Chinese real estate developers are staring at enormous amounts of debt maturing this year, at a time when property sales have slowed and traditional borrowing markets remain closed off following Beijing’s campaign to rein in borrowing in the sector.

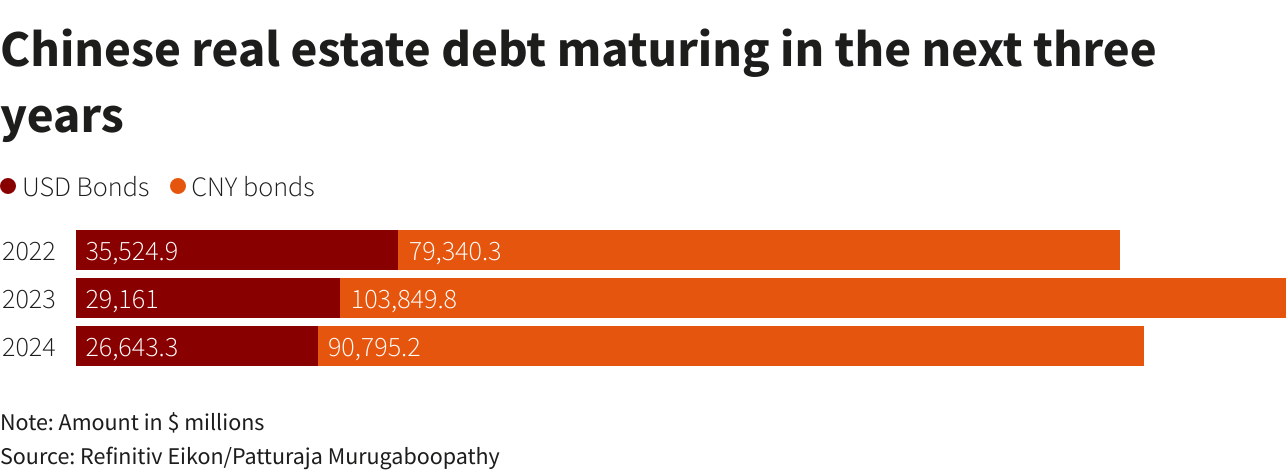

According to Refinitiv data, Chinese real estate developers have $117 billion worth of debt maturing in 2022, with $36 billion of those denominated in dollars.

Developers in the country are facing an unprecedented liquidity squeeze as years of regulatory curbs on borrowing lead to a string of offshore debt defaults and credit rating downgrades.

The slowdown in the sector further pressured developers, with property investments in December falling at the fastest pace since early-2020, clouding the country’s outlook despite a robust headline economic growth figure.

China Evergrande Group has been struggling to repay more than $300 billion in liabilities, including nearly $20 billion of offshore bonds deemed in cross-default by ratings agencies last month after it missed payments.

Their worsening credit conditions have hit equity and bond prices of even the largest developers in recent months.

A 3.125% October 2025 bond issued by China’s biggest developer by sales, Country Garden, has fallen about 17% this year to 73 cents as of Tuesday.

According to Refinitiv data, the developers face debts worth $27 billion coming due in the first quarter of this year, and $31 billion in the second quarter.

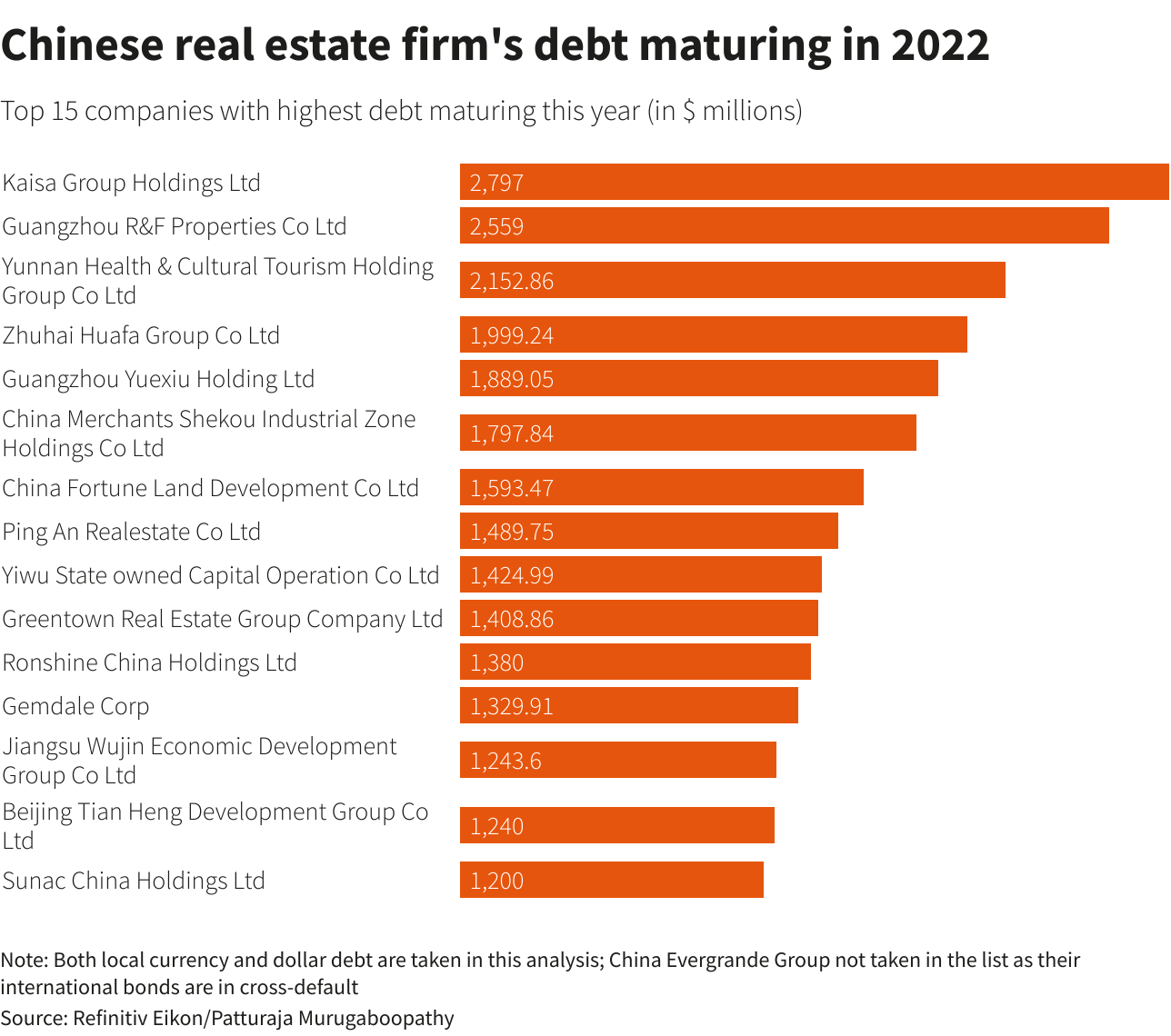

Kaisa Group Holdings, Guangzhou R&F Properties and Yunnan Health & Cultural Tourism Holding Group were among the developers having at least $2 billion worth of debt maturing this year, topping the list.

Evergrande narrowly avoided a technical default on an onshore yuan bond earlier this month after bondholders agreed to extend a payment date. Beijing is expected to soften its attempts to purge the property sector as top leaders prioritise stability and shoring up growth in 2022.

Officials are well aware of the scale and complicated nature of the crisis and doing what they can to alleviate the liquidity crunch. The central bank has taken steps to inject cash into the economy and more initiatives are expected.

China is also drafting nationwide rules to make it easier for property developers to access funds from sales still held in escrow accounts in its latest move to ease a severe cash crunch in the sector, sources said on Wednesday.

The new rules would help developers meet debt obligations, pay suppliers and finance operations by letting them use the funds in escrow that are currently controlled by municipal governments with no central oversight.

But they are not expected to be done till the end of January. News of this move boosted property stocks in Hong Kong on Wednesday afternoon.

• Reuters with additional editing by Jim Pollard

ALSO SEE:

China Looks To Give Developers More Escrow Funds Access

Evergrande Shares Rise After Winning Bond Payments Delay

R&F Properties Hong Kong Arm In ‘Selective’ Default Says S&P

China Country Garden Swoops in With Mini Buyback as Bonds Slump

China Evergrande Default Triggers Brawl Over Local Assets