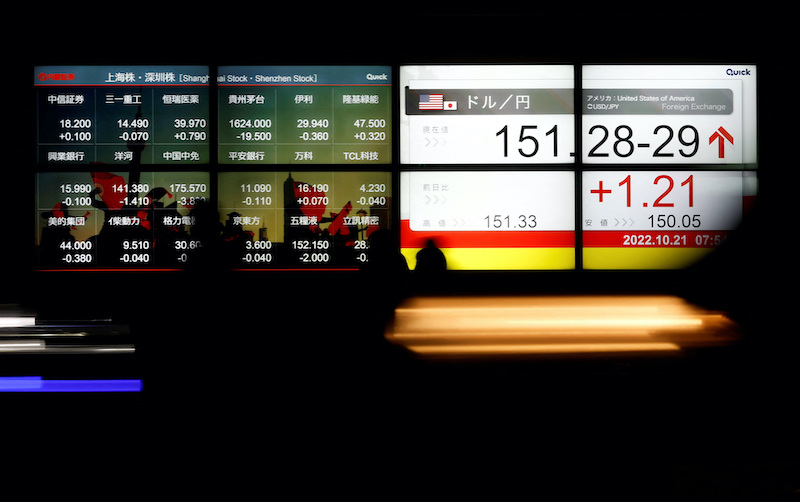

Asian stocks slipped on Wednesday with investors focusing on China’s uneven recovery, and persistent global inflation and how tough will the US Fed’s next move be.

Japan’s Nikkei share average ended lower, snapping an eight-day rally, dragged down by heavyweight technology stocks as traders stepped back.

The Nikkei index edged down 0.18% to 28,606.76, after closing at its highest since August 22 on Tuesday. The Nikkei’s rally was driven by spillover from optimism over billionaire Warren Buffett eyeing increasing investments in the country. The broader Topix inched down 0.03% to 2,040.38.

The insurance sector rose 2.31% to become the top performer among the Tokyo Stock Exchange’s 33 industry sub-indexes.

Also on AF: China’s CATL Eyes Condensed Matter Battery for Planes, EVs

Chinese stocks fell, as a bumpy recovery after China dropped its zero-Covid policy and some contradictory data from the first quarter of the year kept investor sentiment weak.

Real estate developers led declines with a 2% drop, after Tuesday’s data showed property investment fell 5.8% from a year earlier. The data also showed factory output growth was just below expectations, while retail sales growth hit near two-year highs.

The Shanghai Composite Index fell 0.68%, or 23.20 points, to 3,370.13, while the Shenzhen Composite Index on China’s second exchange slipped 0.57%, or 12.28 points, to 2,126.51.

Amid the weak market sentiment, some investors continued to bet on AI stocks. Frenzy around OpenAI’s ChatGPT chatbot had boosted shares of Chinese companies in the tech, media and telecom sector.

Shares in media rose 2.6%, artificial intelligence added 2.4%, and semiconductors climbed 2%.

Tech giants listed in Hong Kong retreated 0.9%, with Alibaba down 0.7%, even after it was reported that Chinese regulators are expected to fine Ant Group about a quarter less than the more than $1 billion initially planned and downgrade their charges against it, as they seek to end a years-long crackdown on marquee technology firms.

The Hang Seng Index dropped 1.37%, or 282.75 points, to 20,367.76.

ASML Profits Boost

Elsewhere across the region, in early trading, Taipei, Bangkok, Manila and Mumbai were all down, while Sydney, Seoul, Wellington, Jakarta and Singapore were up.

Global stocks eased too, while the dollar pulled further above last week’s one-year lows, as investor focus honed in on what the Federal Reserve may have to do to tame inflation, rather than on the recent problems in the US banking sector. The MSCI All-World index fell 0.2%, thanks to a broad-based decline in equities around the world.

S&P 500 and Nasdaq 100 futures fell between 0.3-0.5%, suggesting a touch of weakness at the opening bell. Tesla reports earnings later in the day, as does Morgan Stanley, on the heels of solid earnings at rivals that seem to have soothed some concern about the sector’s stability.

Earnings seasons is underway in earnest in Europe too and Dutch-listed chip equipment maker ASML – one of the region’s most valuable companies by market capitalisation beat first-quarter profit expectations, according to Refinitiv data.

As investors consider the possibility that the Fed may well have to raise rates even more, the US dollar has found some support, but data shows the pressure is also on other central bankers to do something about inflation.

UK inflation fell to 10.1% in March, from February’s 10.4% – above expectations for a decline to 9.8% and the highest in western Europe, according to data on Wednesday.

Brent crude futures eased 0.9% to $84.00 a barrel, roughly where they have traded for a few weeks since OPEC+ announced surprise production cuts. Gold dipped below $2,000 an ounce, given the strength in the dollar.

Key figures

Tokyo – Nikkei 225 < DOWN 0.18% at 28,606.76 (close)

Hong Kong – Hang Seng Index < DOWN 1.37% at 20,367.76 (close)

Shanghai – Composite < DOWN 0.68% at 3,370.13 (close)

London – FTSE 100 < DOWN 0.37% at 7,880.31 (0934 GMT)

New York – Dow < DOWN 0.03% at 33,976.63 (Tuesday close)

- Reuters with additional editing by Sean O’Meara

Read more:

China Sees 4.5% Growth in First Quarter, But Outlook Cloudy

China May Soften Charges, Reduce Fine on Embattled Ant Group