China is set to dominate the global supply chain for solar power for much of the next decade as countries race towards their clean energy transitions, a new report has found.

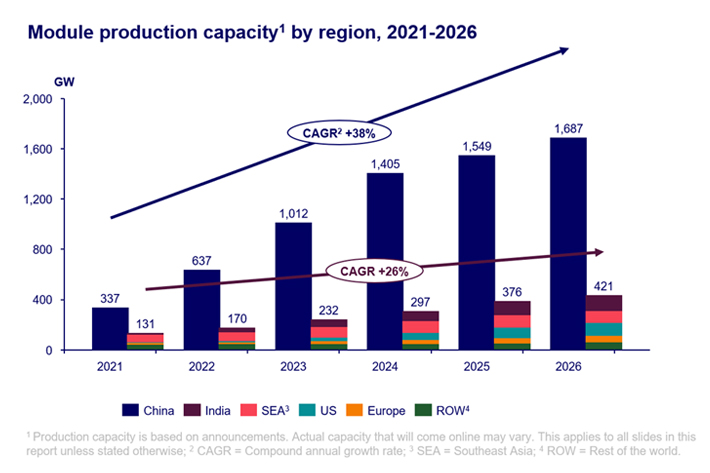

The world’s second-largest economy will account for more than 80% of the global solar manufacturing capacity through to 2026, a report by UK-based energy research firm Wood Mackenzie said.

China will also bring more than a terrawatt of solar wafer, cell and panel capacity online by 2024, enough to meet annual global demand through to 2032, the report added.

Also on AF: China to Scrutinise Rare Earth Outflows as Exports Rise

The report’s findings are in-line with what energy executives have consistently said for the past few years — China has established an overwhelming lead in the production of solar panels.

The country already controls more than 80% of solar panel manufacturing, the International Energy Agency said last year. It projected China will produce almost 95% of the world’s polysilicon and the ingots and wafers further down the solar value chain.

China’s solar energy prowess is down largely to its extensive investment in the sector.

Beijing has invested more than $130 billion into the country’s solar industry just this year, the Wood Mackenzie analysis said.

India to grab second spot

The report also forecast that India would overtake Southeast Asia as the second-largest solar module production region by 2025.

The growth of India’s solar capacity was linked to the Narendra Modi government’s Production Linked Incentive (PLI) scheme that went into effect in 2020.

Efforts by India, and also the United States, to subsidise their own solar production are aimed, in part, at reducing reliance on Chinese-made goods.

The United States and India combined have announced more than 200 gigawatts of module capacity plans since 2022 to achieve their clean energy goals, Wood Mackenzie said.

But “despite strong government initiatives for developing local manufacturing in overseas markets, China will still dominate the global solar supply chain and continue to widen the technology and cost gap with competitors,” Huaiyan Sun, senior consultant at Wood Mackenzie, and author of the firm’s report, said in a statement.

Driving down solar costs

The Wood Mackenzie report also noted that overseas manufacturers are still not yet as cost-competitive compared to China. A module made in China is 50% cheaper than one produced in Europe and 65% cheaper than the US, the report said.

China’s aggressive capacity expansion – both for export and installation at home (which is expected to reach 150 GW this year) – has already forced solar panel prices down dramatically this year.

The earlier IEA report noted that a huge amount of Chinese investment has meant that solar photovoltaic technology, which converts sunlight into electricity, has become the cheapest way to generate power in many parts of the world.

The solar industry has already absorbed a 26% drop in panel prices this year, according to S&P Global Commodity Insights.

Cheap imports from Asia, however, are prompting concern among US producers that are banking on a government-backed domestic manufacturing boom. Apart from China, India, Malaysia, Thailand, Cambodia and Vietnam have also been shipping to the US.

US officials have also repeatedly warned that over-reliance on Chinese clean energy technology could pose a security risk similar to Europe’s historical dependence on Russian natural gas.

- Reuters, with additional inputs from Vishakha Saxena

Also read:

China Warns of Export Curb on Polysilicon, Solar Wafers

China Goods Ban to Spur Big Drop in US Solar Installations

US Crackdown on China ‘Slave Labour’ Blocks Solar Projects

US Ban on Xinjiang Could Hit Global Solar Panel Industry

China’s Trina Solar Eyeing Third Vietnam Plant After US Sanctions

China’s Shift to Renewable Energy Roaring Ahead – Guardian

India’s Power Play to Become a Global Solar Force – Hindu