A potential green-light for Tesla to roll-out its “Full Self-Driving” system in China may have Beijing’s own interests at heart — specifically to trigger a battle to pioneer ‘smart’ car technology among its carmakers.

China’s tentative approval for Tesla’s FSD came during a whirlwind trip to Beijing by the carmaker’s chief Elon Musk over the weekend.

Tesla announced a tie-up with Baidu, China’s biggest search engine operator, to use its mapping licence to collect data, and the state auto industry group declared that the carmaker’s best-selling models comply with the Chinese data-privacy regulations.

Also on AF: Foreign Carmakers Seek Chinese EV Partners on AI, Smart Tech

If Tesla ultimately succeeds in bringing FSD to China, it could prove a fierce competitor in China’s autonomous-vehicle segment, industry analysts and executives say.

Tesla’s strength would be its early lead in developing driver-assistance systems with some autonomous features, they say.

But it would also “pressure the other EV startups [in China] to accelerate their research and development”, said Yale Zhang, managing director at Shanghai-based consultancy Automotive Foresight.

China saw the same dynamic in electric-vehicle development when its government approved Tesla to open a Shanghai plant in 2018. At the time, officials hoped for what they called a “catfish effect” – that dropping a big catfish, Tesla, in the tank would make the other fish, China EV makers, swim faster.

China’s car industry responded. BYD, the nation’s EV leader, has since introduced a slew of models at all price levels – starting below $10,000 – as its China EV sales exploded from just over 105,000 in 2018 to more than 1.5 million last year.

Zhang said Tesla’s autonomous-vehicle development in China could have the same impact: “It would be the ‘catfish effect’ for the second half of the game.”

Xpeng Motors CEO He Xiaopeng said in a statement on LinkedIn that a move by Tesla to launch FSD in China could intensify what he predicted would be a decade-long battle for dominance of “smart EVs”.

And China won’t be the only battlefield. It’s critical for China’s self-driving technology industry, He said, to start “making its mark on international markets outside its own turf.”

Many rivals with cheaper cars

The ability to roll-out FSD in China would be a huge win for Tesla’s long-term efforts to produce fully autonomous vehicles.

It would provide the American EV giant swathes of data, from the world’s biggest automobile market, to train its self-driving systems.

But to succeed, it would need to hold-up against potent rivals that have rolled out systems designed to navigate China’s densely packed urban landscapes.

View this post on Instagram

One such competitor is BYD — the carmaker which briefly stole Tesla’s crown as the world’s biggest EV-seller last year.

Others include Huawei — the US-sanctioned smartphone-maker emerging as a national tech champion — and Xiaomi, another smartphone-maker whose recently launched first EV became an instant hit.

Those three carmakers are among at least 10 automakers and suppliers that have unveiled driver-assistance systems over the past two years that can navigate city streets and make turns at intersections.

Driver-assistance features now offered in China are “level two” systems, meaning they require a driver ready to take over. Tesla’s FSD and its less-advanced options of Autopilot, are also level-two systems requiring attentive drivers.

Any new model priced at more than $30,000 in China now needs advanced driver-assistance features to compete, said Maxwell Zhou, co-founder of DeepRoute.ai, a China-based startup selling software for advanced driver-assistance systems.

“You must have a high-level driving solution to prove you have a smart car, not a stupid car,” Zhou said.

Meanwhile, EV-maker Xpeng plans to launch a new mass-market brand, Mona, with self-driving features on a car priced below $21,000. That’s more than $10,000 cheaper than the China price of Tesla’s Model 3.

Better tech than Tesla

At the Beijing auto show that opened last week, Chinese automakers and suppliers touted “level-two-plus” driver-assistance systems with more advanced sensors and displays. While they are not cleared by regulators for hands-off-the-wheel driving, some are designed to be with future software upgrades.

While Tesla relies only on cameras to detect hazards around self-driving cars, other automakers are rolling out systems that include lidar, which uses pulses of light to detect objects.

Huawei showed off components from telematics receivers that work with both the US-backed GPS system and China’s rival BeiDou satellite system, along with lidar and optical sensors, for advanced driving systems.

The Chinese tech giant aims to compete with other major suppliers of such systems including Bosch and Continental. Bosch welcomes the competition, said Markus Heyn, the Bosch board member who runs the German auto supplier’s mobility unit.

“It’s good for the market,” he said. “We love doing innovative and disruptive stuff.”

Still, Tesla could be among the toughest competitors, in part because of its ability to collect data from its vehicles – the world’s largest fleet of EVs currently on roads. However, under Beijing’s data security rules, it cannot transfer data from its cars in China offshore without approvals.

Musk has pushed for that data to be able to be made available for training its self-driving technology outside China, people familiar with Musk’s discussions with Chinese officials have said.

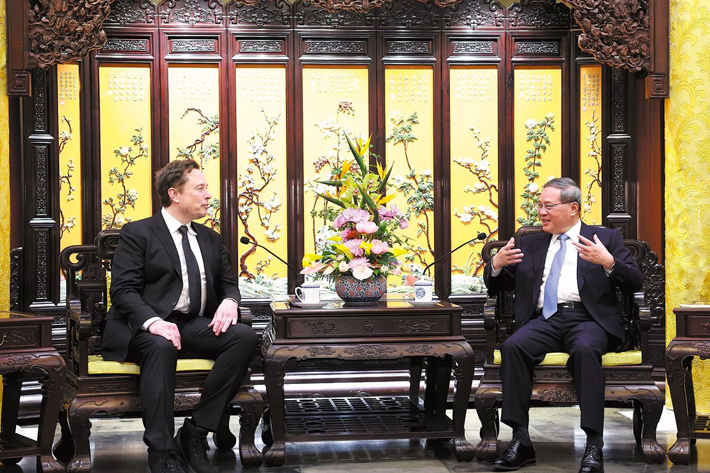

It’s not clear what progress, if any, Musk made on data transfers with Chinese officials he visited in Beijing, including Premier Li Qiang.

- Reuters, with additional editing by Vishakha Saxena

Also read:

Huawei’s Smart Car Tech Gives Foreign Brands A Way Into China

China Backs Firm Tie-Ups in Smart Vehicle Domination Drive

In Battle for China EV Market, Xiaomi’s ‘Thor’ Takes on Elon Musk

Raimondo Says Chinese EVs Are a National Security Risk For US, EU

EU Says China EVs Funded by Subsidies, Plans Retroactive Tariffs

Chinese Outbound EV Investment ‘Hit Record High in 2023’

US Auto Sector ‘Faces Extinction’ From Chinese Mexico Imports

China in Race With West to Build Best Solid-State Battery – Nikkei