Shares of Adani Group‘s listed companies plunged again on Monday following reports that the embattled conglomerate was in talks to raise up to $400 million in debt against some of its assets in Australia.

The Indian conglomerate is in discussions with several large high-yield global credit funds to raise fresh debt, the Economic Times newspaper had reported on Monday. The group had received two indicative term sheets from potential lenders, including hedge fund Farallon Capital Management, the report added.

Later, a spokesperson for Adani Group denied the report in an email to Reuters, calling it “totally false and untrue” but without giving any other details.

Also on AF: Adani to Prepay $121 Million Loan as Market Value Drops 57%

The Indian ports-to-power conglomerate operates the Carmichael coal mine, the North Queensland Export Terminal (NXQT), as well as a solar farm in Australia.

The NXQT, a major port for Queensland coal exports controlled by the Adani family trust, is being considered to raise funds to repay promoter debt, the ET report said, citing sources aware of the fund-raising.

Adani did not immediately respond to a request for comment. Farallon Capital declined to comment.

The report comes at a time when the group’s shares continue to bleed in the aftermath of a scathing report by US short-seller Hindenburg Research.

The firm accused Adani of ‘corporate con’, saying the group was improperly using offshore tax havens and manipulating its stock.

It also said key listed Adani companies had “substantial debt” which has put the entire group on a “precarious financial footing”

The Adani Group has, meanwhile, rejected all allegations of wrongdoing.

More than $147 billion eroded

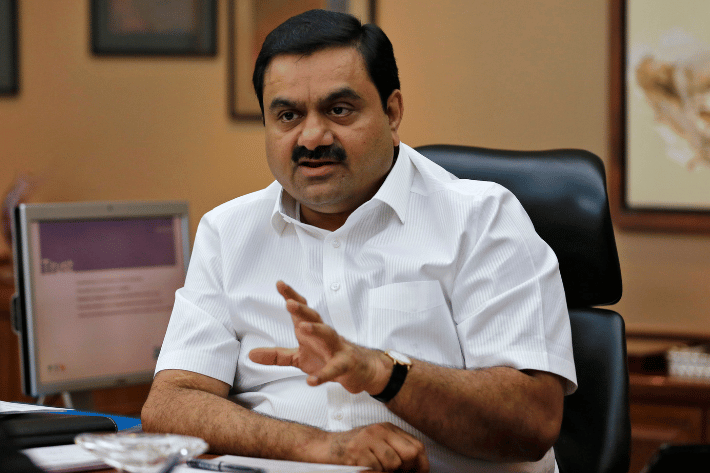

As of Monday, the conglomerate led by billionaire Gautam Adani has seen about $147 billion wiped off its market value since the report was released on January 24.

But the figure could now top $150 billion, as Adani Enterprises, the flagship firm of Adani group, closed almost 10% down on Monday, and has lost around 65% since the Hindenburg report.

Adani Green Energy, Adani Power, Adani Total Gas, Adani Transmission and Adani Wilmar all closed down close to 5% as well.

Australia’s corporate regulator earlier this month said it will review the report that has flagged a wide range of concerns about the group led by billionaire Gautam Adani.

India’s securities regulator SEBI is also reportedly probing the group. The markets regulator also told the country’s apex court it was investigating Hindenburg’s allegations against Adani.

The Supreme Court is also currently hearing multiple public interest petitions concerning steep investor losses caused by the ongoing rout in listed Adani companies.

Meanwhile, Adani is holding fixed-income roadshows this week in Asia, as the conglomerate tries to shore up investor confidence.

- Reuters, with additional editing by Vishakha Saxena

NOTE: The headline and text of this report was updated with further details after the close of trading on Monday February 27, 2023.

Also read:

India’s Adani Bids to Reassure Investors as Rout Continues

All Eyes on India Market Regulator Amid Adani Share Sale Probe

SEBI Probing Adani Share Sale, MSCI Cuts Firms’ Index Weight

Indian Protesters Say Modi Favoured Adani as Losses Top $110bn

Indian Market Rout Intensifies After Adani Drops $2.5bn Share Sale