The investment rush into the Chinese government bond market during the current market sell-off has encouraged fixed income experts, but global investors are yet to consider them as risk-free investments.

The fast-spreading coronavirus has soured risk appetite across the world and Chinese markets have been particularly hard hit because of the supply chain disruptions and travel bans post-Lunar New Year holidays.

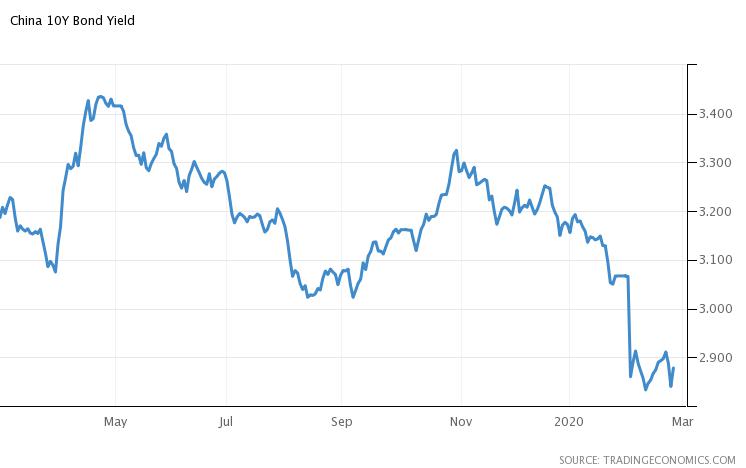

And the one asset class that has attracted flows is the government bonds – the 10-year yield has tumbled by about 40 basis points to 2.88% since the start of the year.

“The reaction of CGBs to the crisis (falling yields) shows that Chinese government bonds have attractive risk-off hedging properties,” said Kenneth Orchard, Portfolio Manager and member of the global fixed income investment team at T. Rowe Price.

“We find Chinese local currency bond markets to be moderately attractive from a relative value global fixed income perspective. T. Rowe Price has been investing in that market for many years,” he said.

China has been slowly opening its doors to foreigners whose ownership in bond markets has leapt in the past two years as the different exposure avenues have emerged – the Qualified Foreign Institutional Investor (QFII) and RMB QFII (RQFII) schemes, direct investment in China’s interbank bond market (CIBM Direct) and Bond Connect.

“Indeed bond yields have fallen precipitously in the wake of the viral outbreak. I think it reflects both the severity of the economic shock and expectations of monetary policy easing. Foreign inflows have continued, although it is a less important factor in driving the yield movement this year,” said Aidan Yao from AXA Investment Managers.

“Sure, I think this plays true in most markets that govies (government bonds) are the safest form of assets, which should perform in times of uncertainties. But whether the CGB has acquired a safe-haven status in the global context, I’m skeptical just because of the still-small size of foreign ownership of these bonds.”

Last year, China’s onshore bond market overtook Japan to become the second-largest in the world in terms of bonds outstanding, behind the United States. Yet at 2.2%, foreigners’ holdings are still tiny when compared with developed markets such as Japan (12.1%) and the US (28%) as well as such emerging markets as Indonesia (39%) and Malaysia (24%).

“The trend in China is in line with global development in the bond market that investors are moving capital towards safer assets, such as treasuries and gold. This is illustrated by the uptick in VIX and the constant spread between 10-year China and US treasuries hovering around 1.4%, ie, the change in yield has not been particularly large or small in China versus the US,” said Gary Ng, Economist, Sectorial Research Asia at Natixis.

“One of the short term drivers is the market expectation on laxer monetary policies by the PBoC.”

State media reported last week, the People’s Bank of China (PBOC), the Chinese central bank, will guide market interest rates lower.

“China’s monetary policy space is still very sufficient, and the toolbox is also sufficient. We are confident and able to offset the impact of the epidemic,” Liu Guoqiang, the bank official, told the government-owned newspaper Financial News last week.

That indeed would make the asset class more attractive to foreigners.

“In the medium run, it is really a question of general holding of Chinese onshore assets versus a specific asset class itself. Given the low allocation, it is likely that foreign investors will increase their exposure on CGB in the medium run but the pace will still depend on how the economic prospect is perceived,” said Natixis’ Ng.

And as the gap between the Chinese and US bond yields remain significant – the 10-year benchmark yield is more than double US Treasuries – inflows will persist. But haven status is distant.

“Over the coming years, expectations remain intact for steady inflows into CGBs as they become increasingly included into global bond indices,” said Leonard Kwan, vice-president and portfolio manager of T. Rowe Price.

“I would not yet expect CGBs to be one of the first things international investors would reach for (as a hedge).”