(ATF) Bond investors are keeping a sharp eye out for China’s upcoming Q3 GDP data on Monday, and a slew of other data, as well as the October setting of China’s benchmark lending rate for corporate and household loans a day later.

Beyond that, observers are keenly awaiting the Fifth Plenum of the 19th Communist Party Congress on October 26-29, when senior leaders will unveil China’s economic and social development targets for 2021-25.

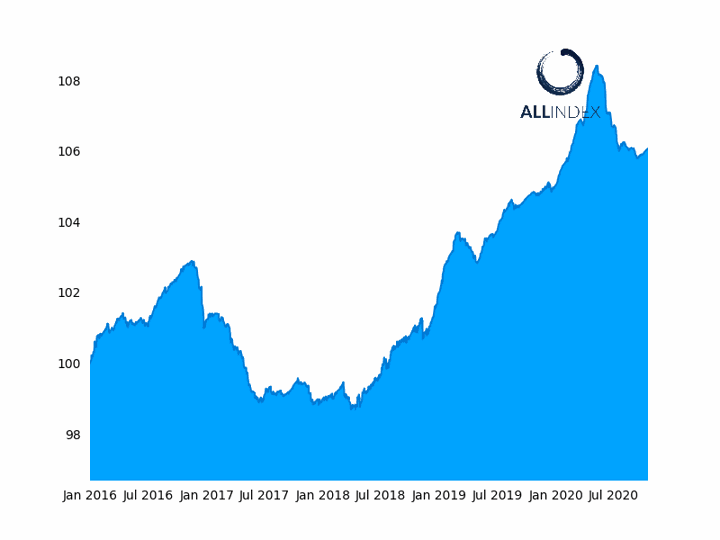

The flagship China Bond 50 index closed the week 0.05% higher, its third week of advances. It was little changed on Friday, when the ATF ALLINDEX Corporates, Enterprise and Local Government, inched up 0.01%, while the ATF ALLINDEX Financial didn’t move at all.

Analysts estimate that a stronger GDP performance in the third quarter than the second quarter, forecasting 5.2% year-on-year GDP growth in July-September, versus 3.2% in the second quarter.

ORE WARS: China cuts rare earths exports by 43% in Sept, builds stockpile

“Higher manufacturing PMI in September heralded firmer industrial production, while strong industrial profit growth in recent months likely pulled fixed-asset investment growth back into positive territory in September,” Prakash Sakpal, senior economist Asia at ING, wrote in a research note.

“A surge in spending ahead of the long National Day holiday and the government’s drive to promote cross-provincial tourism should support retail sales too. While there was ample banking sector liquidity supporting the domestic economic activity, external demand also continued to improve, as data earlier this week showed.”

China’s exports hit a record high in September, rising 9.9% in dollar terms from a year ago and recording an increase for the fourth consecutive month.

Sakpal expects no change to the country’s monetary policy stance. Given the Chinese central bank’s 500-billion yuan ($74bn) liquidity injection via its medium-term lending facility (MLF) at the unchanged rate of 2.95% on Thursday, the one-year and over five-year Loan Prime Rate (LPR) are expected to be kept the same on Tuesday, at 3.85% and 4.65% respectively.

Communist party meeting

Looking further ahead, all eyes are on the Fifth Plenum, where China’s leaders are expected to outline the next five-year plan to reconfigure China’s economic growth model by implementing its “dual circulation” strategy. This aims to move China towards increased domestic reliance by boosting domestic consumption, and new – and traditional – infrastructure investment (the internal circulation component) while maintaining China’s export-led economic model (external circulation).

“There is a debate right now in the market about whether China will push through structural reforms in a serious manner,” said Duncan Wrigley, chief strategist at Everbright Sun Hung Kai. “I think for investors it’s important to know that China will indeed implement fairly serious structural reforms that, if implemented effectively, will allow China to maintain decent, sustainable GDP growth in the next five-10 years.”

One widespread misconception is that this might involve China switching to a consumption-driven growth model similar to the US or the UK, said Wrigley. However, this is not feasible for China at this stage of its development, he added, citing the country’s still relatively low average income and lack of a national social safety net.

“Structural change will be much more about tweaking the way investment capital is currently deployed across the country and ensuring it goes to economically justifiable areas of the economy.”

The ATF China Bond 50 climbed 0.01%

One key pillar of that is to reconfigure the urbanisation strategy, Wrigley said.

“The previous 2014-2020 urbanisation strategy tried to push people to go to small cities and towns in order to spread the growth across the country, but that was pushing against economic reality and migrant workers largely ignored it,” he said.

“The urbanisation strategy is already starting to shift and, instead of pushing against the economic tide, it’s going with it: encouraging urbanisation towards the most economically dynamic parts of the country such as the big city clusters of the Pearl River Delta and the Yangtze River Delta around Shanghai.”

Wrigley explained China’s leaders are driving change around three factor-market reforms aimed to spur growth, unveiled by China’s State Council in a new policy document in April. These are:

- Land reforms involving delegating authority to local governments to enable the conversion of rural land, adjacent to urban areas, into urban land and build on it.

- Labour reforms around Hukou, or the household registration system, with restrictions on migrant workers previously unable to benefit from public services in the cities in which they were not born being eased.

- Reforms to make capital markets more efficient and transparent, reducing investments in poor quality infrastructure assets and over-leverage. The introduction of China’s keenly awaited infrastructure REITs, for example, will reduce leverage issues amongst project investment companies, and stimulate infrastructure projects to boost construction revenue and profit.

Wrigley noted that Xi Jinping’s speech on Wednesday in Shenzhen to mark the special economic zone’s 40th anniversary and its resounding success as one of China’s first special economic zones could signal China’s commitment to these reforms.

He said the speech echoed Deng Xiaoping’s southern tour in 1992, when his talks and remarks renewed momentum for stalled reforms and opening-up program in mainland China.

“Shenzhen is a pioneer of market reform and opening-up, and is trying to transition to the next stage of development ahead of the rest of the country to a more hi-tech, value-added model of production,” stated Wrigley.

“In the same way that Deng’s tour was widely seen as providing critical momentum to China’s economic reforms at the time, so could Xi’s Shenzhen visit be a hopeful sign of leadership backing for China market-factor reforms.”