but the excitement soon fizzled out as the latest report showed the labour market remains tight, while central bankers were still cautious about inflation.

Japan’s Nikkei share average snapped a three-day winning streak to end lower, tracking Wall Street’s lacklustre overnight finish, while uncertainties over the Bank of Japan’s policy trajectory also weighed on sentiment.

Also on AF: US to Target Chinese Connected Cars Over National Security

The Nikkei slipped 0.34% to close at 38,787.38, but gained 1.43% for the week. The index recouped some losses after the BOJ maintained the amount for its regular bond-buying operation.

The central bank on Monday abruptly reduced the amount for bonds with 5-10 years left to maturity, raising speculation that it would continue its hawkish move.

The broader Topix recouped early losses to end 0.30% higher at 2,745.62 and posted a 0.64% weekly gain.

Chip-related shares fell, with Tokyo Electron losing 2.01% to become the biggest drag on the Nikkei. Toyota Motor rose 2.51% to become the biggest boost for the Topix.

China stocks struggled for direction but ended ahead despite a slew of domestic data showing that growth prospects for the world’s second-largest economy remain challenging.

China’s factory output topped forecasts in April, while retail sales unexpectedly slowed and new home prices fell at fastest pace in over nine years, piling pressure on Beijing to do more to support growth.

Meanwhile, China’s finance ministry auctioned 30-year bonds at a yield of 2.57% on Friday, as Beijing kicked off sales of 1-trillion-yuan long-term special bonds to help stimulate a flagging economy.

Shares of some Chinese property developers rose ahead of a news briefing held by officials about policies to ensure completion of housing projects, helping sentiment.

Seoul, Singapore Fall

China’s blue-chip CSI300 index was up 1.03% with, earlier in the session, its financial sector sub-index higher by 0.06%, the consumer staples sector up 0.07%, the real estate index down 1.01% and the healthcare sub-index down 0.85%.

The Shanghai Composite Index rose 1.01%, or 31.63 points, to 3,154.03, while the Shenzhen Composite Index on China’s second exchange was up 1.18%, or 20.88 points, to 1,785.59.

Hong Kong stocks extended gains, driven by a 7% surge in Alibaba Group after US regulatory filings showed some global funds, including ‘Big Short’ investor Michael Burry, accumulated the firm’s stocks last quarter.

Chinese H-shares listed in Hong Kong – stocks belonging to companies from the Chinese mainland – rose 0.34% to 6,894.43, while the Hang Seng Index gained 0.91%, or 177.08 points, to 19,553.61.

Elsewhere across the region, in earlier trade, there were also gains in Mumbai, Taipei and Jakarta. But Sydney, Seoul, Singapore, Manila and Wellington fell.

MSCI’s broadest index of Asia-Pacific shares outside Japan was down 0.36% after touching a two-year high on Thursday. The index was still set for an increase of 2% this week for its fourth straight week of gains.

European bourses were set to carry on with the listless mood and open lower, with Eurostoxx 50 futures down 0.34% and FTSE futures 0.15% lower.

Descending Dollar

Overnight, the Dow rose as high as 40,051.05 while the S&P 500 and Nasdaq also hit record highs before gradually losing steam and finishing slightly lower on the day.

In the currency markets, the dollar was headed for its largest weekly fall versus the euro in 10 weeks. The euro is up roughly 1% against the dollar and was last at $1.08595.

The yen weakened 0.23% to 155.80 per dollar, giving back some of the gains it made after the mild US CPI report earlier in the week.

The Japanese currency has fallen around 9.5% this year as the Bank of Japan has kept monetary policy loose while higher US interest rates have drawn money towards US bonds and the dollar.

Tokyo is suspected to have intervened on at least two days in late April and early May to support the yen after it tumbled to lows last seen more than three decades ago.

In commodities, oil prices rose, with global benchmark Brent set for its first weekly increase in three weeks on signs of improving global demand.

US crude rose 0.14% to $79.18 a barrel and Brent was 0.3% higher at $83.52 per barrel.

Key figures

Tokyo – Nikkei 225 < DOWN 0.34% at 38,787.38 (close)

Hong Kong – Hang Seng Index > UP 0.91% at 19,553.61 (close)

Shanghai – Composite > UP 1.01% at 3,154.03 (close)

London – FTSE 100 < DOWN 0.40% at 8,404.81 (0934 BST)

New York – Dow < DOWN 0.10% at 39,869.38 (Thursday close)

- Reuters with additional editing by Sean O’Meara

Read more:

China Shrugs as Biden’s New Tariffs Seen as Election Ploy

Biden Scraps Tariff Exemption to Protect US Solar Sector

China’s ‘White-List’ Makes Little Headway Amid Property Gloom

Nikkei Lifted by Rates Bets, Hang Seng Gains on Property Boosts