China‘s parliament begins its annual meeting on Saturday, when it is expected to unveil more stimulus to ease a growth slowdown that could fuel job losses in a politically sensitive year, with war in Ukraine adding fresh uncertainty.

Policymakers are likely to go slow on painful economic reforms to ensure nothing goes wrong before a twice-a-decade meeting of the ruling Communist Party in autumn, when President Xi Jinping is almost certain to secure a precedent-breaking third term as leader, policy insiders and analysts said.

“Stability overrides everything before the 20th Party Congress. We need to create an environment for stable development,” Xu Hongcai, deputy director of the economic policy commission at the China Association of Policy Science, said.

That has become more difficult as war in Ukraine has rattled markets and fuelled western criticism of China, which has not condemned Russia’s attack on the country or called it an invasion.

The Covid-19 pandemic and Beijing’s response to it remain another key uncertainty. Strict measures that have all but kept borders shut for nearly two years show no sign of easing and put China increasingly at odds with the rest of the world.

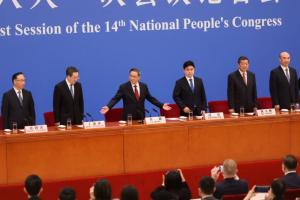

The National People’s Congress will kick off in the massive Great Hall of the People on the west side of Tiananmen Square, with Premier Li Keqiang delivering the 2022 work report, which is likely to unleash more fiscal spending and tax cuts to spur investment and consumption, policy insiders and analysts said.

China‘s strong recovery from its pandemic-induced slump lost momentum in the middle of last year, weighed by debt problems in the property market and anti-virus measures that hit consumer confidence and spending.

“This year’s parliament session will focus on how to cope with economic pressures, stabilise growth and employment,” said a government adviser who spoke on condition of anonymity.

Any sharper slowdown could stoke job losses as the number of college graduates is expected to surpass 10 million for the first time this year. The property, tech and education sectors, all big employers, were hit hard in last year’s wide-ranging regulatory crackdowns.

This year’s parliament session, already shortened by Covid-19, is expected to be a low-key event, said Yang Chaohui, a politics lecturer at Peking University.

“I anticipate delegates will be extra prudent this year and avoid airing alternate views on hot-topic issues such as the zero-Covid policy, ‘common prosperity‘ or China‘s position on Ukraine,” he said.

Lower Growth Target

China will likely target growth of 5% to 5.5% or “above” 5% in 2022, say policy insiders and analysts, who expect the annual budget deficit ratio and a special local government bond quota to be largely in line with those of 2021.

The central bank has started cutting interest rates and pumping more cash into the economy, while local governments have sped up infrastructure spending in a bid to cushion a slowdown that looks set to worsen in the first half.

Finance Minister Liu Kun has pledged to unveil tax and fee cuts this year that exceed last year’s 1.1 trillion yuan ($174.3 billion).

In 2021, China set a budget deficit of 3.2% of GDP and a quota of 3.65 trillion yuan on special bonds.

The economy expanded 8.1% last year, the fastest in a decade due partly to the low base from 2020 when Covid-19 jolted the economy, comfortably beating an official target of “above 6%”.

Reforms that could hurt growth are likely to take a backseat, including a long-awaited property tax. Under Xi’s push to achieve common prosperity, Beijing hopes such a tax could cool housing speculation and reduce the yawning rich-poor gap.

But China is likely to refrain from unveiling a property tax trial until the second half of 2022, when the housing market is expected to stabilise, analysts said. Regulators have marginally loosened property financing curbs to ward off debt defaults.

“When the economy faces relatively big pressures, it is not a good time for pushing forward drastic reform measures,” said Wang Jun, chief economist at Zhongyuan Bank.

• Reuters with additional editing by Jim Pollard

ALSO on AF:

China Frenzy Over Infrastructure REITs as Stocks Struggle

China’s Real Estate Debt Crisis Spills Over Into Steel Sector

From E-Commerce to Education, China’s Season of Regulatory Crackdown

China’s Private Tutoring Overhaul Stuns Online Education Industry