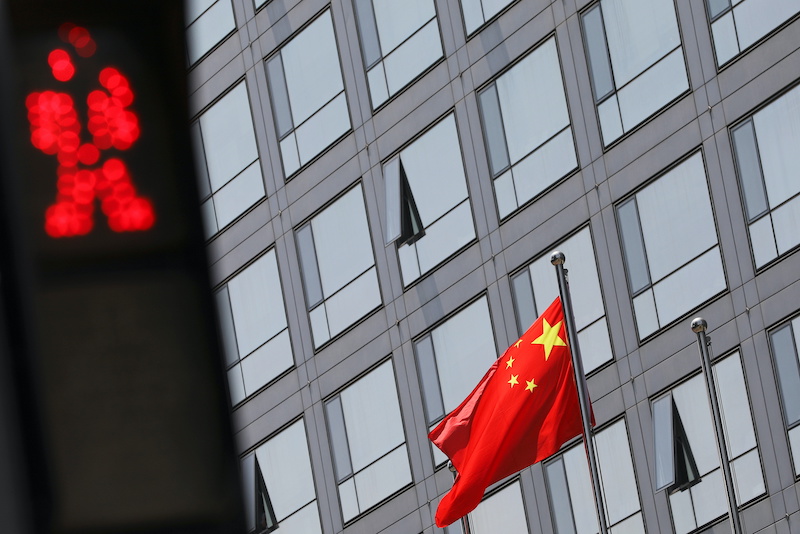

China has proposed revising its confidentiality rules involving offshore listings, removing a legal hurdle to Sino-US cooperation on audit oversight while putting the onus on Chinese companies to protect state secrets.

The draft rule, announced by the China Securities Regulatory Commission (CSRC) on Saturday, is Beijing’s latest attempt to resolve a long-running audit dispute with Washington that could lead to roughly 270 Chinese companies being forced to delist from US exchanges in 2024.

DELISTING UPDATES: China Stocks Delisting From US: Everything You Need to Know

China’s updated rules will scrap requirements that on-site inspection of overseas-listed Chinese companies be conducted mainly by Chinese regulators.

That could open the door to inspections by US regulators, who demand complete access to such firms’ audit working papers, which are stored in China.

China is stepping up its efforts to ensure Chinese firms remain listed in New York. The commission said on Thursday that Chinese and US regulators had held multiple rounds of meetings and both sides had a willingness to solve their audit dispute.

But US securities and audit regulators have pushed back on speculation of an imminent audit deal with China. In March, the US Securities and Exchange Commission (SEC) identified 11 US-traded Chinese companies, including Baidu Inc and Yum China, that face delisting risks.

The draft rules make clear that Chinese companies are responsible for information security in overseas listings, reducing the chance that confidential information unnecessarily enters auditors’ working papers, CSRC said.

Current Confidentiality Rules Outdated, Says CSRC

“Procedural requirements” are added to the rules, demanding Chinese companies provide written explanation when they provide “sensitive information” to intermediaries, such as underwriters and auditors, although such situations should be “very rare,” based on experience, according to the watchdog.

CSRC said the rules will offer clear guidance on how to protect state secrets, leading to “orderly” securities issuance and listing activities by Chinese companies.

The current confidentiality rules, which were published in 2009 by the CSRC, the state secrets bureau and the archives bureau, are outdated, CSRC added.

Sources said last month that Chinese regulators had asked some of the country’s US-listed firms, including Alibaba, Baidu and JD.com, to prepare for more audit disclosures.

In mid-March, Vice Premier Liu He said talks between Chinese and US regulators over offshore listing issues had made progress and both sides were working on specific cooperation plans.

- Reuters with additional editing by Sean O’Meara

Read more:

Baidu, Weibo Among Latest Firms Warned Over US Delisting

In Numbers: Possible Impact of China Stocks Delistings

Chinese Firms Flock to Switzerland as US Delisting Risks Loom