Global banks are assessing risk from their exposure to Indian billionaire Gautam Adani, as fallout continues to grow from his indictment in the United States on charges of bribery and fraud.

US prosecutors say Adani and his co-conspirators, which include his nephew Sagar, paid millions of dollars worth of bribes to Indian government officials to snag contracts and develop India’s largest solar power plant project.

The Adanis then proceeded to raise funds from investors — including those in the US — while lying about their ‘anti-bribery’ policy and also concealing they were under investigation for improper practices.

Also on AF: Adani Stocks Plunge After US Charges For Bribery, Fraud

Prosecutors on Thursday issued arrest warrants for Adani and his nephew following the indictment, wiping a collective $26 billion in market value off the conglomerate’s seven listed companies in India.

Experts say the indictment — that is yet to result in Adani’s arrest or provide any clarity on what lies ahead for one of the wealthiest people in the world — has upped risks for global banks, and also, India’s drive to develop renewable energy.

Credit pause

S&P Global Ratings said in a note on Friday the indictment could affect investor confidence in Adani group entities, thereby potentially impairing their funding access and increasing their funding costs.

“We believe domestic, as well as some international banks and bond market investors, look at Adani entities as a group, and could set group limits on their exposure. This may affect the funding of rated entities,” it said.

And banks concerned about their exposure to Adani are, indeed, considering temporarily halting fresh credit to his conglomerate.

Senior executives at two of Adani’s global lenders told Reuters that they have had multiple calls within their respective banks since the indictment details were announced to discuss exposure to the group and what the impact of the latest development would be on the group’s financials.

“We will have to put a pause to fresh lending until we are able to figure how this will play out. I think it will be a while before the bank is able to tap the credit market,” a banker at one of the leading Western banks said.

The banker, who is involved in talks related to Adani credit exposure and declined to be named as he was not authorised to speak to the media, said most of the group’s firms have stable cash flows and are not in “desperate need” to raise capital.

‘Getting a little bit nervous’

The indictment would, however, cast a cloud over fundraising plans for expansion within India and abroad, as there will be greater creditor scrutiny not just on the indictment outcome but also on the “key man risk” for the group, the banker said.

A senior banker at another Western bank, which is one of the major lenders to the group, said that the bank would also put a temporary freeze on fresh lending and was keeping a close watch on the Indian government’s reaction to the indictment.

“Our future course of action will largely depend on whether the government will now try to find a way to resolve this or launch its own probe,” said the senior banker at a Western bank, adding the infrastructure giant has now become “too-big-to-fail” for India.

“There’s been no conviction … but if you’re a risk officer at a bank with exposure to Adani, maybe you’re getting a little bit nervous,” said Ed Al-Hussainy, head of emerging market fixed income research at Columbia Threadneedle.

Civil liability risks

Some global banks with ties to Adani are also parsing through bond and loan documentations to see if it exposed them to a risk of default or created a liability if investors decided to demand their money back, another banker said.

But there was not a lot of legroom in documentation for either investors or the bankers to force the company to pay them back since there was no conviction yet, lawyers familiar with corporate bond and loan agreements said.

The most likely liability facing the banks is civil liability from investors introduced to Adani through the banks, said John Joy, managing attorney at FTI Law, a law firm that specializes in Foreign Corrupt Practices Act (FCPA) violations.

“Civil litigation is a lengthy process, and it is possible that during discovery investors could uncover involvement that has not been disclosed by the SEC (Securities and Exchange Commission) or DOJ (Department of Justice),” he said.

Indian renewables under scrutiny

Meanwhile, analysts also say the fallout from Adani’s conviction was unlikely to be limited to the Adani group of companies.

“India’s renewable energy sector, a critical pillar for global climate goals, may face reduced international investment as a result of this controversy,” Nimish Maheshwari, an independent analyst who publishes on Smartkarma, said.

“Investors may demand greater transparency and due diligence, slowing down the pace of project financing.”

Gautam Adani said in 2021 that his Adani Green Energy Ltd — the firm that landed contracts through the bribery scheme — was on track to be the world’s largest renewables player by 2030. But he has not appeared in public or commented on social media since the indictment.

Meanwhile, White House spokesperson Karine Jean-Pierre played down any impact from the case on US-India relations, saying the countries would “continue to navigate this issue, as we have with other with other issues that may have come up.”

Rick Rossow, head of the India programme at the Center for Strategic and International Studies in Washington, however, said the indictment added a “chill” to relations.

“The positive side of the ledger still probably outweighs the negative, but this will feed into a continued sentiment in India that the United States will employ dirty tricks to slow India’s rise as a global power,” Rossow said.

Cheers after Kenya scraps deals

US prosecutors say the alleged $265 million bribery scheme was so calculated that Adani’s nephew went as far as to identify a per megawatt bribe rate to secure power contracts in various Indian states.

He recorded all of those details on his phone, referred to as “bribe notes” in court filings.

In return for those bribes, the Adanis expected to yield $2 billion in profit over 20 years.

But the indictment has already cost Adani way more.

Aside from the billions wiped off his conglomerate’s shares, bonds issued by the Adani Group continued to drop sharply for a second day on Friday. Adani Green Energy also cancelled a scheduled $600 million US bond sale.

Meanwhile, shortly after the indictment, Kenya cancelled a procurement process worth nearly $2 billion that had been widely expected to award control of the country’s main airport to the group.

It also nixed a 30-year, $736-million public-private partnership deal that an Adani Group firm signed with the energy ministry last month to construct power transmission lines.

The move, announced by Kenyan President William Ruto, was met with thunderous applause and cheers from lawmakers in parliament, where he gave his address.

The deals had drawn sharp criticism from many politicians and members of the public over concerns about a lack of transparency. A lawsuit earlier this year also argued Adani’s airport proposal did not offer taxpayers value for money.

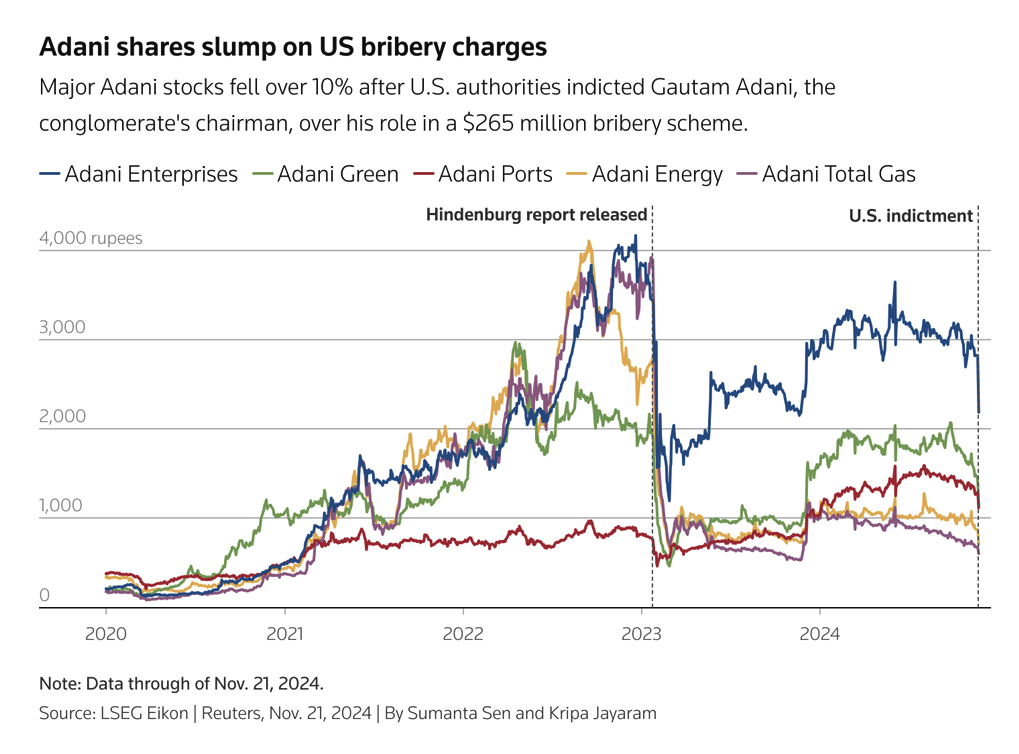

This is the second crisis to hit the ports-to-power conglomerate in two years. Last year, US-based short-seller Hindenburg Research accused the Adani Group of improper use of tax havens and stock manipulation.

Adani denied Hindenburg’s allegations and went on to say global banks including Barclays, Deutsche Bank, Japan’s Mizuho, Mitsubishi UFJ Financial Group, SMBC Group and Standard Chartered reaffirmed their confidence in his conglomerate.

But that was after the Hindenburg report sparked an approximately $150 billion meltdown in Adani Group shares — losses they are yet to claw back.

Following Wednesday’s indictment, Hindenburg said in a statement that “since releasing our January 2023 report identifying Adani as the largest corporate con in history, we have never wavered in our view, nor has Adani ever refuted our findings.”

What lies ahead

The Adani Group has yet again denied the latest charges against it. The group said allegations by US prosecutors were “baseless and denied,” adding it would seek “all possible legal recourse.”

Meanwhile, US prosecutors plan to hand arrest warrants against Gautam and Sagar Adani to foreign law enforcement, US court records show.

The defendants may seek to dismiss the indictment without appearing in person or being extradited pursuant to India’s treaty with the United States.

Adani could fight extradition, and it is unclear how long the process might take. The billionaire is accused of bribing Indian government officials, which could make extradition more politically fraught.

Adani could also strike a plea deal with prosecutors by agreeing to admit to certain crimes in exchange for a lighter sentence, though prosecutors are under no obligation to negotiate. Any deal would also need to be approved by a judge.

If convicted, Adani could face decades in prison as well as monetary penalties, though any sentence would ultimately be up to the judge overseeing the case.

- Reuters, with additional editing by Vishakha Saxena

Also read:

New Hindenburg Report Wipes up to $13 Billion Off Adani Firms

India Regulator Puts Seven Adani Firms on Notice For Violations

US Lends $553m to Adani Colombo Port JV Amid China Rivalry

Indian Regulator Seen Probing Adani’s Ties With Gulf Asia Fund

Adani Family Partners ‘Used Opaque Funds to Buy Stocks’

India Regulator Warns Against Hasty End to Adani Group Probe

Indian Protesters Say Modi Favoured Adani as Losses Top $110bn

All Eyes on India Market Regulator Amid Adani Share Sale Probe

Probe Into Some Adani Offshore Deals for Disclosure Violations

Indian Market Regulator Seen Seeking Details on Foreign Investors

Indian Market Rout Intensifies After Adani Drops $2.5bn Share Sale