Libra Association member Novi’s rebrand of its digital wallet to ‘Novi’ – Latin for ‘new way’ – is a sign of our times, as the global financial system hurtles towards a digital future embracing new payment modes.

The coronavirus pandemic has accelerated that transition as governments looks to minimise the use of physical cash in an effort to safeguard their populations while keeping the wheels of their economies turning.

It also allows fulfilment of long held ambitions of financial inclusion, risk management and cracking down on financial crimes like money laundering. For example, financial inclusion could be unlocked at a scale previously unimaginable. Just look at what mobile money has achieved in sub-Saharan Africa, and imagine that the world over.

The US and UK have both taken unprecedented steps in using fintechs to distribute stimulus funds and the PBoC and HKMA are promoting stablecoins to reduce money laundering.

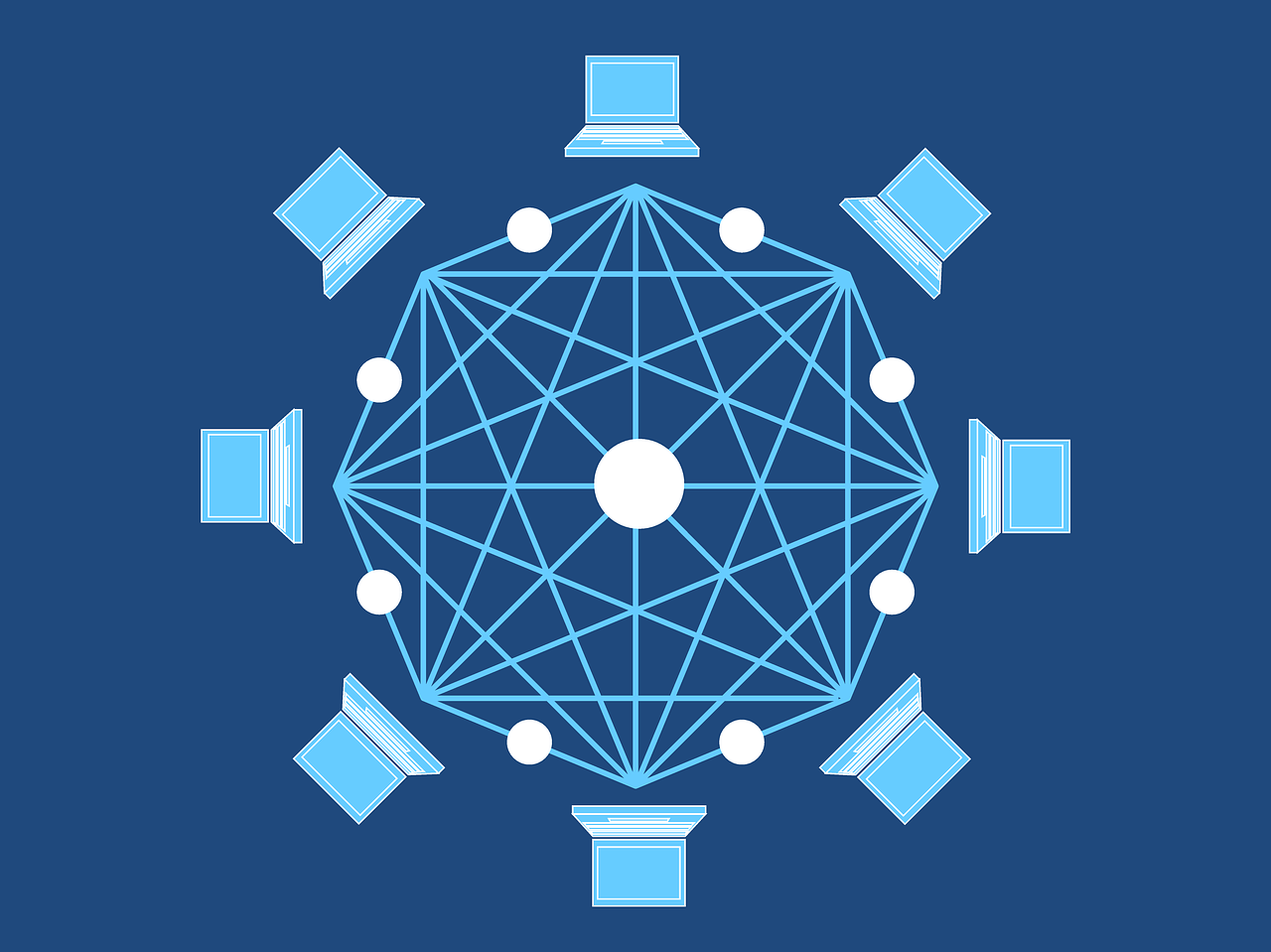

And the one technology that is helping drive this change is blockchain.

It is well known that the tech made its first debut at the time of the last global financial crisis in 2008. Blockchain has since developed, becoming touted as one of the most ground-breaking technologies.

Due to its transparent and trackable properties, it has the potential to impact every industry from financial services to manufacturing to education. And now, twelve years on, we are beginning to see financial institutions consider it a real potential alternative that could become a mainstream currency.

Traditional institutions driving change

The most momentous change we’ve seen in the last year is the shift in central banks’ attitudes. While these institutions can often be slow to innovate, rightly concentrating on security and regulation, we’re now seeing them recognise the need for a more accessible currency.

One of the driving factors behind this acceleration is the attempt to minimise the use of cash in an effort to reduce the transfer of coronavirus. Players who previously considered digital currency as a convenience now see its importance in keeping people healthy and the economy moving.

The US and UK have both taken unprecedented steps in using fintechs to distribute stimulus funds and more central banks are exploring new avenues for moving money in these unusually challenging times. A recent survey of 66 central banks by the Bank for International Settlements shows that more than 80% are currently working on central bank digital currencies.

Leading the way in Europe is, appropriately, the European Central Bank. At the end of last year, the institution brought together a group of central banks to understand whether they should launch their own digital currencies.

It’s since promised to release a report detailing what this currency would look like. In response, the Association for Financial Markets in Europe published a whitepaper sharing recommendations for how the industry should work together to regulate crypto-assets.

It called out specific players, highlighting that ‘there is currently an opportunity for the industry, NCAs and EU bodies (e.g. European Banking Authority (EBA), European Securities Markets Authority (ESMA), ECB, EC) to collaborate in fostering convergence’. Collaboration for the benefit of the continent is the call to action with the aim of providing a global hub for digital currency.

Meanwhile, the People’s Bank of China heads up the charge, already trialling its central bank digital currency wallet. Building on this, Chinese political advisers have proposed a regional digital currency that would be backed by four major Asian currencies.

The Hong Kong Monetary Authority has encouraged this development as it will pave the way for China’s central bank digital currency rollout identifying potential risks. In turn, this enables the regulatory body to create a much more accurate framework to monitor the stablecoin’s cross-border transactions, manage risks and discourage money laundering.

Regulation as a gateway for innovation

With the world suddenly forced to turn its attention to keeping economies running with limited movement, blockchain’s potential cannot be ignored. It could be the solution to the problem that so many countries are currently facing. And in order to ensure funds can move safely and securely, regulatory bodies have to be involved.

Regulators were already starting to recognise the vital role they have in supporting the progression of new technologies. 2019 saw the founding of the Libra Association, which proposes a new blockchain digital currency that will be more accessible to all members of the public, particularly those typically excluded from financial ecosystems.

To support its alignment with governments and regulators worldwide, Libra recently appointed a CEO and a general counsel with significant expertise in the legal and regulatory aspects of financial services. The whole industry faces the challenge of blending new and innovative technologies with essential regulation and security.

We need to keep both moving together to ensure progress isn’t lost. The next stage of growth for digital currencies will involve acceptance by the general public, which makes it imperative that a set of rules are created by regulators and adopted by developers to inspire trust and confidence.

Entrepreneurs, fintechs and innovators can all keep exploring the capabilities of technology, but without a clear and safe path forward within financial services, progress hits a roadblock. A global currency, backed by blockchain, has the potential to enable a more accessible payment tool.

A current working example of this is Luno: a PayU portfolio company and Malaysia’s first fully regulated crypto exchange that is helping residents of emerging markets to invest and trade in cryptocurrencies. Many users are already making fair returns on their investments. Financial inclusion could be unlocked at a scale previously unimaginable. Just look at what mobile money has achieved in Sub-Saharan Africa, and imagine that the world over.

In order for blockchain to begin to deliver on its revolutionary potential, regulators as a collective need to dedicate greater resources and time to investigating how it can be used effectively, safely and securely. This will have a tremendous impact on broadening access to essential financial services for billions of people, and on lowering costs for those who need it the most.

Note: The introduction to this report initially said “Libra’s rebrand..”, which was incorrect. It was amended on August 7.

Fady Abdel-Nour is Global Head of M&A and Investments at PayU