Shares of China Evergrande New Energy Vehicle Group more than doubled on Monday when trading restarted following a liquidators’ stake sale deal.

Shares of embattled developer China Evergrande’s EV unit soared as much as 113% to HK$0.81, their highest since September 22, becoming the top gainer on the Hong Kong bourse, and last stood up 79%, following the May 17 trade halt.

The non-binding deal by liquidators acting for China Evergrande Group, Evergrande Health Industry and Acelin Global provides for a third-party buyer to take a stake of 29% in the unit, with an option for 29.5% more, the EV unit said on Sunday.

Also on AF: China’s Third Chip Fund Gets $47 Billion to Boost Output

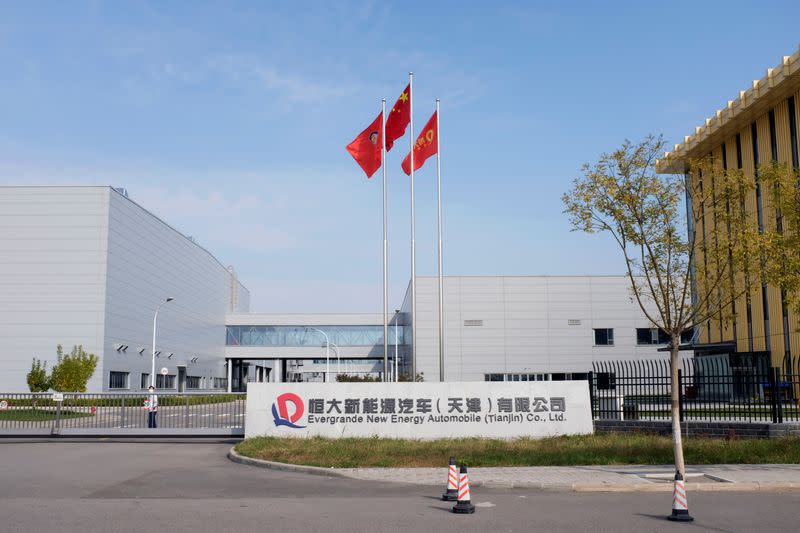

The three collectively hold 58.5% of the cash-strapped EV unit, whose factory in the northern city of Tianjin stopped production at the start of 2024.

The EV unit said the term sheet also mentioned that the potential purchaser would provide a line of credit to fund its operation and business development.

Last week, China Evergrande New Energy Vehicle said its unit had received a letter from local administrative bodies demanding repayment of 1.9 billion yuan ($262 million) in subsidies and incentives.

Earlier this year, China Evergrande, the world’s most indebted property developer, was ordered to be liquidated after it was unable to offer a concrete restructuring plan, more than two years after it defaulted on its offshore debt.

- Reuters with additional editing by Sean O’Meara

Read more:

China Evergrande EV Unit Told to Return $262m in Subsidies

Evergrande EV Unit Shareholders Agree $3.6bn Restructure

China Evergrande EV Unit Posts $10 Billion Two-Year Loss

Evergrande EV Arm to Start Taking Car Orders ‘Imminently’