(AF) The AF indexes closed broadly positive on Friday, ahead of what is likely to be a volatile week in Asia due to the US election on 3 November and a raft of economic data activity.

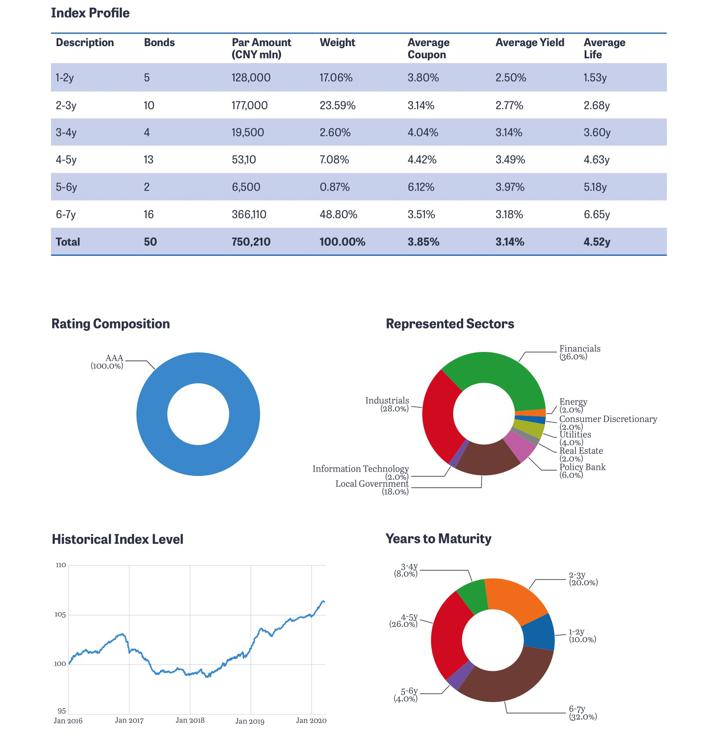

The benchmark China Bond 50 index climbed 0.01%, finishing the week 0.12% higher. Meanwhile, the ATF ALLINDEX Enterprise rose 0.02%, while the AF ALLINDEX Corporates and Local Governments sub-gauges inched up 0.01%. The ATF ALLINDEX Financial didnt move at all, and closed at 105.72.

“Market expectations have coalesced around a Biden presidency, with some hope of even a blue sweep of both House and Senate,” according to a research note from DBS economists. “Another possibility, though much slimmer, is a Republican sweep,”

“Both eventualities entail a sizeable fiscal stimulus that will deliver a boost to US growth. A strong reflationary environment should stoke appetite for Asian credit, particularly those of export-oriented economies.”

On Saturday, China’s National Bureau of Statistics announced higher PMI figures for the country in October, with the manufacturing PMI moderating slightly to 51.4 from 51.5 in the previous month, and the non-manufacturing PMI rising to 56.2 from 55.9 in September.

China’s ongoing economic recovery and slew of positive economic data in October has led to a rising expectation that the People’s Bank of China (PBoC) will exit from both broad-based and targeted stimulus measures.

Following a speech by PBoC governor Yi Gang’ speech last week Peiqian Liu, Chief Economist at NatWest Markets, expects the central bank to maintain targeted stimulus, and to focus on short-term liquidity fine-tuning rather than any long-term liquidity injections.

Expectations of a stimulus exit have caused a sell-off in Chinese government bonds, with yields on 10-year Chinese sovereign paper hitting pre-COVID levels this month. On Friday, it was yielding 3.19%. , highly-rated Chinese corporate credit spreads also rallied, tightening 20 basis points since mid-September.

“We have withdrawn all our forecasts for Loan Prime Rate and Reserve Ratio Requirement cuts, but the PBoC might surprise the market with more Medium-Term Lending Facilities and seven-day reverse repo open-market operations,” said Liu.

In other developments, the yuan extended gains against the dollar on Friday after Chinese leaders announced ambitious plans for sustained economic growth following the Fifth Plenum of the 19th Communist Party Congress. It rose 0.1% to 6.699 after the People’s Bank of China set the mid-point rate at 6.7232, according to Trading Economics, an online data provider.

Earlier this week, the Chinese central bank removed the counter-cyclical factor on its daily yuan midpoint fixing to allow the fixing to more accurately reflect currency market moves. This came shortly after the PBoC suspended the 20% reserve requirement ratio for dollar purchases in the derivatives market.

“These moves are an indicator that the PBoC is becoming comfortable with the idea of freeing up the yuan,” said Liu. “We will see much more two-way volatility now that these two backstops have been removed.”

Liu noted that this will also lead to much more fluctuation in the yield gap between Chinese government bonds and US treasuries, which itself will have an impact on the risk-free rate in China and resulting capital inflows.