Solar panel makers in China are seeking government interference to stop ‘over-investment’ in the industry as plunging prices of solar cells and modules erode their profits.

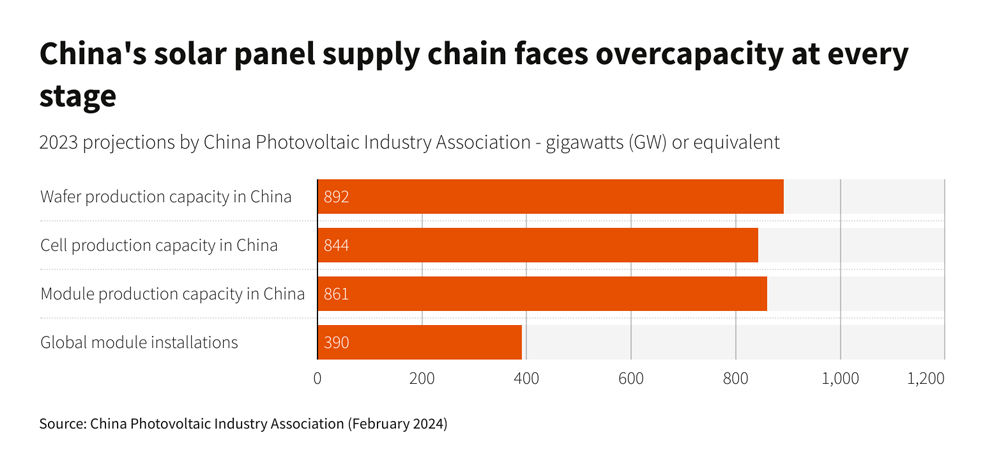

Billions of dollars worth of state subsidies and incentives have helped China dominate the global solar industry. The country now accounts for 80% of global module capacity.

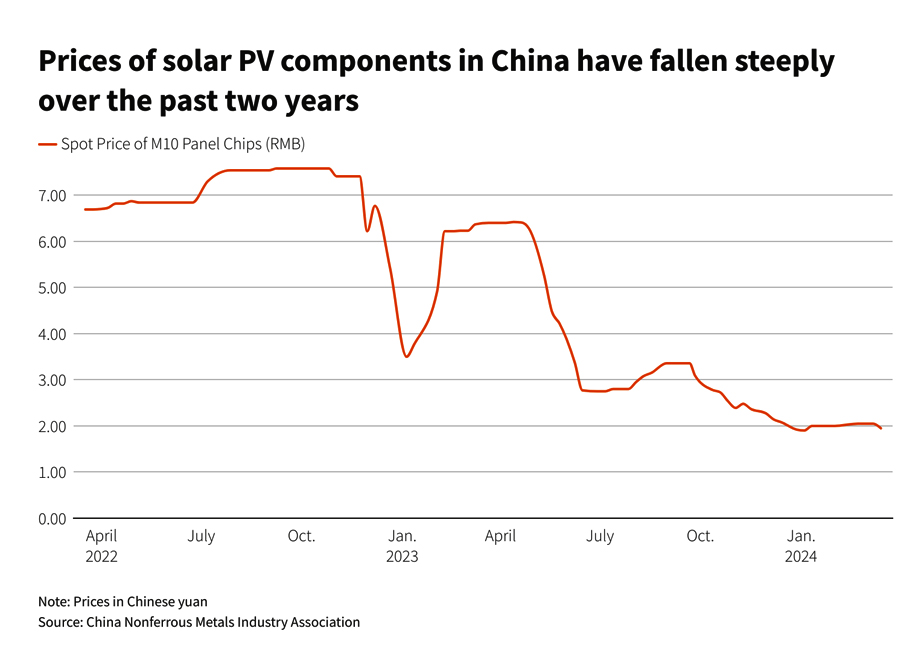

But that dominance has come at a price — industry overcapacity has fuelled a steep plunge in prices of solar cells and modules, with no end in sight.

Also on AF: Chinese EV-Makers Face New Tariffs of up to 38%, EC Says

Prices of finished solar panels in China plunged by 42% last year.

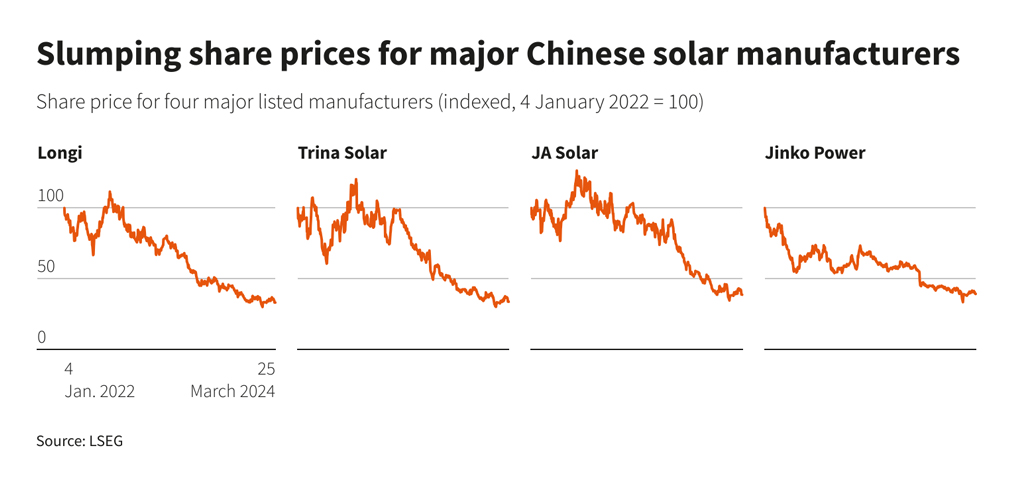

That has threatened not only the profit margins of major Chinese solar panel-makers but also forced smaller players to shut up shop.

“We need to join our forces together to avoid over-investment,” Gao Jifan, chairman and CEO of Trina Solar and honorary president of CPIA, said.

Gao’s comments came as the country’s solar panel makers converged at the International Solar Photovoltaic and Smart Energy conference on Tuesday and called for industry collaboration.

While Gao sought government regulation of new investment in the sector to plug further losses, SiNeng Electric’s president Duan Yuhe asked the Chinese state planner to intervene.

‘Survival is the goal’

Analysts expect Chinese manufacturers to add up to 600 gigawatts (GW) this year, enough to meet global demand through 2032.

The blistering jump in capacity has meant that even China’s own power grid does not have enough storage or transmission capacity to soak up the excess power generated from rooftop solar panels when the sun is shining.

That has led Beijing to impose restrictions on supplying excess power from rooftop solar into the grid and also slash the some of the price support that led to the rapid growth of distributed solar.

The remaining option before manufacturers then is to export more and more solar panels to global markets which are racing to meet their climate goals.

But Chinese solar panel-makers are running into road blocks there too. Markets like India and the US have imposed restrictions on imports from not only China but also Southeast Asian nations such as Vietnam, Malaysia and Cambodia, markets that Chinese manufacturers have reportedly been shipping solar panels from.

A major market for China — Europe — has also been raising the alarm on Chinese solar panel imports to combat the threat to domestic manufacturers.

View this post on Instagram

Those challenges coupled with intense rivalry at home is threatening to drive smaller industry players into bankruptcy.

“Survive – that’s the goal,” Li Gang, chairman of Seraphim Energy Group, told Tuesday’s conference.

‘Consolidation has already begun’

Between June 2023 and February 2024, at least eight companies cancelled or suspended more than 59 GW of new production capacity, equivalent to 6.9% of China’s total finished panel production capacity in 2023, according to the China Photovoltaic Industry Association (CPIA).

And small players weren’t the only ones hit by the industry’s worsening fortune. In March, China’s Longi Green Energy Technology, one of the world’s largest solar panel manufacturers, announced it will lay off about 5% of its employees.

A month later, the company’s vice president Dennis She told Reuters consolidation would be “good for the leading players” in the country.

At Tuesday’s conference, Gongshan Zhu, chair of the Asian Photovoltaic Industry Association, warned new companies against rushing into the sector.

He noted that industry profits had plunged 70% due to overcapacity and falling prices, while exports were curbed by trade barriers imposed by the United States.

“If you’re just a copycat, it will not be sustainable for you,” Zhu said, adding that the situation has been exacerbated by local governments investing for the sake of boosting employment.

Industry executives speaking at the conference also called for an end to race-to-the-bottom price competition. They suggested bidding processes take into account levels of research and development, instead of just pricing.

Some company officials, such as Wuxi Suntech Power chairman Fei Wu, said consolidation had already begun. The industry’s prospects were expected to worsen this year and more small companies were likely to go out of business, he added.

- Reuters, with additional inputs from Vishakha Saxena

Also read:

China’s Clean Energy Spending Set to Match US-Europe Combined in 2024

China Solar Panel Costs Plunge in 2023, 60% Cheaper Than US

China Turns on World’s Biggest Solar Farm in Xinjiang

China’s Solar Sector Seen Facing Years of Oversupply, Low Prices

US, EU Can’t Meet Climate Goals Without China’s Cheap Green Tech

EU Can’t Close Borders to Chinese Solar, Energy Chief Says

China’s Cheap Solar Panels Killing Europe’s Solar Manufacturers

China Wind, Solar Capacity Set to Outstrip Coal For First Time

China Solar Firms Paying Price of Global Dominance – FT