Investors have snapped up three real estate investment trusts (REITs) that were sold in Shanghai and Shenzhen this week, giving a boost to the nation’s beleaguered property industry

The response to the first batch of publicly-traded REITs opens up a new financing channel for the debt-laden property sector.

The three new REITs, based on affordable rental properties, were each more than 100 times oversubscribed among institutional investors, managers said in filings. They were expected to raise a combined 3.8 billion yuan ($56 million).

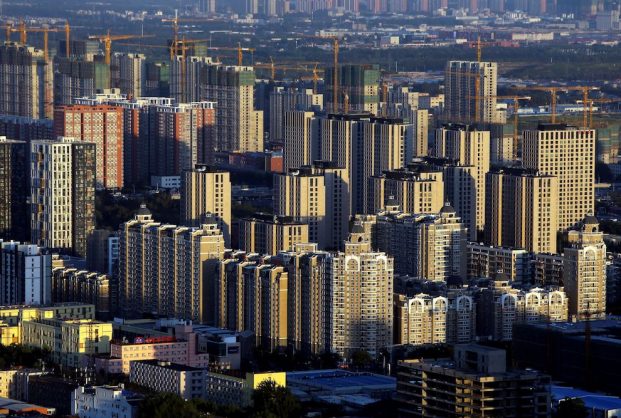

The rental property REIT launches come as Beijing steps up efforts to aid the real estate business, a sector that was a pillar of growth in the world’s second-biggest economy over the last two decades but is now reeling amid debt piles, mortgage boycotts and sluggish sales.

ALSO SEE: China City Scraps Limits On Home Buying To Boost Market

Rental Properties

China launched a public REITs market based on infrastructure projects about a year ago, but this week’s launches mark the first time the REIT market has been tested for residential rental properties.

“The market is flush with liquidity hunting for assets that can generate stable returns,” said Cai Hongfei, property analyst at Central Wealth Securities. “Rental property REITs are appealing as they have strong government policy support.”

REITs produce stable yields for investors based on cash flows from a collection of properties or infrastructure assets.

Meanwhile, news emerged on Tuesday that China will guarantee new onshore bond issues by a few select private developers to support its embattled property sector.

China has also been encouraging development of its REITs market, which regulators hope can channel fresh capital into real estate and infrastructure and reduce leverage for companies and local governments.

Expanding Finance Channels

China’s first public property REITs were launched by asset managers CICC Fund, China Asset Management and Hotland Innovation Asset Management Co, and based on affordable rental properties in capital city Beijing, and southern Shenzhen and Xiamen cities.

China has been encouraging developers to build homes for rent as part of President Xi Jinping’s vision for “Common Prosperity”.

Although the rental properties bundled into this week’s REIT launches were built by a number of government-backed rental housing developers, analyst expect the scope to broaden.

“The launch of residential REITs can expand financing channels of rental residential firms,” Everbright Securities said in a report.

The brokerage flagged this as an investment opportunity for developers with mature rental properties, including China Vanke Co, Poly Developments, Gemdale Corp and China Merchants Shekou Industrial.

- Reuters with additional editing by Jim Pollard

ALSO SEE:

China Property Protests Threaten $220 Billion Hit For Banks