Many eyes will be focused on a Hong Kong court on Monday afternoon, when a local judge will conduct a hearing that could see a liquidator appointed to wind up China Evergrande, the world’s most indebted developer.

The case, which will be heard by Justice Linda Chan, is one of more than 560 filed in Hong Kong last year that involved the potential winding up of a company – “the most since the global financial crisis year of 2009,” according to a report by Nikkei.

The Evergrande hearing is being closely watched by insolvency practitioners to see how many Chinese cities recognize the Hong Kong liquidation proceedings, it said, as “Chinese courts have recognized only one of the five winding-up applications granted in Hong Kong courts” under a 2021 arrangement and other developers now in default could face similar legal predicaments.

ALSO SEE: China EV Firms Can Destroy Rivals Without Trade Barriers: Musk

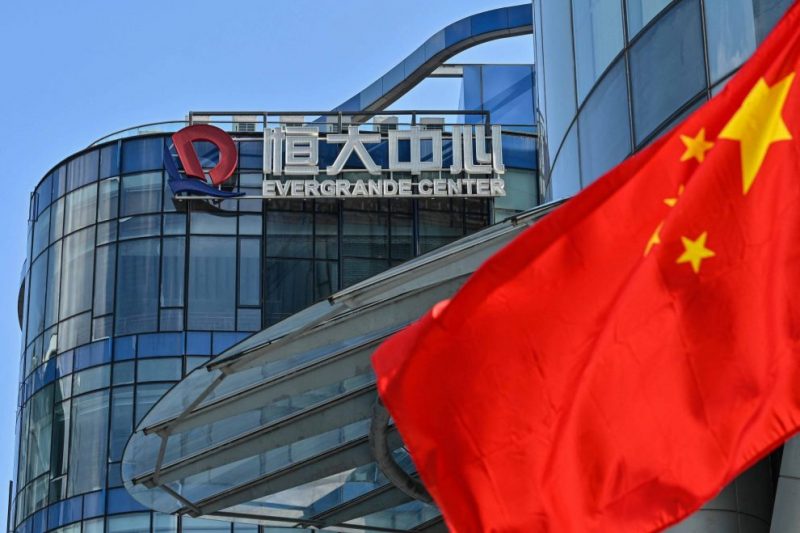

Evergrande, founded in 1996 by Hui Ka Yan (Xu Jiayin), grew into a massive conglomerate said to have developed projects in over 170 cities in mainland China. But in recent years it became a prime example of the country’s enormous real estate bubble, having accumulated liabilities of more than $320 billion, before going into default in December 2021.

Reuters has explained some possible outcomes that could come from Monday’s hearing:

A key offshore bondholder group of Evergrande plans to join a petition to liquidate the developer at the January 29 hearing in Hong Kong on Monday.

The bondholder group owns more than $2 billion in offshore notes guaranteed by Evergrande and its support to a winding-up petition increases the chances of an immediate liquidation order from the court, lawyers have said.

What happens if the court orders Evergrande liquidated?

If a liquidation order is issued, a provisional liquidator and then an official liquidator will be appointed to take control and prepare to sell the developer’s assets to repay its debts.

The liquidators could propose a new debt restructuring plan to offshore creditors holding $23 billion of debt in Evergrande if they determine the company had enough assets or if a white knight investor appeared. They would also investigate the company’s affairs and could refer any suspected misconduct by directors to Hong Kong prosecutors.

Evergrande could appeal a liquidation order, but the liquidation process would proceed pending appeal.

It is unclear if Evergrande shares would be suspended from trading after a liquidation order. Listing rules require a company to demonstrate a business structure with sufficient operations and asset values.

How much debt might creditors recover and what are the main challenges?

Evergrande cited a Deloitte analysis during a Hong Kong court hearing in July that estimated a recovery rate of 3.4% if the developer were liquidated.

However, after Evergrande said in September its flagship unit and its chairman Hui Ka Yan were being investigated by the authorities for unspecified “illegal crimes”, creditors now expect a recovery rate of less than 3%.

Evergrande’s dollar bonds were bid at around one cent on the dollar on Friday.

Most of Evergrande’s assets have been sold or seized by creditors, leaving its two units listed in Hong Kong – Evergrande Property Services Group and Evergrande New Energy Vehicle Group. Their combined market capitalisation had dropped to $973 million as of Friday.

A liquidator could sell Evergrande’s holdings in the two units although it might be difficult to find buyers.

After a liquidation, the liquidator could take control of Evergrande’s subsidiaries across mainland China by replacing their legal representatives one by one, a process that could take months or years.

Insolvency experts said it would be a challenge for the liquidator to change the representatives as Guangzhou, where Evergrande is based, is not one of the three Chinese cities that mutually recognise liquidation orders with Hong Kong.

Even if a liquidator were to take possession of the units that have onshore projects, many of these have already been taken over by creditors, frozen by courts, have little value left or are even in negative equity because of falling property prices.

How significant would liquidation be for China’s property market?

While a winding-up of the developer with $240 billion of assets would send shockwaves through already fragile capital markets, experts said it would not offer a blueprint on how liquidation might unfold for other embattled developers.

Given the sheer size of Evergrande’s projects and debt, the process would involve many authorities and political considerations.

Completing ongoing home construction projects will be a top priority for the company, the sector and the government.

- Jim Pollard with Reuters

ALSO SEE:

China Evergrande Stock Jumps as Liquidation Hearing Put Off

Evergrande Unit Launches $280m Legal Case Against Parent

Evergrande Chief’s Two Luxury Mansions ‘Seized by Creditor’

Evergrande ‘Offering Offshore Creditors 30% Stake in Two Units’

Beijing Seen Taking Over China Evergrande’s Debt Revamp

China Evergrande Chairman ‘Suspected of Crimes’, Company Says

Hui Ka Yan and The Rise and Fall of China Evergrande

China Evergrande Files Claim in US Court to Protect Its Assets