Analysts say China faces pressure to act on decade-old economic policy promises that it repeated at its leadership meeting last week.

With imbalances in China’s economy deepening, threats of lingering deflation, plus weak demand at home and increased hostility towards its export dominance abroad, national leaders chose policy continuity rather than any structural shifts at the twice a decade political event known as a plenum.

Investors were not impressed. Chinese stocks fell on Monday, even as the central bank surprised markets with rate cuts.

ALSO SEE: Chinese Officials Admit its Economic Goals ‘Full of Contradictions’

The plenum “has clearly not been a game changer in terms of the reforms announced, especially given the challenges ahead both externally and domestically,” Alicia Garcia Herrero, chief Asia Pacific economist at Natixis, said.

“It seems as if the Chinese authorities prefer to muddle through, while doubling down on their convictions. The problem is that there is now much more mud to deal with.”

While economists would welcome progress on pledges such as improving the business environment for the public sector, giving markets a decisive role in allocating resources or increasing tax revenues, they are not convinced such moves will occur.

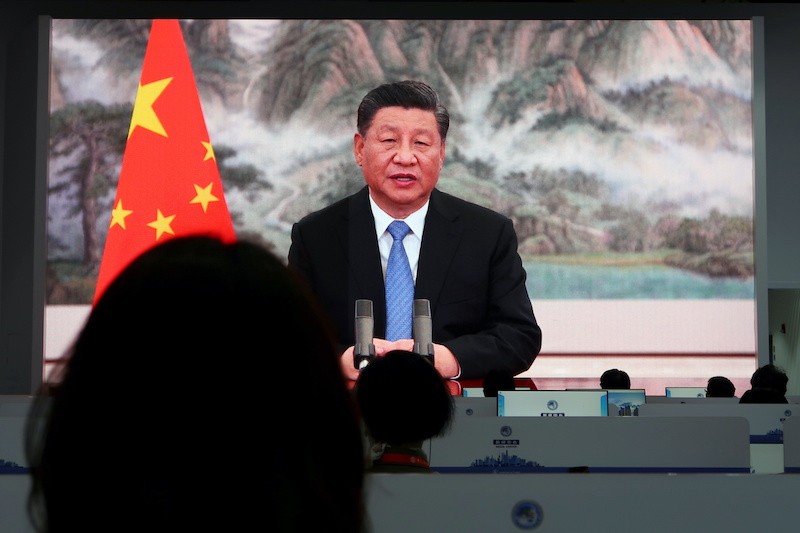

The 2024 plenum agenda included limited deviations from the one published in 2013, which at the time fuelled a great degree of confidence in China’s future expansion and positioned President Xi Jinping as a reformer in the eyes of global investors.

But many economists argue that China has since made steps in the opposite direction on market liberalisation and the private sector, having tightened capital controls after a stock market rout in 2015 and with regulatory crackdowns on tech, finance and other industries in recent years.

Huge inequalities, credibility deficit

China’s pledges to boost domestic demand, reform a Mao-era internal ‘hukou’ passport system blamed for huge rural-urban inequalities, strengthen rural land rights or improve social security also date back to at least 2013.

In reiterating a policy agenda with a mixed track record, Beijing faces a credibility deficit it did not have a decade ago and will need to act with more urgency if it wants to lift business and consumer sentiment from near-record lows, economists say.

Unusually for a plenum, as they tend to be vague on implementation timelines, Beijing committed to meet its policy goals by 2029. But the concrete deadline failed to inspire investors.

“It’s not simple and easy to change market expectations,” Zong Liang, chief researcher at state-owned Bank of China, said.

“Having gone a little bit too far, now you want to reverse course, but people are not confident.”

Zong said the plenum set out a positive path forward, but worried that a “troublesome external environment,” especially if former President Donald Trump wins the US election, could weaken reformist voices in China.

Bet on high-tech exports spurs pushback

One significant difference from 2013 is the emphasis the latest plenum’s agenda placed on “new productive forces,” a term coined by Xi last year that envisions scientific research and technological upgrades of the country’s sprawling industrial complex.

China is betting on high-tech export products becoming a new driver of growth that compensates for the dwindling returns on infrastructure investment and the growing writedowns it faces after its giant real estate bubble popped in 2021.

That bet is unnerving Washington, Brussels and other capitals that argue Beijing is driving industrial overcapacity in various sectors that cheapen Chinese exports and threaten manufacturing jobs around the world.

It also concerns many economists who have argued the world’s second-largest economy needs to reduce its over-reliance on external markets and debt-fuelled investment and stimulate household consumption instead.

These economists see a more consumer-driven development model as vital for China’s long-term growth potential.

“If access to China’s major export markets is restricted, officials will have to rely on the languishing domestic economy to generate growth — a difficult task given the lingering unease about the health of the domestic economy,” Moody’s Analytics wrote in their post-plenum note.

Frederic Neumann, chief Asia economist at HSBC, said global investors expecting “dramatic change” might get disappointed by the “incremental” updates in the policy agenda, but he retained some optimism.

A key difference is that the 2013 agenda reflected ambitions inherited by Xi from his predecessors. The latest plenum outcome was by contrast championed entirely by the Chinese leader, which increases chances of more forceful implementation, he said.

“We need to give it the benefit of the doubt a little bit,” Neumann said. “But I do think that in a period of six months or so we need to see some reforms,” he added, warning investors’ patience had run thin.

- Reuters with additional editing by Jim Pollard

ALSO SEE:

Chip Stocks Lose Near $600 Billion in Value On China Tech Fears

Creative Ideas Needed to Stem China’s Overcapacity: US Official

China Shifting to ‘Green’ Steel Production as EU Levy Looms

EU Plans Duties On Cheap Goods From Temu, Shein, AliExpress: FT

Beijing Slams US Plan to Review China’s Supply of Legacy Chips

China’s Push to Reform Historic Residency Rules Hits Hurdles

China Sees Calls for Deep Reform, Others Urge More Spending