(ATF) The recent jump in real interest rates could hurt China’s economy, smothering its nascent recovery, with consumption and manufacturing investments lagging but the central bank’s liquidity accommodation should provide a buffer.

China’s government bond market yields have shot up since the lows of April to 2020 highs last month on a combination of factors. The 10-year yield rose 70 basis points to 3.16%, but has since eased to 2.96%.

This came at a time when inflation continued to fall as supply outruns demand and producer prices under deflationary pressure, pushing up real interest rates.

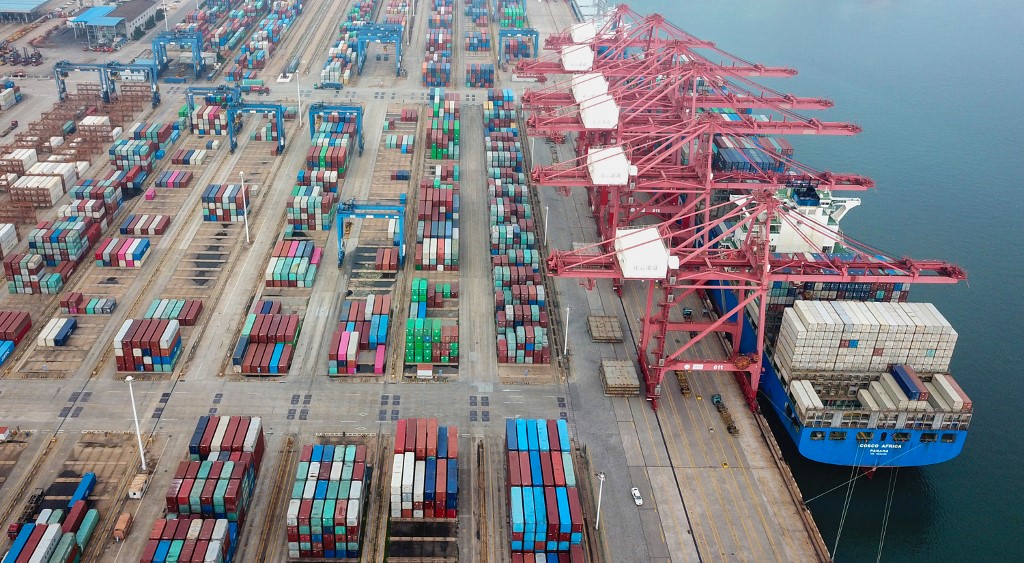

China’s economic data for July indicated an unbalanced recovery, and that extraordinary policy support would be needed. And although the industrial sector has been remarkably resilient, it has been driven by buoyant global demand for technology and medical equipment arising from the global pandemic.

Stimulus spending lifted infrastructure investment and rising household savings propped China’s property market.

At the same time, consumers are lagging behind in this recovery with retail sales still below the levels for the same period last year. Before the coronavirus pandemic, monthly retail sales had been growing at close to 8% year-on-year.

Manufacturing investments remain soft easing by about 1% in July. The fall would have been greater without investment in the electronics and medical-related sectors which were aided by robust global demand and policy support in these areas.

State-owned enterprises boosted investment in all sectors 14% in July compared with 3% for private firms. SOE investments outpaced private firms for some time now, stretching back to 2019, S&P said.

Social distancing blamed

“Social distancing – enforced or voluntary – suppresses demand for business and consumer services, holding back jobs. The purchasing managers’ index (PMI) for services indicate most firms asked are still reporting fewer jobs,” S&P’s chief economist for the Asia-Pacific Shaun Roache said.

“The service sector and private firms are the engines of job growth in normal times. It seems too early for China’s economy to have to deal with rising real interest rates, a more onerous debt-servicing burden, and tightening financial conditions,” he said.

While the rebound in rates could be explained by earlier-than-expected exit of monetary easing, bond supply pressure, and positive surprises in economic data, any further rise will be capped by actively managed liquidity.

“We expect PBoC to maintain the current neutral stance and actively manage liquidity impacts from government bond issuances,” BofA Securities said in a note.

“July economic activity data surprised on the downside and showed the recovery pace was indeed slowing, which in turn suggest less upward pressure on yields from developments of economic fundamentals.”

BofA Securities analysts have forecast a year-end target of 3% for the 10-year bond.

Last month’s China Central Depository & Clearing Co report sparked speculation the central bank may have been secretly buying government bonds in the market. But the PBoC’s balance sheet showed that its claims on government were unchanged in July at 1.53 trillion yuan.

“While some investors might be disappointed by the fact that PBoC wasn’t offering market reliefs by buying CGBs, on the brighter side, it has been taking the traditional route by providing liquidity,” BofA Securities analysts said referring to the central bank’s heavy funds injections.

“While we and our economists don’t expect the recent signs of weaker momentum in economic recovery will drive PBoC towards easing in the near-term, it certainly strengthens the case that they should keep liquidity accommodative for the rest of 2020, a key assumption for our CGB yields forecast.”