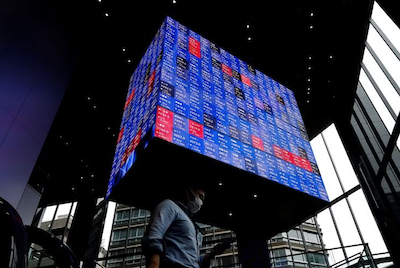

Asia’s major stock indexes slipped into the red on Tuesday with investors focused on China’s poor growth despite a bounceback in global chip stocks.

Bleak demand outlook from China dragged down commodity prices and dampened the mood across the region’s trading floors.

Beijing had surprised markets with a number of interest rate cuts on Monday but it ended up putting a spotlight on China’s economic weaknesses.

Also on AF: Hong Kong Still a Key Link in Illicit Chip Supplies to Russia

China’s stock market saw significant declines on Tuesday, primarily dragged down by liquor and consumer-related shares, as despite the government’s efforts to stimulate domestic consumption with its rate cuts, market pessimism remained.

China’s blue-chip CSI300 index declined by 2.14% despite a 0.59% rise in its financial sector sub-index.

The Shanghai Composite Index fell 1.65%, or 48.85 points, to 2,915.37, while the Shenzhen Composite Index on China’s second exchange slumped 2.58%, or 41.54 points, to 1,566.95.

Consumer staples were down by 2.13%, real estate declined by 0.86%, and healthcare lost 2.06%.

The Hang Seng Index lost 0.94%, or 166.52 points, to 17,469.36, with investors there waiting on more concrete policy pledges from Beijing to turn around the world’s No2 economy.

Japan’s Nikkei share average ended marginally lower, extending its losing run to a fifth consecutive session, as caution over a strengthening yen overshadowed gains in chip stocks.

The Nikkei share average edged down 0.01%, or 4.61 points, to close at 39,594.39, while the broader Topix was ahead 0.21%, or 5.86 points, to 2,833.39.

Bond Markets Flat

Chip sector stocks made up the Nikkei’s top two points gainers, tracking a rally in US peers overnight. Chip-testing equipment maker and Nvidia supplier Advantest advanced 2.87%, followed by a 1.32% rise in chip-making machinery giant Tokyo Electron.

Meanwhile, a stronger yen threatens to weigh on corporate bottom lines among the Nikkei’s exporter-heavy constituents, just as the earnings season begins to gather pace this week. The Japanese currency last traded at 156.20 per dollar on Tuesday, after ending last week at 157.50.

However, elsewhere across the region, in earlier trade, Sydney, Seoul, Singapore, Wellington, Jakarta and Taipei were all in in positive territory but Mumbai dipped. MSCI’s Asia ex-Japan stock index increased by 0.67%.

European futures rose 0.1% and US futures fell 0.2% following a 1.1% rise in the S&P 500 on Monday.

Broader bond and foreign exchange markets were mostly steady as focus turned to the data docket and a busy week of US earnings. The euro held at $1.088 and the yen was firmer at 156.40 per dollar.

Benchmark 10-year Treasury yields inched two basis points lower to 4.24% and two-year yields were steady at 4.51%. Markets have priced in two US rate cuts this year with the first in September, but expectations could be ruffled by growth and consumer price data due later in the week.

Tesla, Alphabet Earnings

Advance US gross domestic product is forecast to show growth picking up to an annualised 1.9% in the second quarter, while the closely watched Atlanta Fed GDPNow indicator points to growth of 2.7% suggesting some risk to the upside.

The core personal consumption expenditures index, the Fed’s preferred inflation measure, is seen rising 0.1% in June, pulling the annual pace down a tick to 2.5%.

A slew of earnings are also due, headed by Tesla and Google-parent Alphabet, which begin the season for the “Magnificent Seven” megacap group of stocks.

The tech sector is projected to increase year-over-year earnings by 17%, while profit for the communication services sector is seen rising about 22%, according to LSEG IBES, but richly valued stocks are also prone to disappointment.

Tesla and Alphabet report after Tuesday’s close in New York. Others reporting include France’s LVMH, which will be closely-watched as sliding demand from China has pummelled the luxury sector.

Gold prices were pinned around $2,400 after peaking above $2,450 last week. Brent crude futures, which hit a one-month low on Monday, were steady at $82.41 a barrel.

Bitcoin, which has rallied on bets a Trump administration would take a light-touch approach to cryptocurrency regulation, pulled back 2% to $64,466.

Key figures

Tokyo – Nikkei 225 < DOWN 0.01% at 39,594.39 (close)

Hong Kong – Hang Seng Index < DOWN 0.94% at 17,469.36 (close)

Shanghai – Composite < DOWN 1.65% at 2,915.37 (close)

London – FTSE 100 < DOWN 0.32% at 8,172.68 (0932 BST)

New York – Dow > UP 0.32% at 40,415.44 (Monday close)

- Reuters with additional editing by Sean O’Meara

Read more:

Chinese Firms Raise a Record $14 Billion in Offshore Bonds

China Quant Funds Await Tough New Rules Set to Rock Sector

Reactions to China’s Central Bank Cuts to Short, Long-Term Rates

Nikkei Slides in Wake of IT Chaos, China Tech Lifts Hang Seng