(ATF) The ATF indices closed steady on Friday, ahead of China’s release of key economic data for July next week.

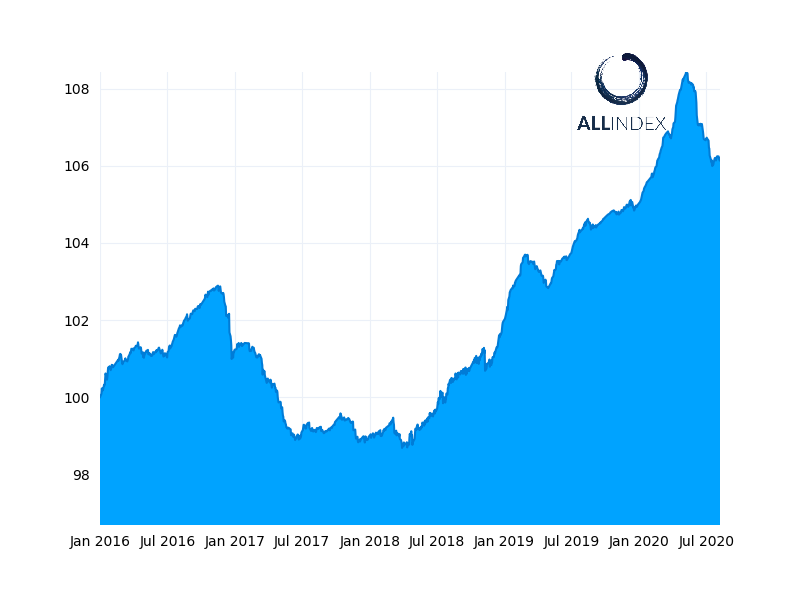

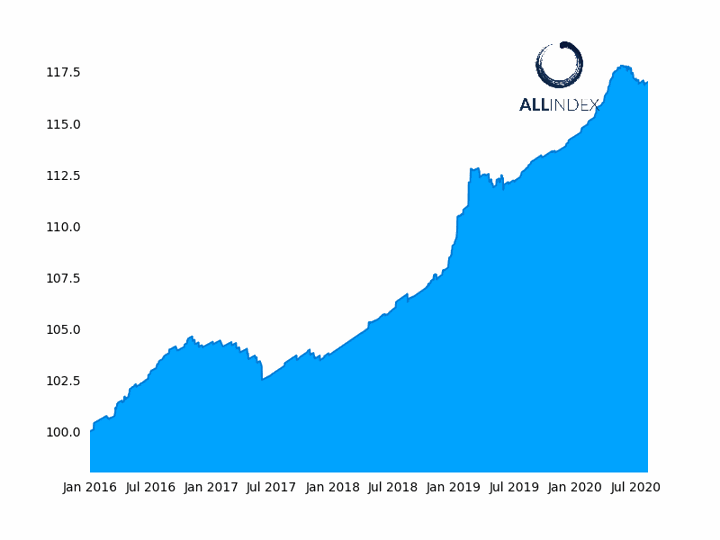

The flagship China Bond 50 index, the ATF ALLINDEX Enterprise and Local Government gained 0.01%, while the ATF ALLINDEX Financial inched up 0.02%. The ATF ALLINDEX Corporates didn’t move at all.

Most of the indicators will post better readings than they did in June, suggesting that the third quarter of the year is off to a firmer start, according to Prakash Sakpal, Senior Economist Asia at ING.

The ATF ALLINDEX Enterprise gauge gained 0.01% on Friday.

The July data pipeline, which started this week, will extend to next week and will include figures on industrial production, fixed investment, retail sales, consumer and home price inflation as well as monetary and lending indicators.

“In terms of the data dump next week, what people will be looking at closely is the credit data and the data on consumer spending,” said Shaun Roache, Chief Economist APAC at S&P Global Ratings.

“There is this expectation that the bulk of the easing in China has been done, that the recovery is picking up steam and that policy-makers can hold back a little bit,” said Roache. “People will be watching the credit data for evidence that this is true, and I think they expect to see some moderation in credit growth in the second half of the year.”

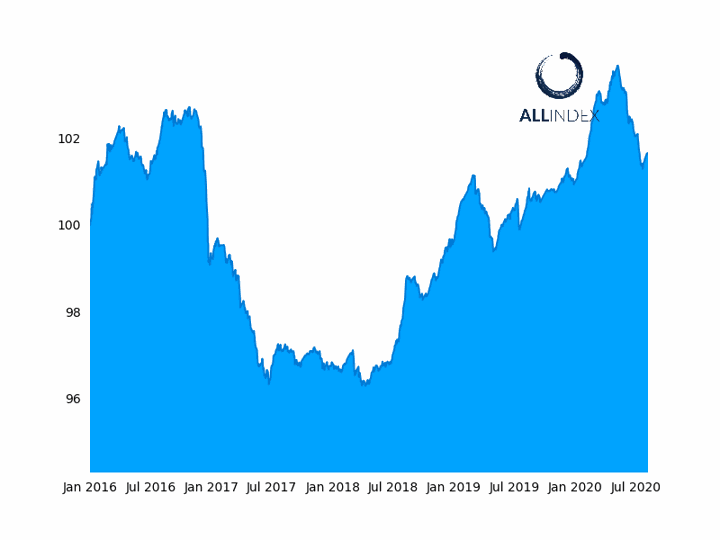

The ATF ALLINDEX Financial sub-index was up by 0.02% on Friday.

On top of that, observers will be keen to see whether there has been a pick-up in consumer spending, since China’s rebound has been uneven, he noted. “The recovery has been driven by the industrial sector, but consumer spending has been weak. That’s going to have to change if the recovery is to be self-sustaining.”

Roache stated that Beijing will need to provide “ongoing and outsized economic support” if it is to maintain its economic momentum and expects net new credit flows to be broadly stable as a share of GDP. New loans, which reached 1.81 trillion yuan in June, up from 1.48 trillion yuan in May, will need to remain over 1 trillion yuan for a while, he said. “I think new loans will moderate, but not much.”

“Repo rates have edged higher over the last month, leading many to think that Beijing is taking stimulus out of the financial system, but I don’t see it that way.”

He pointed to S&P’s Financial Conditions Index (FCI), which takes into account real interest rates, effective and benchmark lending rates, as well as bond yields, credit spread aggregate credit as a share of GDP, along with financial market turnover. “The FCI surged in the first 4-5 months of the year, and was the loosest that we’ve seen it since 2009. It has tightened a little in the last month, but stimulus-driven demand has not yet handed over to private consumption as the driver of growth and until it does, China’s recovery will remain unbalanced and vulnerable to shocks.”

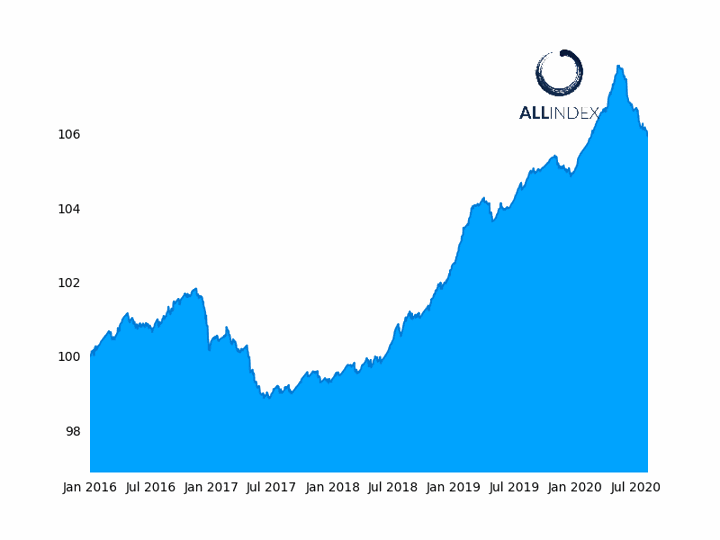

The ATF ALLINDEX Local Government gauge gained 0.01% on Friday.

China has implemented stringent Covid-19 mitigation policies, still some of the toughest in Asia-Pacific according to the Oxford Covid-19 Government Response Tracker’s Containment and Health index, and its success in containing the virus has come at a cost. “China’s social distancing policies have been a good deal tighter than many other places, and while that has contained the virus, it does suppress demand and activity, and that’s playing out in consumption demand, for example.”

The pandemic is still blowing a very big hole in cash-flow for a lot of corporates, he added, and something will have to plug that gap. “It’s most likely that credit is going to plug that gap, and that’s going to have to come from the banks.”

The ATF ALLINDEX Corporates sub-index held steady on Friday.