By Neil Thomas and Michael Hirson

On 8 October, People’s Daily, the official mouthpiece of the Communist Party’s Central Committee, published an article titled “How to understand the significance of promoting common prosperity.” The author was Xie Fuzhan, a veteran policy economist who serves as President and Party Secretary of the Chinese Academy of Social Sciences and who has been a Central Committee member since 2012.

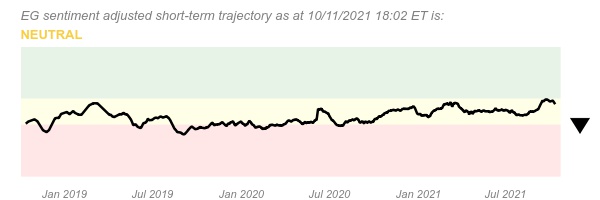

The article deserves attention because it is the first statement that expands on the common prosperity agenda, which Xi elevated to the national spotlight this summer, since crises began to roil the Chinese property, power, and finance sectors a few weeks ago. It may form part of an official response to heightened market concern about China’s economic direction and indicates that internal policy debates could be moving common prosperity in a more incremental direction—at least for now.

Put broadly, Xie’s article reinforces Eurasia Group’s call that Xi’s common prosperity agenda, the basic aim of which is to reduce income inequality, is a foundational policy program that will be pursued gradually, for the most part, over coming years (please see Eurasia Group’s special report, Xi’s drive for “common prosperity” embeds a more muscular regulatory agenda, 24 September 2021). Its most novel contribution is to suggest a role for common prosperity in Beijing’s ideological contest with the West.

Xie’s article on common prosperity also seems to be the first of many by senior officials and academics ahead of the Sixth Plenum in November and the 20th Party Congress next fall, each of which could provide further details and more signals regarding Beijing’s policy planning. On 12 October, People’s Daily began an editorial commentary series on common prosperity and Zhang Zhanbin, Dean of the Marxism Institute at the Central Party School, published an article in People’s Daily on common prosperity. Gu Hailiang, a Marxism professor at Peking University, penned a similar piece the day before.

Common prosperity may become important to China’s foreign policy as well as its domestic policy

Xie reaffirmed that common prosperity is a central pillar of Xi’s domestic political platform. His article declared that “taking common prosperity as an important feature and goal of Chinese-style modernization” has “opened up a new horizon in the Sinicization of Marxism,” a key concept in Party ideology. This framing lends further official support to suggestions that common prosperity will be a key theme of both the Sixth Plenum and the 20th Party Congress. Indeed, the need to achieve common prosperity may serve as an ideological justification for Xi securing a norm-defying third term as Party leader at next year’s congress; Xie says it “will further strengthen people’s confidence in socialism.”

The biggest revelation in Xie’s article is that common prosperity could play a significant role in Chinese foreign policy. Xie said the movement of 1.4 billion Chinese people toward common prosperity “will completely rewrite the map of high-income countries in human society,” “provide a completely new choice for other developing countries to promote common prosperity and achieve modernization,” and “provide Chinese inspiration for human society to achieve freedom and all-round human development.”

This language suggests that common prosperity could occupy a key position in Beijing’s public diplomacy and in its competition with the West for ideological influence in global governance and international affairs. Xie even criticized “some developed countries”—of which the United States is almost certainly one—whose “social systems” mean “not only have they yet to resolve the issue of common prosperity, but the problem of the gap between the rich and the poor has instead become more and more serious.” Zhang Zhanbin’s article said that common prosperity “has become an important indicator that differentiates the new path of Chinese modernization path from the path of Western modernization.”

A focus on closing the gap between the rich and the poor would align with Xi’s efforts to rally the developing world to oppose US efforts to decouple from China, to support Chinese positions in multilateral institutions, and to learn from “Chinese solutions” on their paths to development. The upshot is that US-China strategic competition in the developing world is likely to intensify and multinationals will face increased political risk in emerging markets that opt for Chinese approaches. (Please see Eurasia Group’s note, “Xi’s push to promote ‘Chinese solutions’ abroad will deepen US-China competition in developing countries,” 12 July 2021).

More incremental and less redistributive than the hype

Xie’s article also offers signal about Xi’s domestic agenda for common prosperity, which confirm Eurasia Group’s call that it will be as significant but more incremental than many expected.

Common prosperity will not see Beijing eschew growth for redistribution. Xie insisted that “development is still the basis and key to solving all of China’s problems” and that “without high-quality development, there is no way to speak of achieving common prosperity.” What Beijing wants is “high-quality” growth that keeps expanding China’s economy but without exacerbating systemic risks like extreme inequality and social polarization. The goal is to improve income equality while all incomes continue to rise.

The People’s Daily article on 12 October was even more explicit. It declared, “Common prosperity is not equal prosperity; we cannot require different regions and different people to achieve the same income and living standard nationwide.” And, referencing a well-known political debate between growth and equity in China, it said “The word ‘prosperity’ reflects efficiency and requires enlarging the cake, while the word ‘common’ reflects fairness and requires dividing the cake well.” Xi’s plan is to “divide the cake well in the process of continually enlarging the cake,” which is the meaning of the emerging phrase of “promoting common prosperity in high-quality development.”

Common prosperity will not produce a rapid expansion of tax-and-transfer policies, which play a much smaller role in China than in the West. Xie said Beijing “must deeply absorb the profound lesson of some countries that engaged in excessive welfarization that went beyond their level of development,” and “always adhere to the conditions of economic development and adequate financial resources.” Beijing is unlikely to contemplate consumer stimulus and any moves toward taxes on property, inheritance, or capital gains will likely be gradual. The focus is on enhancing equality through structural reforms that remove distortions and improve incentives. This is positive from the standpoint of avoiding precipitous changes in policy that could affect the investment environment. But Beijing’s reluctance to scale up transfer policies means economic rebalancing towards consumption will continue to be gradual.

Common prosperity will be pursued incrementally and with less policy shocks in future. Xie wrote that “common prosperity is a long-term goal, requires a process, and cannot be achieved in one step,” and so Beijing would “accumulate small victories to produce a decisive victory” in this “protracted war.” He warned against “overdoing it” and repeatedly highlighted the “gradual” or “progressive” achievement of common prosperity. The People’s Daily commentary on 12 October also described common prosperity as a “long-term mission” that would “strengthen the foundations of the Party’s long-term rule.” This language suggests Beijing may have heeded the market shocks it created this summer and supports our call that the private tutoring crackdown will remain an outlier in its severity.

*The views expressed on Industry Announcements are not necessarily the views of

Asia Financial.

*To contribute press releases, research or commentaries, please send an email to

[email protected]