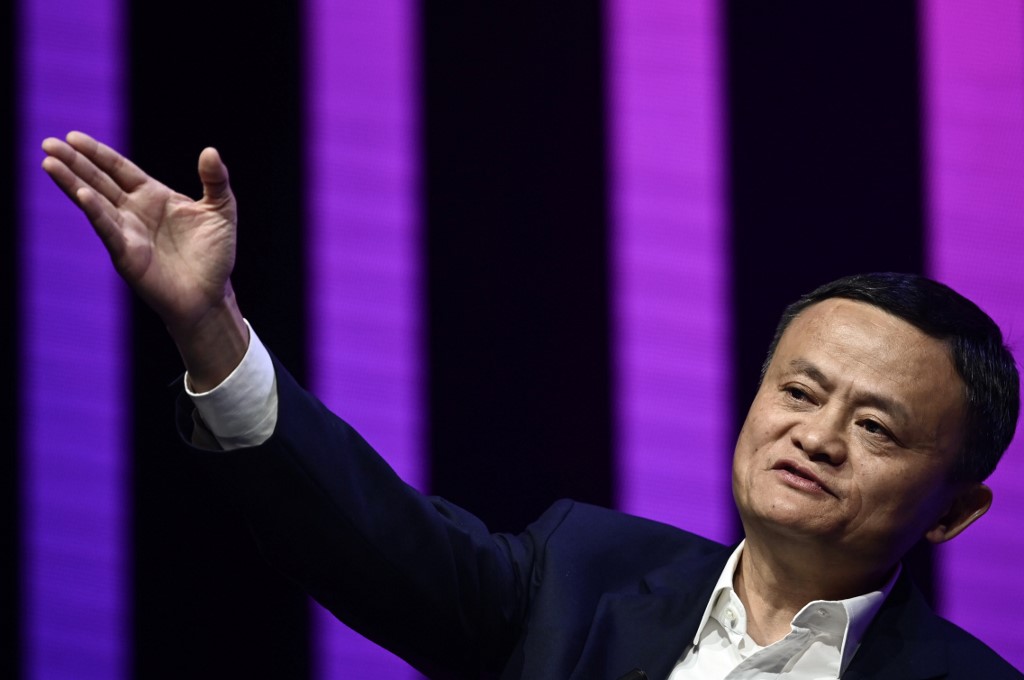

(ATF) It was easy to spot short-term losers from China’s rebuke to Jack Ma for his criticism of the country’s financial regulatory framework.

The decision to suspend the Ant Group IPO that had been poised to raise up to $37 billion caused a fall in Alibaba’s US-listed share price of over 8%, reducing the value of the 33% owner of Ant by more than $70 billion, or roughly twice the amount set to be raised in the IPO.

Jack Ma saw the value of his personal stake in Alibaba fall by around $3 billion.

Bank arrangers of the Ant IPO led by CICC, Citigroup, JPMorgan and Morgan Stanley face the loss of their fees, at least until the deal can be revived.

And major investors in the IPO – backed by around $3 trillion of latent retail demand for shares – will also have to wait to see whether the share sale can get back on track, and if the suspension arrests the expected sharp upward trajectory in value for Ant.

Chinese authorities may believe they have delivered a strong message about the direction of regulation in the country, along with their personal rebuke to Ma.

The IPO suspension was rooted in a significant change in financial regulation in China, as well as a desire to slap down Ma for his temerity in publicly criticising supervisory authorities.

New rules for online micro-lending that were announced by the People’s Bank of China and the China Banking and Insurance Regulatory Commission on Monday will increase capital requirements for Ant and other fintech lenders.

This is part of a broader move by Chinese authorities to restrain rising debt levels and deter speculative purchases of stocks, bonds and real estate in the country.

One long-term effect of these changes should be to bolster the competitive position of established banks within China against upstart fintech firms led by Ant – the biggest originator of online lending by far.

Other consequences

The dramatic way in which Chinese authorities chose to enforce their message may have other consequences that they cannot control, however.

The shock suspension of the Ant IPO could undermine attempts to establish Shanghai as a viable alternative to other regional centres as a listing venue, for example.

It is difficult to believe that Chinese authorities could not have tightened their regulatory stance without derailing what was on course to be the biggest IPO in history.

That was a reminder that the supervisory backdrop to Shanghai listings can be arbitrary, or at the very least opaque.

That in turn could increase the appeal of Hong Kong as an IPO venue, despite the many political problems for the city and its own relations with Beijing.

Singapore can also be expected to promote its virtues to companies considering an Asian listing, and exchanges based in London and New York will renew their case as venues for firms with international reach that are planning to raise capital.

China may also have handed American banks some unintended assistance in their battle to retain dominant market share as advisers and underwriters of big fundraising exercises.

Citigroup, JPMorgan and Morgan Stanley will be disappointed at China’s intervention to suspend the Ant IPO just before shares were scheduled to start trading.

The steady move up the international equity underwriting league tables of CICC and other Chinese banks may be more seriously affected by the IPO suspension, however, while firms such as Goldman Sachs, JPMorgan and Morgan Stanley could be entrenched as the leading deal arrangers.

There could also be some unexpected second order effects of the Ant IPO suspension if it has a sustained effect on the value of Alibaba.

SoftBank’s global investment spree – including purchases of major stakes in Asian technology-based firms such as Didi Chuxing and Paytm – effectively originated in the value of the Alibaba stake held by SoftBank founder Masayoshi Son.

China’s assault on one charismatic company founder – Jack Ma – could therefore have an impact on the investing decisions of another: Masa Son.

But the most significant impact of the Ant IPO suspension will be felt on the development of China’s own capital markets.

It will take some time before it is clear whether China has prevented an unwanted speculative bubble or simply made the development of mature domestic capital markets more complicated.