The move will allow qualified Chinese investors to invest in the carmaker through the Stock Connect regime

(AF) Chinese electric vehicle maker Xpeng filed for a dual primary listing on the Hong Kong Stock Exchange on Wednesday.

A dual primary listing is different from secondary listing and will allow qualified Chinese investors to invest in the company through the Stock Connect regime linking mainland Chinese and Hong Kong markets, according to the exchange’s rules.

New York-listed shares of the company rose more than 4% to close at $41.61 on Wednesday.

Rivals Nio and Li Auto have similar plans to Xpeng, which went public in New York last year, has a market capitalisation of $32 billion.

It is based in the Chinese southern city of Guangzhou, and makes two sedan models and one sport-utility vehicle model at two domestic factories.

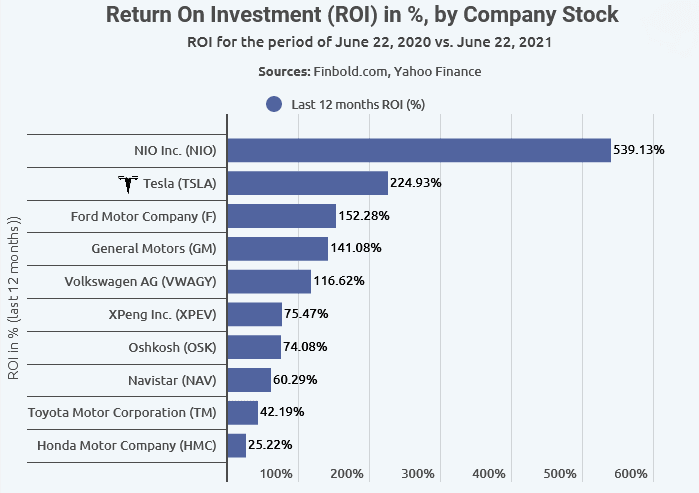

For shareholders, return on investment exceeded 75% in the past 12 months, according to data from Finbold and Yahoo! Finance, far below Nio and Tesla, but ahead of automotive stalwarts such as Toyota and Honda.

Xpeng sells its vehicles mainly in China, the world’s biggest car market, where it competes with Tesla and Nio.

The company is developing ‘smart car’ technologies, such as autonomous driving functions, with an in-house team of engineers and plans two new car plants in China.

Xpeng’s backers include Alibaba Group and Xiaomi Corp.

Sales of new energy vehicles, including battery electric, plug-in hybrid and hydrogen fuel-cell cars, are expected to grow more than 40% annually for the next five years, according to the China Association of Automobile Manufacturers.

With reporting by Reuters