In China Evergrande Group’s heyday, the launch for sale of its new apartments often triggered frenzies as throngs of people battled to snap up the best units.

These days it’s creating frenzies of a different kind as provincial governments battle for control of the troubled developer’s remaining assets. Since news broke December 3 of Guangdong province’s de facto takeover of the ailing property giant, headquartered in its capital Guangzhou, Jiangsu and Zhejiang on the east coast and Hainan island in the south are among provinces rushing to seize the company’s local assets before Guangdong beats them to it.

The scrum underscores how much is at stake for local governments as China Evergrande teeters on the brink of bankruptcy with more than $300 billion of debt after Fitch Ratings declared it in default on December 9 for failing to make bond coupon payments of $82.5 million. Provincial officials fear that fury among the thousands of people who have sunk their life savings into buying unfinished Evergrande apartments may trigger social unrest.

“If cadres in Jiangsu and Zhejiang fail to get hold of funds or accounts before Guangdong, they may be left to pay for any shortfalls from their own coffers,” said Liu Xiaobo, a financial commentator and blogger in Shenzhen. “They may need to plough their own funds into projects, compensate homebuyers and help banks.”

Jiangsu Needs 40bn Yuan to resuscitate China Evergrande Projects

Liu says his back-of-the-envelope calculation, based on project costs and sales figures in Evergrande’s financial reports, indicate that in Jiangsu alone it would take as much as 40 billion yuan ($6.3 billion) to resuscitate dormant property projects. The threat to small banks in Jiangsu, Zhejiang and elsewhere is so great that they may need protection from local authorities as their bad loans go through the roof, he said.

China Evergrande’s interim report noted that China Zheshang Bank in Zhejiang, Huishang Bank in Anhui, Bank of Luoyang in Henan were among its principal settlement and transaction banks.

READ MORE: China Evergrande Debt Crisis: The Next Flash Points

Local provinces were already maneuvring to manage the unwinding of Evergrande’s operations. Things took a dramatic turn after the Guangdong government announced it would send cadres on attachment to Evergrande’s headquarters in Guangzhou and Shenzhen. The move came just hours after China Evergrande Chairman Hui Ka Yan admitted in a filing to the Hong Kong stock exchange that there’s “no guarantee” his tottering property empire would have sufficient funds to continue to meet financial obligations.

Guangdong’s de facto takeover saw officials seconded to China Evergrande to examine its books, review its capital structure and liquidity conditions. The aim was to reduce leverage, resume construction of projects and protect homebuyers and investors in Guangdong, the Beijing-based Caixin media said, quoting an anonymous cadre working at the company’s Guangzhou head office.

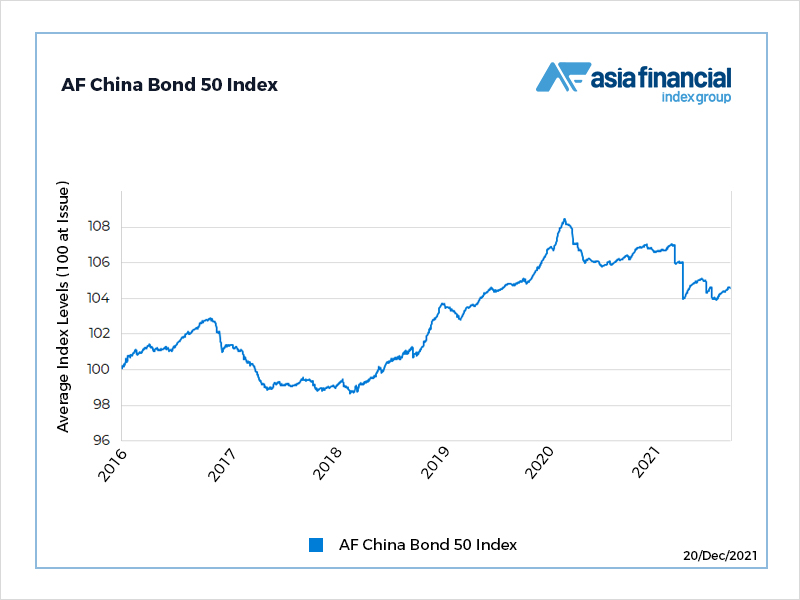

China’s effective takeover of the troubled developer has helped calm investor nerves over the risk that its potential implosion ripples across China and the world. That’s reflected in the AF China Bond 50 index, below, which has trended up recently after a bumpy period.

Guangdong’s move triggered alarm bells in other provinces, and not without reason. In June, after Evergrande launched aggressive promotional blitzes to dump homes in Jiangsu and elsewhere at steep discounts to raise cash, some of the proceeds meant to pay contractors were transferred to Guangdong, according to a Jiangsu source close to the matter.

The Jiangsu task force, led by a deputy governor, has moved to prevent more funds from being transferred to Guangzhou’s head office – or being misappropriated or siphoned off – from branches in Nanjing, Suzhou and Wuxi, said the source. Any funds are instead deposited into special government escrow accounts there and the task force confiscated the company’s official chop in those three branches, the source added.

China Evergrande Projects Lie Abandoned in Jiangsu

About a third of China Evergrande’s 50-plus projects in multiple prefecture-level cities in Jiangsu continue to lie abandoned even as construction is slowly resuming on projects in Guangzhou, Shenzhen and other Guangdong cities. While Guangdong may backstop Evergrande’s faltering projects in its home province, the fate of numerous projects elsewhere remains unclear, says Terence Chong, an associate professor of economics at the Chinese University of Hong Kong.

Another city that’s not waiting around is Haikou, capital of the tropical resort island of Hainan in the south. On Tuesday, it invoked its land resumption ordinance to take back a total of eight waterfront plots that China Evergrande shelled out 8.6 billion yuan for in 2015. There was no compensation and local media reports say Haikou will resell the land by open tender to use the proceeds to compensate buyers of Evergrande’s idle projects in the city.

“The race is getting tense as Evergrande is very likely being prodded by Guangdong officials to concentrate on its home base and winnow down the number of projects elsewhere,” said Liu. “Guangdong government’s takeover of Evergrande means the 79 projects in Guangzhou, Shenzhen and other cities there may get the priority [in fund reallocation] to resume construction. Stakeholders outside Guangdong with similar exposure are worried and Guangdong has the upper hand as the developer’s home province.”

- By Frank Chen

ALSO ON AF: Second Ratings Agency Declares Evergrande In Default

China Audits Evergrande and its Wealthy Chairman’s Assets

China Evergrande and Kaisa Declared in Default by Fitch

What’s Next For China Evergrande As Bond Default Looms?